UK-based energy giant BP has taken the final investment decision on the Ginger gas development offshore Trinidad and Tobago.

In addition, BP Trinidad and Tobago also discovered gas at its Frangipani well offshore the country, according to a BP statement.

Drilling at the Frangipani exploration well identified “multiple stacked gas reservoirs within the same geological structure.”

BP said options are currently being evaluated to move the discovery forward at pace. BP Trinidad and Tobago has a 100 percent working interest in both Ginger and Frangipani.

Taking FID on Ginger and discovering gas at Frangipani are the “latest demonstrations of upstream activity this year for BP, in line with its strategy to grow its oil and gas business,” it said.

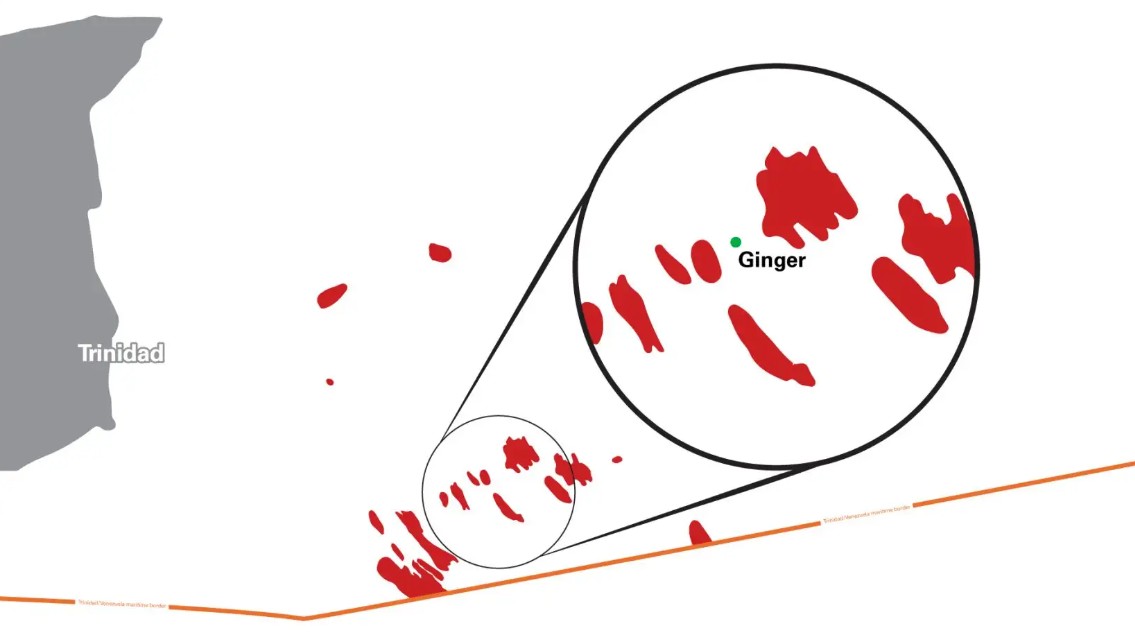

Ginger will become BP Trinidad and Tobago’s fourth subsea project and will include four subsea wells and subsea trees tied back to its existing Mahogany B platform.

BP expects first gas from the project, which will make up one of BP’s ten major projects expected to start up in the next three years, in 2027.

At peak, the development is expected to have the capacity to produce average gas production of 62 thousand barrels of oil equivalent per day.

The Ginger development, as well as BP’s Cypre gas project, scheduled to start up in 2025, are part of its strategy of maximizing production from existing acreage, developing “capital-efficient” projects that tie into existing infrastructure.

Atlantic LNG

BP is a shareholder in Trinidad and Tobago’s Atlantic LNG plant.

In December 2023, Trinidad and Tobago finally signed a restructuring deal with the shareholders of Atlantic LNG, Shell, BP, and NGC.

The new commercial structure has resulted in an increase of government shareholding through NGC from 10 percent and 11.2 percent in trains one and four respectively to 10 percent government shareholding for each of the four LNG trains.

The Point Fortin facility features four trains with a total capacity of about 15 million tonnes per annum of LNG, but the facility has been experiencing supply issues due to dwindling domestic gas reserves.

Atlantic LNG’s first train has been idled since 2020 due to reduced gas supplies.

In July 2024, A unit of UK-based LNG giant Shell took the final investment decision for the development of the Manatee gas field to supply the Atlantic LNG export plant.