Australia’s Woodside said Tuesday it decided to exit its 50% non-operated interest in Chevron’s proposed Kitimat LNG export project in Canada.

The move follows Chevron’s recent announcement saying it would stop further feasibility work on the development located in British Columbia.

The US energy giant operates the 50/50 venture but it revealed a plan to divest its interest in the project in December 2019.

However, Chevron’s Canadian unit has not managed to find a buyer for its stake since then.

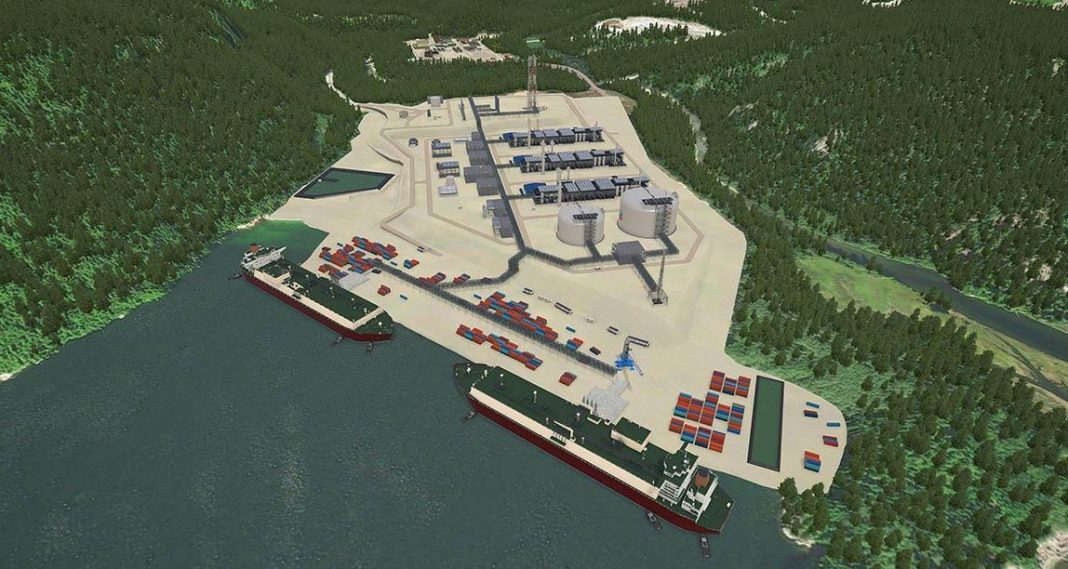

Woodside said the exit would include the divestment or wind-up and restoration of assets, leases and agreements covering the 480 km Pacific Trail Pipeline route and the site for the proposed 18 mtpa LNG facility at Bish Cove.

Also, Woodside will retain a position in the Liard Basin upstream gas resource.

The Australian LNG firm said it would work with Chevron’s Canadian unit to “protect value during the exit.”

Woodside expects the costs associated with the decision impact 2021 net profit after tax (NPAT) by about $40 – 60 million.

The firm added it would exclude these costs from underlying NPAT for the purposes of calculating the dividend.

To focus on “higher value opportunities” in Australia and Senegal

Woodside acting chief executive Meg O’Neill said exiting Kitimat LNG would allow Woodside to focus on the “successful delivery of higher value opportunities in Australia and Senegal.”

Following Chevron’s decision to exit the LNG project and subsequent decision in March to cease funding further feasibility work, Woodside undertook a “comprehensive review of our options for the project and our wider development portfolio,” O’Neill said.

“The Kitimat LNG proposal was designed to develop a new source of LNG to supply Asian markets in the latter part of this decade. However, we have decided to prioritise the allocation of capital to opportunities that will deliver nearer-term shareholder value,” she said.

Woodside will focus on working towards the targeted final investment decision for the Scarborough LNG development in Western Australia in the second half of 2021 and the execution of the company’s Sangomar oil project offshore Senegal.

“Retaining an upstream position in the prolific Liard Basin provides Woodside a low-cost option to investigate potential future natural gas, ammonia and hydrogen opportunities in British Columbia,” O’Neill said.