Spot charter rates for the global liquefied natural gas (LNG) carrier fleet remained steady this week, while European prices dropped compared to the previous week.

Last week, charter rates were also almost flat compared to the last week.

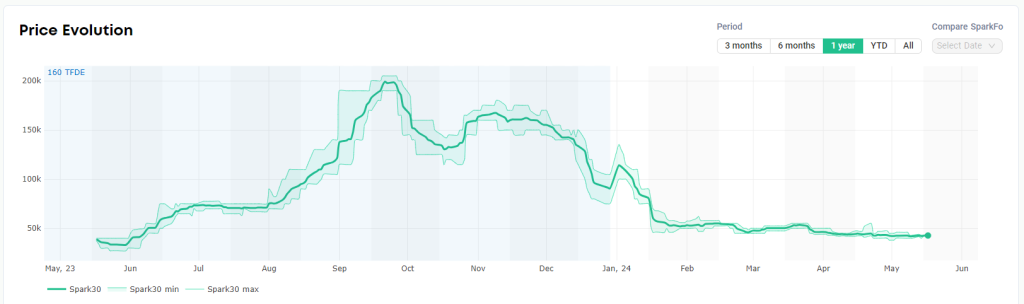

“Freight rates in the Atlantic and Pacific basins stayed steady this week, with the Spark30S Atlantic spot rate increasing by $750 per day to $42,750 per day, and the Spark25S Pacific rate stayed unchanged at $45,750 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

“Freight rates have remained within an extremely tight range over the last few weeks, staying within a $2,000 per day spread since the beginning of April for both Atlantic and Pacific basins,” he said.

US cargoes pulled to Asia

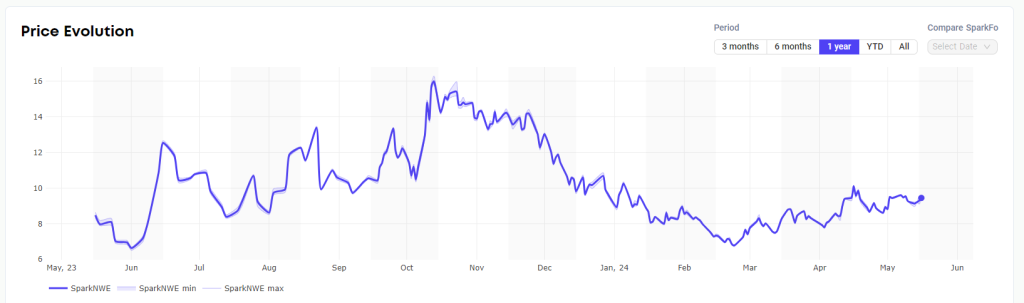

In Europe, the SparkNWE DES LNG front month dropped compared to the last week.

“The SparkNWE DES LNG front month price for June delivery is assessed at $9.451/MMBtu and at a $0.185/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.097/MMBtu decrease in DES LNG price, and a $0.015/MMBtu narrowing of the discount to the Dutch TTF.

“The discount has narrowed 35c in the last 3 months as demand for European regasification, which this spread is driven by, has waned as US cargos are pulled to Asia on higher Northeast Asian prices,” Afghan said.

Levels of gas in storages in Europe rose compared to the last week.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU rose from last week and were 66.06 percent full on May 15.

Gas storages were 62.94 percent full on May 8, and 64.07 percent full on May 15 last year.

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, for July settled at $11.045/MMBtu on Thursday, rising from the previous week.

JKM for June settled at 10.475/MMBtu on Friday last week and was at 10.469/MMBtu on Wednesday this week.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that JKM decreased in the first half of the last week due to weak demand and high inventories, but it increased in the second half of the week due to heatwaves in Southeast Asia, South Asia, and demand for summer season.

All Freeport LNG trains back online, Bintulu LNG power loss

US LNG exports rose to 28 shipments in the week ending May 15 compared to 22 shipments in the prior week, with the Freeport LNG terminal shipping four cargoes during the period, according to the EIA.

Freeport LNG, the operator of the 15 mtpa liquefaction plant in Texas, told LNG Prime on Wednesday it has resumed operations at all of its three liquefaction trains.

The LNG terminal operator said on March 20 that only the third liquefaction train was operating.

Since then, the plant has been shipping about one LNG cargo per week, and increased its shipments in the week ending May 8 to three.

This week, Malaysian energy giant Petronas reported a power loss at the giant Bintulu LNG complex in Sarawak.

MLNG, a unit of Petronas, experienced a power loss on May 10 at the LNG complex.

Petronas said the cause of the power loss had been identified and start-up efforts to resume operations were in progress.

The 30 mtpa LNG complex includes MLNG Satu, MLNG Dua, MLNG Tiga, and the most recent Train 9 which started commercial operations in 2017.

In Australia, one of the three trains at Chevron’s Gorgon LNG terminal in Western Australia remains offline.

Chevron Australia, a unit of US energy giant Chevron, said on May 3 it was working to resume full production from its Gorgon LNG terminal following a “mechanical fault” which is affecting one LNG production train.

The fault occurred on April 30 in a turbine, and Chevron Australia said that repair activities are expected to “take a number of weeks”.

Sources familiar with the matter told LNG Prime on May 8 that following further assessment of the fault, the 5.2 mtpa production train is likely to be offline for at least five weeks.