Wes Edens-led New Fortress Energy has revealed plans to install up to eight floating liquefaction facilities in the US Gulf of Mexico, as Europe seeks more US LNG supplies.

The US LNG firm recently filed applications with the relevant authorities to request all necessary permits and regulatory approvals for the FLNG export project off the southeast coast of Grand Isle, Louisiana.

After that, the US Coast Guard, in coordination with the Maritime Administration, has affirmed the completeness of NFE’s deepwater port license application.

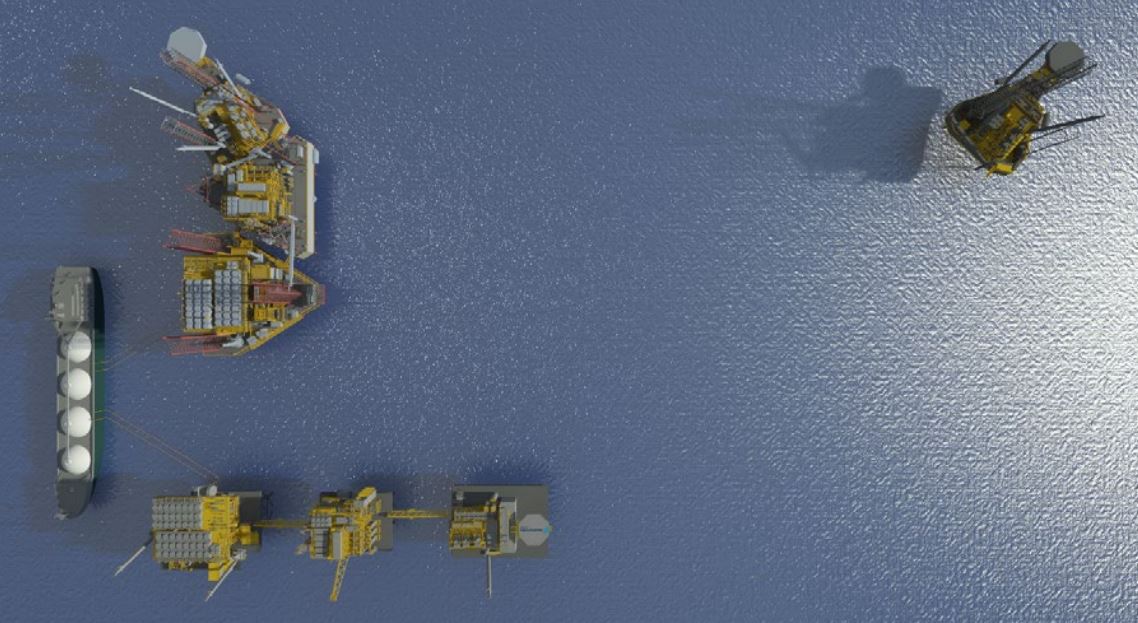

NFE will deploy its “Fast LNG” liquefaction design that uses modular, midsize liquefaction technology with jack up rigs or similar offshore infrastructure.

Under this proposal, NFE plans to install two floating liquefaction units each with a capacity of about 1.4 mtpa in 2023. Combined, the two units would have a capacity of about 2.8 mtpa of LNG or 145 billion cubic feet of natural gas per year.

However, NFE has now revealed plans to add six additional units with a capacity of 1.4 mtpa offshore Texas.

Combined, the floating liquefaction units would have a capacity of 11.2 mtpa.

Meeting European LNG demand

As part of a recent deal, the US will work to supply at least 15 billion cubic meters (bcm) or about 11 million tons of additional LNG to European Union markets, as the EU looks to slash dependence on Russian gas.

Wes Edens said during the company’s quarterly earnings call on Thursday these eight floating liquefaction units can match those volumes.

He said that the company was preparing to file for the additional six units off the coast of Texas in the month of June.

“We say and our goal is no better than the 1st of July, but we’re hopeful that we can get that done before then. And basically, the design that we are using for this is essentially the same design that we have utilized in Louisiana,” he said.

Equipment orders placed for first three units

Besides the US plans, NFE has also joined forces with Italy’s Eni for the Congo FLNG project where it plans to deploy one 1.4 mtpa unit.

NFE’s finance chief Christopher Guinta said during the call the firm had already placed orders from “industry-recognized” manufacturer for all long lead items for the first three units.

Edens expalined the long lead items, “really are the compressor strings and the turbines in particular. Those are the highly specialized piece of equipment, those in the cold box.”

The company is also in the process of ordering equipent for units four through nine.

“We wanted to ensure we had best-in-class equipment providers which is why we have partnered with those of likes of Chart, Siemens, Baker Hughes and others,” Guinta said.

From a marine infrastructure standpoint the company has procured three jack-up rigs and has “brokers on others”.

“We purchased two semi-submersible drilling rigs, the Sevan units, that are well suited for deeper water and we’ve designed and reserved slots for jackets and decks for fixed platform solution,” he said.

“It’s critical to have this planning done well in advance and have a top-quality service provider to minimize the time in the field and to ensure best pricing,” he said.

European FSRU offering

NFE bought two Golar LNG units last year for about $5.1 billion, adding a fleet of vessels including FSRUs.

European players such as Gasunie, Uniper, RWE, and others have recently signed deals to charter FSRUs as the fastest solution to start importing LNG.

NFE owns seven FSRUs with two conversion candidates.

“Today, existing in the world, there are only 46 FSRUs and basically none currently available outside of the NFE fleet,” managing director Andrew Dete said during the call.

He said the firm has two FSRUs available now for deployment in 2022.

“We have the equipment needed to convert an additional FSRU in the next nine months to 12 months,” Dete said.

“And we’re seeing charter rates that are up $50,000 to $100,000 a day. So about 100 percent increase year-over-year in charter rates, which means that based on what we were seeing last year, deploying an FSRU today is equivalent to about $25 million more in earnings per year per ship,” he said.

Dete said there was a “lot of activity” happening with the rush to add regas capacity in Europe.

“We’re right in the middle of that and want to be supportive to some of the folks in Europe, helping to add this regas capacity to import more gas and offset the Russian gas and have a great commercial opportunity ahead of us,” he said.