Delfin Midstream, the developer of a floating LNG export project in the Gulf of Mexico, said it has signed a long-term deal to supply liquefied natural gas to a unit of energy trader Vitol.

The parent company of Delfin LNG and Avocet LNG said in a statement on Wednesday it has finalized a binding LNG sale and purchase agreement with Vitol Inc., the Americas-based affiliate of Vitol.

In addition to the SPA, Vitol has completed a strategic investment in the company, Delfin said, but it did not reveal more information.

Under the SPA, Delfin will supply 0.5 million tonnes per annum on a free on-board (FOB) basis at the Delfin Deepwater Port 40 nautical miles off the coast of Louisiana to Vitol for a 15-year period.

Also, the Henry Hub-linked deal is valued at about $3 billion in revenue over 15 years, according to Delfin.

FID this year?

In addition to the agreement with Vitol, Delfin said it has signed other HOAs and term sheets that are being finalized into fully termed agreements.

As a modular project requiring only 2 to 2.5 mtpa of long-term contracts to begin construction, Delfin “is on schedule to make final investment decision on the first FLNG vessel by the end of this year,” it said.

Moreover, the firm expects to launch operations in 2026.

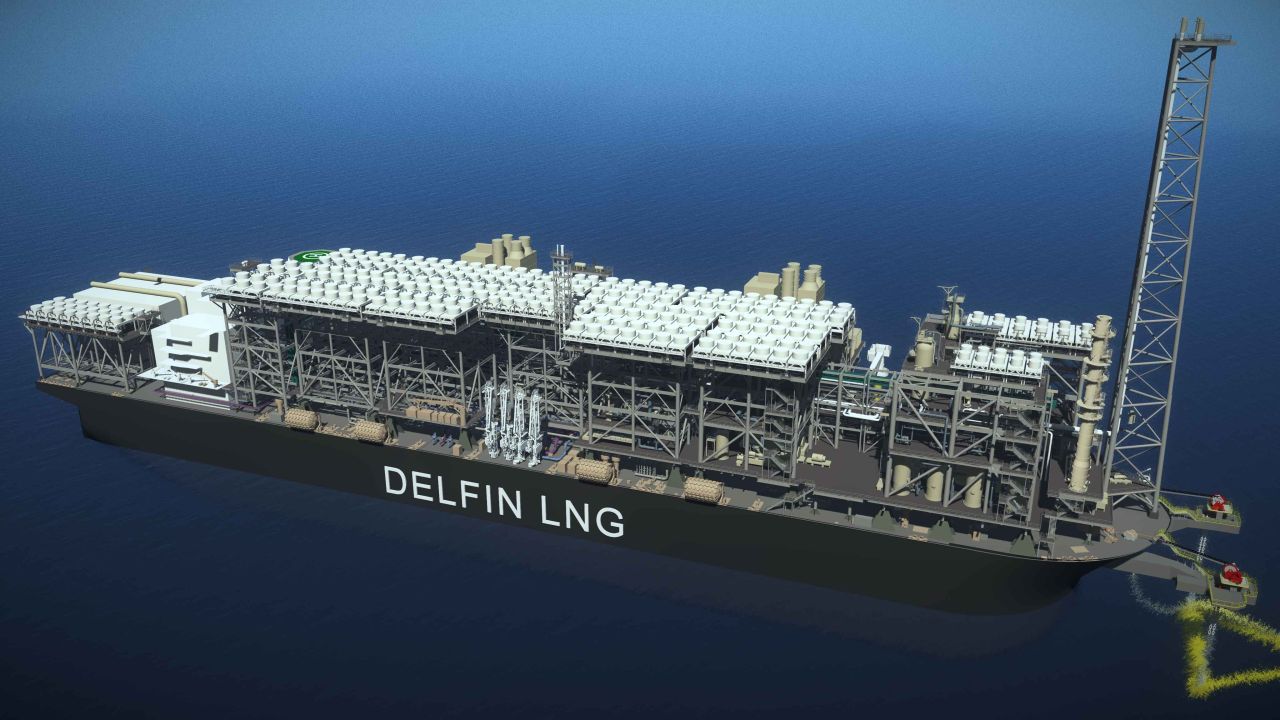

In 2020, Delfin completed the front-end engineering and design work on a 3.5 mtpa vessel that would be used for its floating export development.

Its unit Delfin LNG plans to install up to four self-propelled FLNG vessels that could produce up to 13 mtpa of LNG or 1.7 billion cubic feet per day of natural gas in the Gulf of Mexico.

“Recent events have only accelerated the need for a wider array of potential buyers to source reliable low-cost energy from the safety of the US at compelling prices and Delfin is perfectly positioned to serve this growing need,” Dudley Poston, CEO of Delfin, said in the statement.

Pablo Galante Escobar, Vitol’s global head of LNG and European gas and power, said “global LNG demand is experiencing tremendous growth and Vitol continues to strengthen its position to safely and reliably deliver cost effective, flexible solutions to our customers around the world.”

He added that Vitol’s commitment and investment grade rating would “help Delfin on its path to financial close of this exciting project.”