Spot charter rates for the global liquefied natural gas (LNG) carrier fleet continued to rise this week as the market is tightening ahead of winter, according to Spark Commodities.

Last week, LNG freight rates rose in both basins with the Pacific rate increasing to $142,750 per day and the Atlantic rate climbing to $137,750 per day.

Henry Bennett, Spark’s head of pricing, told LNG Prime on Friday that the freight rates climbed further this week, with the Spark30S Atlantic rate rising $22,250 to $160,000 per day and the Spark25S Pacific rising $24,000 to $167,250 per day.

Bennett said the market is tightening ahead of the winter as demand for vessels increases with the arbitrage to Asia for US cargoes open and floating storage economics for Europe positive for October.

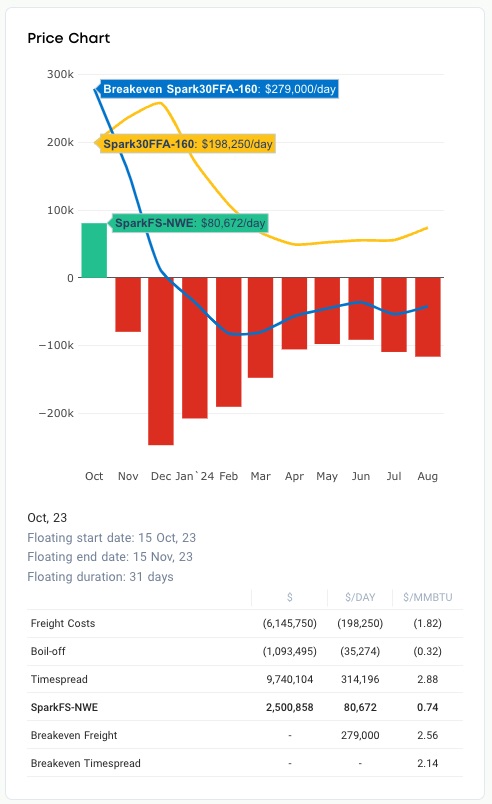

“A 160,000-cbm TFDE vessel in NWE would be over $80,000 per day better off by floating between mid-October and mid-November to deliver into NWE one month later as the steep NWE DES contango means the higher price received for November NWE deliveries versus October outweighs the additional costs of LNG boil-off and freight hire,” he said.

Bennet said that LNG freight rates for 160,000-cbm TFDE carriers would need to rally to over $275,000 per day in October, all else being equal, for this arbitrage opportunity to disappear.

As per European LNG pricing, SparkNWE DES LNG front month dropped from the last week.

Last week, NWE DES LNG for October loadings was at $10.612/MMBtu, a $0.53 discount to the TTF gas hub price.

Bennett said on Friday that NWE DES LNG for October loadings was assessed at $9.731 per MMBtu, a $0.545 discount to the October TTF price.

The TTF price for October settled at $10.355 per MMBtu on Thursday, while the JKM spot LNG price for October settled at $13.320 per MMBtu.

Natural gas prices have been volatile since the last month due to uncertainty about Australian LNG supplies amid the potential for strikes.

Woodside and unions representing its workers at North West Shelf offshore gas platforms reached an agreement last month.

However, workers at Chevron’s Gorgon and Wheatstone LNG plants have started protected action on Friday after talks between the energy giant and unions ended without an agreement.

The Gorgon LNG plant on Barrow Island has three trains and a production capacity of some 15.5 mtpa, while the Wheatstone LNG plant near Onslow has a capacity of about 8.9 mtpa.