Investment company KKR said it has purchased 2.4 trillion won ($2 billion) worth of newly issued redeemable convertible preferred shares of South Korea’s SK E&S.

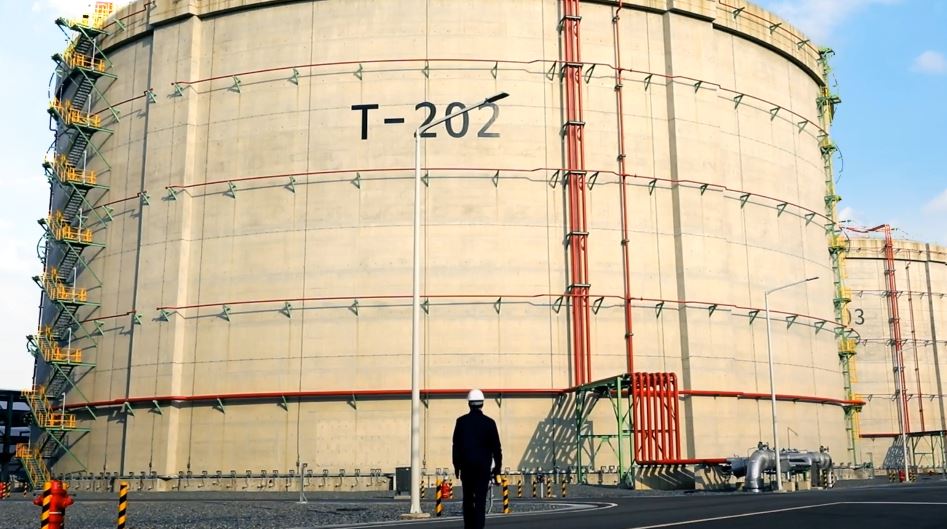

SK E&S, a unit of South Korean conglomerate SK Group, would use the funding to accelerate its growth and transformation into a “global clean energy solution provider,” KKR said on Friday.

KKR made the investment from its Asia Pacific Infrastructure Fund.

“The investment will provide KKR with an opportunity to receive cash or in-kind redemption as an option for repayment in the future paired with the possibility of converting into common shares of SK E&S,” it said.

SK E&S has recently revealed ambitious plans for its LNG and hydrogen business by 2025.

The company aims to produce 280,000 tons of hydrogen, 7GW of renewables and 10 million tons of “green” LNG by 2025.

It aims to grow into a major global LNG provider that would supply 6 million tons and 10 million tons of LNG by 2023 and 2025, respectively.

Also, the plans include increasing the value of the company five times from 7 trillion won now to 35 trillion won ($30.2 billion) in 2025.