Delfin Midstream, the US developer of a floating LNG export project in the Gulf of Mexico, expects to take a final investment decision on its first floating LNG producer in October this year.

Earlier this year, Delfin said in its March corporate presentation that it expected that technical, commercial, and financing workstreams for the first FLNG were “on track” for an FID in the second quarter.

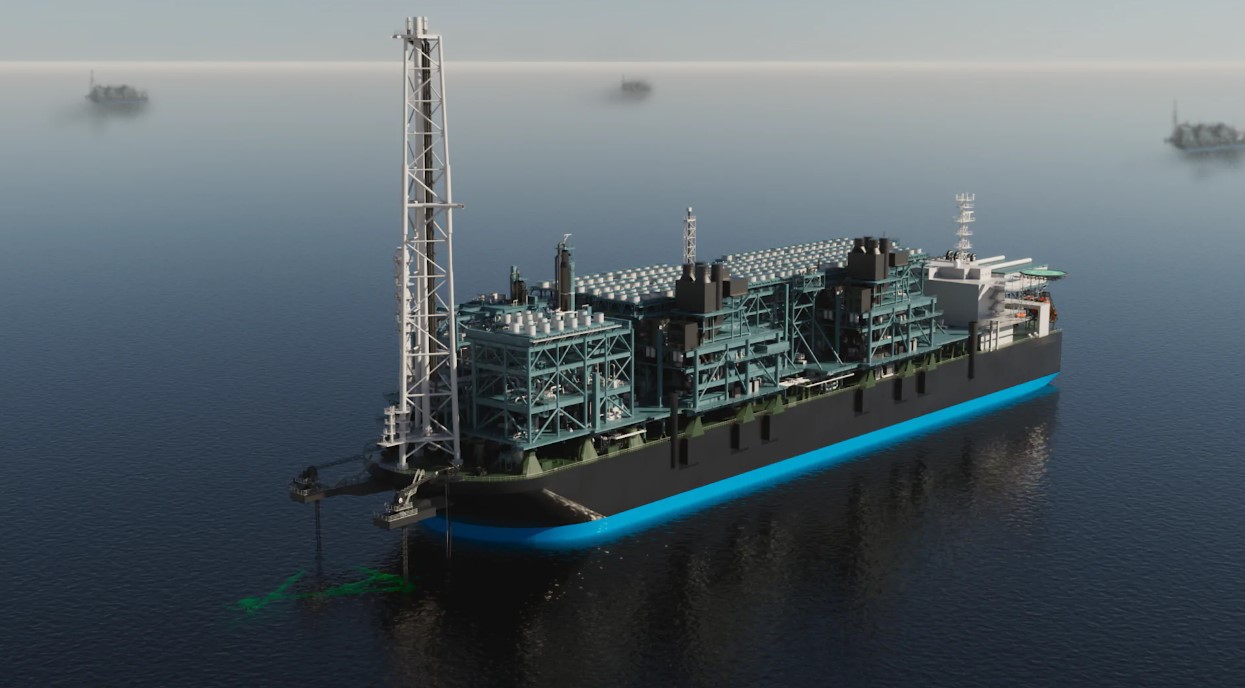

Delfin plans to install up to four self-propelled FLNG vessels that could produce up to 13.3 mtpa of LNG or 1.7 billion cubic feet per day of natural gas as part of its Delfin LNG project.

The firm also aims to install two FLNG units under the Avocet LNG project.

$18 billion

Delfin has been quite busy this year and it recently sealed a supply deal with UK-based Cetnrica worth about $8 billion.

Prior to that, the firm secured an investment from Japan’s shipping giant MOL and previously signed supply deals with Hartree Partners and Vitol.

In addition to these agreements, Delfin LNG entered into a heads of agreement in September last year with US oil and gas producer Devon Energy for long-term liquefaction capacity, but also a pre-financial investment decision strategic investment.

According to a filling with FERC dated July 21, Delfin’s unit Delfin LNG expects to execute “very soon” a binding LNG offtake agreement with Devon as part of the larger agreement announced in September.

The deal is for 1 mtpa of LNG.

Taken together, all these four LNG offtake agreements will provide revenue to Delfin LNG of about $18 billion over their contract terms, the firm told FERC.

Extension

Last year, the US FERC granted a one-year extension of time, to September 28, 2023, to Delfin to construct and make available for service the LNG project’s onshore facilities.

Now Delfin is asking FERC to extend that for another four years by September 28, 2027.

Delfin said that the offtake contracts already executed “amply support” FID for its first floating LNG producer.

Based on additional ongoing negotiations, Delfin expects that the FID for its second FLNG will follow “soon” after the first.

Delfin expects to announce “very soon” its agreement with major infrastructure investors to provide the needed equity for its first two FLNGVs and has begun discussions with a consortium of banks (led by Delfin’s financial advisor Citigroup) to provide the project debt financing, it said.

Furthermore, Delfin LNG has not only completed the FEED for the FLNG construction with South Korea’s Samsung Heavy Industries and US engineer Black & Veatch, but also has negotiated a binding engineering, construction and procurement contract with those counterparts that is expected to be executed by September this year, the firm said.

Delfin has been in active discussions with MARAD and the US Coast Guard concerning satisfaction of the conditions of the MARAD ROD and expects the issuance of its final deepwater port license “soon” as well.

“Given all this significant progress, Delfin LNG is confident that it is nearing FID on its first FLNGV and expects the FID to occur this October,” it said.

“Accordingly, Delfin LNG respectfully urges the Commission to act on this request expeditiously and to grant the requested extension prior to the current condition deadline of September 28, 2023, to facilitate the expected FID in October,” the firm said.