This story requires a subscription

This includes a single user license.

ExxonMobil picked Chart on behalf of Mozambique Rovuma Venture (MRV), which includes Italy’s Eni and China’s CNPC.

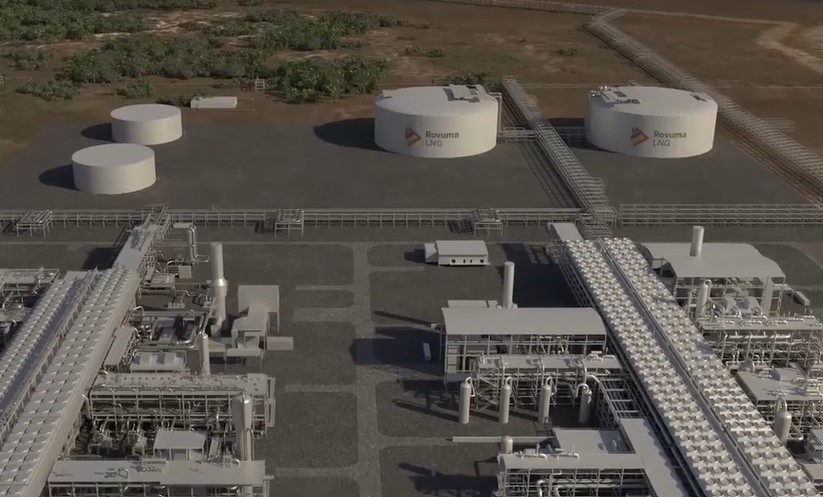

The LNG project will liquefy natural gas from reservoirs of the Area 4 block of the offshore Rovuma Basin.

It ncludes the construction of 12 modules of 1.5 mtpa each, with a total LNG capacity of 18 million tonnes annually, as well as associated onshore facilities.

According to a statement by Chart, the selection of its IPSMR technology for the 12 liquefaction modules is expected to “help enable increased project competitiveness, improved reliability, and lower GHG emissions.”

Chart did not provide further details regarding the contract.

FEED, FID

Houston-based McDermott, through a consortium with Italy’s Saipem and China Petroleum Engineering and Construction Corporation, recently won the front-end engineering design (FEED) contract for the Rovuma LNG project.

In addition, France’s Technip Energies and Japan’s JGC also announced the FEED award for the project.

The two joint ventures will compete to win the EPC contract.

The FEED phase is expected to take around 16 months and is the last step before a final investment decision (FID).

In August, Mozambique’s President Filipe Nyusi announced that ExxonMobil plans to decide on its Rovuma LNG onshore terminal in Mozambique by 2026.

Nyusi met with ExxonMobil’s upstream president Liam Mallon to discuss the onshore LNG project in Cabo Delgado.

MRV operates the deepwater Area 4 block in the Rovuma basin off Mozambique, which would feed the planned LNG export plant on the Afungi peninsula from the Mamba reservoirs.

The joint venture holds a 70 percent interest in the Area 4 exploration and production concession contract.

In addition to MRV, Galp, Kogas, and Empresa Nacional de Hidrocarbonetos each hold a 10 percent interest in Area 4.

ExxonMobil is leading the construction and operation of the liquefaction and related facilities on behalf of MRV, and Eni is leading the construction and operation of the upstream facilities.