Delfin Midstream, the US developer of a floating LNG export project in the Gulf of Mexico, has finalized a deal worth about $8 billion to supply liquefied natural gas to UK-based energy firm Centrica.

The two firms announced a heads of agreement in August last year under which Centrica will buy 1 million tonnes per annum of LNG for 15-years on a free on board basis at the Delfin Deepwater Port, located off the coast of Louisiana.

Now they signed a 15-year sale and purchase agreement for 1 mtpa of LNG, according to a joint statement issued on Tuesday.

This agreement will see Centrica take delivery of around 14 LNG cargoes per year and could provide enough energy to heat 5 percent of UK homes for 15 years, the statement said.

The deal, with a market value of $8bn, marks an additional move by Centrica to build further resilience in the UK’s energy security, it said.

Operations and first LNG are expected to start at the Delfin Deepwater Port in 2027.

Delfin moves closer to FIDs

With this and previous deals, Delfin is moving closer to taking final investment decisions on two floating LNG producers.

The firm recently secured an investment from Japan’s shipping giant MOL as well and previously signed supply deals with Hartree Partners and Vitol.

It also entered into a deal in September with US oil and gas producer Devon Energy for long-term liquefaction capacity, but also a pre-financial investment decision strategic investment.

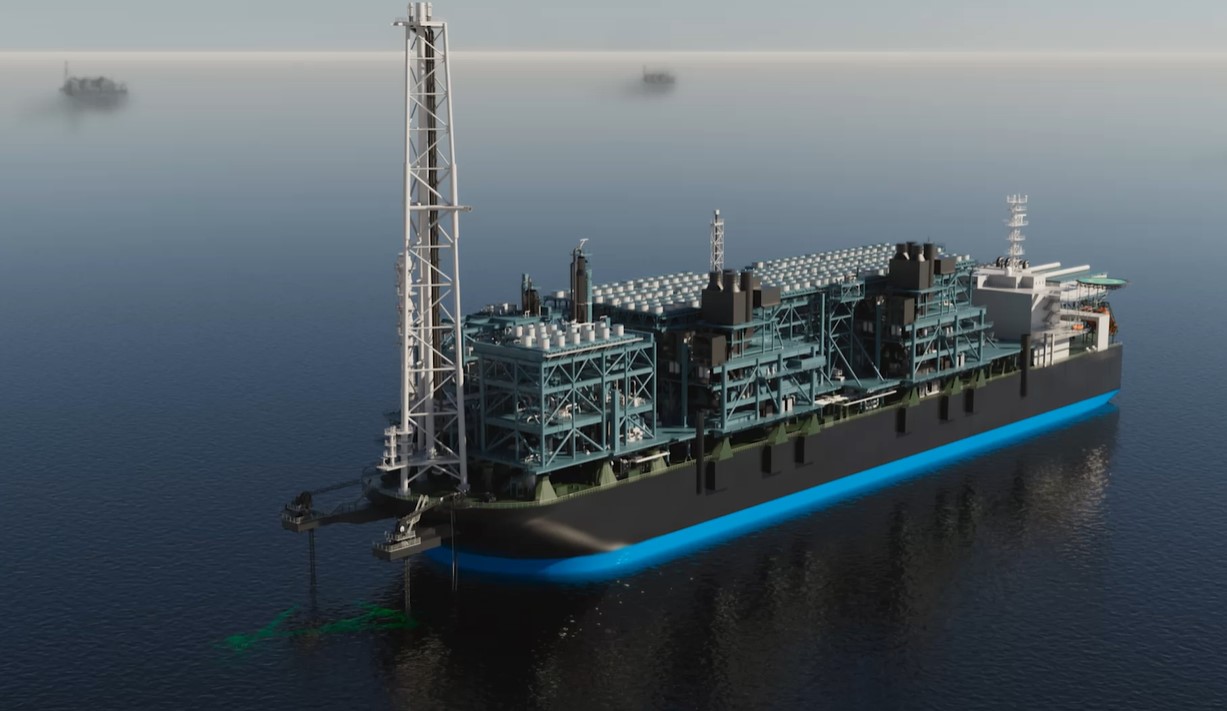

Delfin plans to install up to four self-propelled FLNG vessels that could produce up to 13.3 mtpa of LNG or 1.7 billion cubic feet per day of natural gas as part of its Delfin LNG project.

The firm also aims to install two FLNG units under the Avocet LNG project.

“We are excited to finalize this SPA with Centrica, converting our previously announced heads of agreement and reaching another important milestone for our Deepwater Port LNG export facility,” Dudley Poston, CEO of Delfin, said in the statement.

“There is growing global demand for long-term, scalable LNG supply. With the off-take capacity for Delfin’s first FLNG vessel now sold, we continue to move towards final investment decision and bring this important project forward,” Poston said.