Spot charter rates for the global liquefied natural gas (LNG) carrier fleet were almost flat this week, while European and Asian prices decreased compared to the week before.

Last week, charter rates rose for the first time since mid-November 2023 due to the opening of the US arbitrage to NE-Asia, coupled with the increased voyage time from the diversion of cargoes unable to transit the Suez Canal.

“Freight rates have stayed almost level this week, with the Spark30S Atlantic unchanged at $54,500 per day, whilst the Spark25S Pacific increased by $500 (1 percent) to $58,000 per day,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

Since January, LNG carriers, including Qatari vessels delivering LNG shipments to Europe, are favoring the Cape of Good Hope for safer passage.

Kpler said earlier this month that the Suez Canal has witnessed no LNG transits since January 17.

Vessels face an extra 21-day voyage time on a round-trip basis via the Cape of Good Hope as opposed to the Suez Canal.

European and Asian prices decline

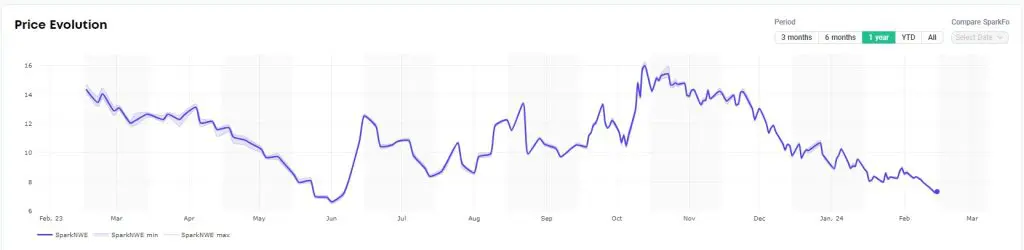

In Europe, the SparkNWE DES LNG front month dipped compared to the last week.

The NWE DES LNG for March delivery was assessed last week $8.172/MMBtu and at a $0.60/MMBtu discount to the TTF.

“SparkNWE front month reaches a new 8 month low, with the SparkNWE DES LNG price for March delivery assessed at $7.339/MMBtu and at a $0.535/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.833/MMBtu decrease in DES LNG price, and a $0.065/MMBtu narrowing of the discount to the TTF.

Levels of gas in storages in Europe remain high for this time of the year due to mild weather.

Data by Gas Infrastructure Europe (GIE) shows that gas storages in the EU were 65.94 percent full on February 14. Gas storages were 67.87 percent full on February 7.

This week, JKM, the price for LNG cargoes delivered to Northeast Asia, dropped when compared to the last week, according to Platts data.

JKM for March settled at $9.347/MMBtu on Thursday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that the JKM decreased as demand declined due to the Lunar New Year in China and Korea.

METI previously said that Japan’s LNG inventories for power generation as of February 4 stood at 2.29 million tonnes, up 0.13 million tonnes from the previous week.