Commonwealth LNG has postponed a final investment decision on its 9.3 mtpa LNG facility in Cameron, Louisiana.

According to Commonwealth LNG’s website, FID is now “targeted for H1 2025”.

French engineer Technip Energies completed FEED for the project in the second quarter of 2023.

“Using a highly modularized approach will enable the company to build the facility with greater schedule and cost assurance, allowing commercial operations to begin by the end of 2028,” Commonwealth LNG said.

The LNG terminal developer said in September 2023, when it signed a preliminary deal with US natural gas producer EQT, that it still anticipates FID on the project in the first quarter of 2024.

After that Commonwealth LNG announced in November that it expects to take the decision to build the facility in the first half of 2024, with first cargo deliveries expected in 2027.

However, the Biden administration said in January it will “temporary pause” pending decisions for LNG export terminals.

The US paused pending decisions on exports of LNG to non-FTA countries until the Department of Energy can update the underlying analyses for authorizations.

Commonwealth LNG received FERC authorization in November 2022, but DOE still needs to approve its non-FTA application. The NFTA approval is the only remaining permit required for the project.

A spokesman for Commonwealth LNG told LNG Prime later on Thursday that the revised projected FID date is attributable to the DOE pause in permit reviews.

“While Commonwealth LNG is disappointed in the DOE delay, we remain fully committed to developing our LNG export facility in Cameron, Louisiana and delivering LNG to our nation’s allies to help meet global climate initiatives,” he said.

LNG supply deals, Kimmeridge investment

The company’s plant in Cameron will use gas turbines and other equipment from energy services firm Baker Hughes as part of a deal announced in August 2023.

Moreover, Commonwealth LNG entered into a non-binding 20-year supply deal with Switzerland-based energy trader MET Group for 1 mtpa of LNG and it also closed an investment of development capital from private funds managed by Kimmeridge Energy Management.

Commonwealth LNG and Kimmeridge have also agreed in principle on terms for a 20-year, 2 mtpa LNG offtake commitment from the facility along with the associated gas supply.

This investment completes the development funding required for Commonwealth LNG to reach FID, it previously said.

Besides these deals, Commonwealth LNG also finalized a supply deal in 2022 with Australian LNG firm Woodside.

The deal is for the supply of up to 2.5 mtpa of LNG over 20 years to Woodside Energy Trading Singapore from Commonwealth’s LNG export facility.

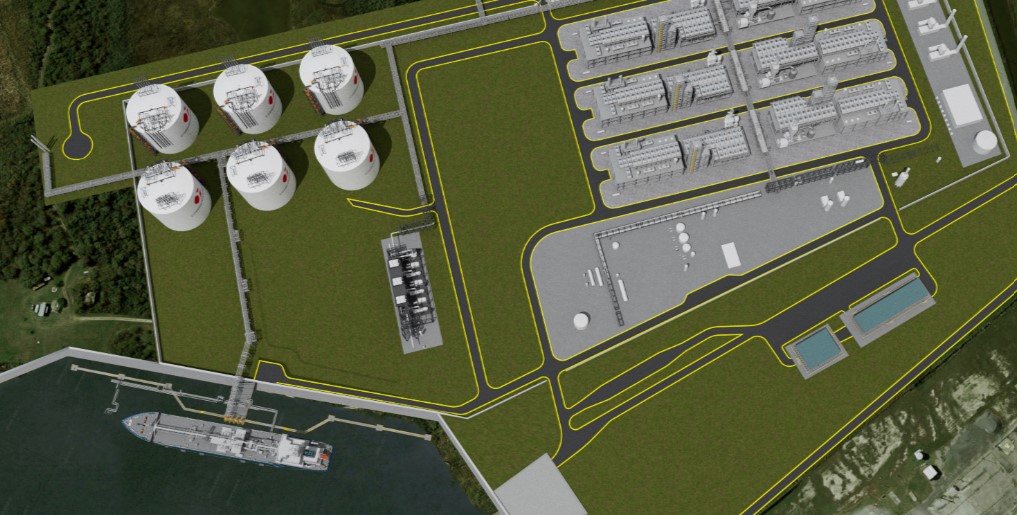

Commonwealth LNG is planning to build the six-train liquefaction and export facility on the west bank of the Calcasieu Ship Channel at the mouth of the Gulf of Mexico near Cameron, Louisiana.

The facility includes six 50,000-cbm LNG storage tanks, one jetty with the capacity to service vessels from 10,000 cbm to 216,000 cbm, and a pipeline.

(Article updated to include a comment by a Commonwealth LNG spokesman.)