Spot charter rates for the global liquefied natural gas (LNG) carrier fleet fell for the eighth consecutive week, while European prices rose slightly compared to the last week.

Last week, spot charter rates dropped below $60,000 per day in both basins.

“The Spark30S Atlantic decreased by $3,750 (7 percent) to $53,250 per day, whilst the Spark25S Pacific decreased by $4,000 (7 percent) to $55,000 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

The Atlantic freight prices have halved since the beginning of the year.

Spot rates are continuing to decline despite reports of vessels diverting away from the Red Sea.

LNG ships are now favoring the Cape of Good Hope for safer passage. These include Qatari LNG shipments heading to Europe.

Spark previously said that diverting a voyage via the Cape of Good Hope from the Arabian Gulf to North West Europe adds only $0.09 per MMBtu to the freight cost versus via Suez given Suez Canal savings, but increases laden voyage time by 9.5 days.

State-owned LNG giant QatarEnergy said in a statement this week that Qatar’s LNG production continues uninterrupted.

“While the ongoing developments in the Red Sea area may impact the scheduling of some deliveries as they take alternative routes, LNG shipments from Qatar are being managed with our valued buyers,” the firm said.

European, Asian prices

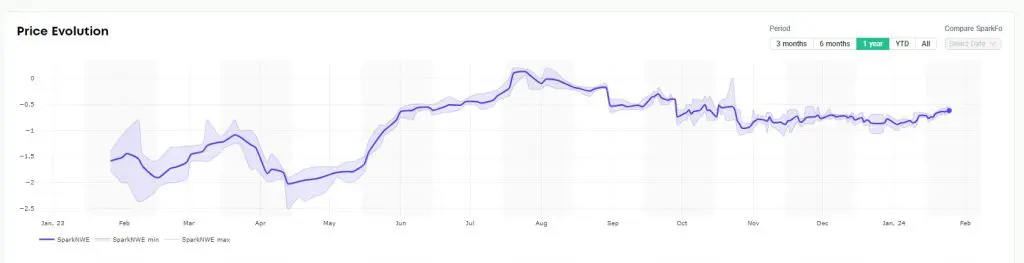

In Europe, the SparkNWE DES LNG front month rose slightly compared to the last week.

The NWE DES LNG for February delivery was assessed last week at $8.126/MMBtu and at a $0.745/MMBtu discount to the TTF.

“The SparkNWE DES LNG price for February delivery is assessed at $8.199/MMBtu and at a $0.62/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.125/MMBtu week-on-week narrowing of the discount to the TTF, the third consecutive week this discount has narrowed and resulting in the smallest TTF discount since October 24, 2023.

“This indicates reduced demand for NW-Europe regasification, as falling freight rates have made routes via the Cape more competitive. Consequently, the US arb to NE-Asia is open via the Cape for the first time since September 2023,” he said.

Levels of gas in storages in Europe remain high for this time of the year due to mild weather.

Data by Gas Infrastructure Europe (GIE) shows that gas storages in the EU were 73.04 percent full on January 24.

This week, JKM, the price for LNG cargoes delivered to Northeast Asia dropped when compared to the last week, according to Platts data.

JKM for March settled at $9.390/MMBtu on Thursday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that Asian spot LNG prices continued to decline as inventories remain high across Northeast Asia, and demand remains weak.