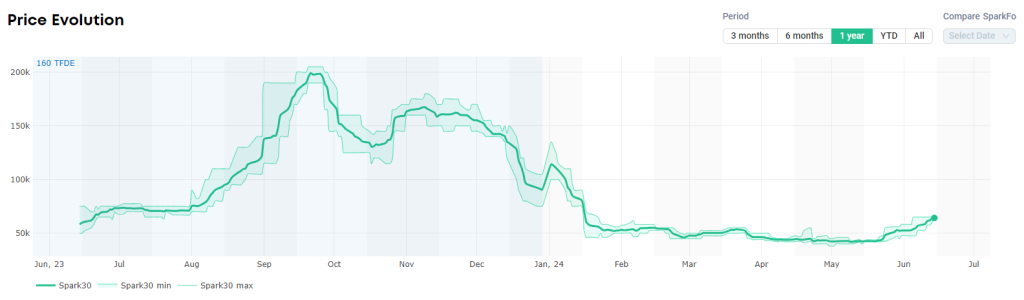

Spot charter rates for the global liquefied natural gas (LNG) carrier fleet and European prices increased this week compared to the week before.

Last week, Atlantic freight rates increased to $57,000 per day.

“Freight rates in both the Atlantic and Pacific basins have experienced sharp increases this week, with the Spark30S Atlantic rate increasing by $7,250 to $64,250 per day, and the Spark25S Pacific rate increasing by $2,750 to $48,000 per day,” Qasim Afghan,” Spark’s commercial analyst told LNG Prime on Friday.

“This is the fourth consecutive week of Spark30S Atlantic rate increases, and the highest week-on-week increase of 2024 thus far,” he said.

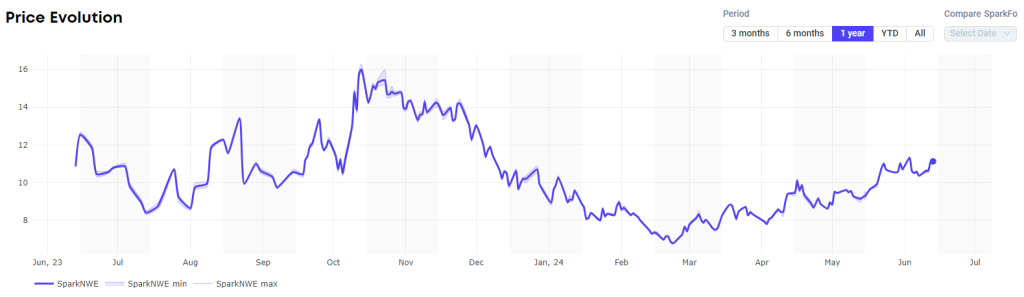

European prices up

In Europe, the SparkNWE DES LNG front month rose compared to the last week.

“SparkNWE DES LNG prices increased this week, with the front month price for July delivery assessed at $11.122/MMBtu and at a $0.155/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.547/MMBtu increase in DES LNG price, and a $0.01/MMBtu narrowing of the discount to the TTF.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to rise and storages were 72.50 percent full on June 12.

Gas storages were 70.86 percent full on June 5, and 72.56 percent full on June 12 last year.

European gas storage is forecast to reach 100 percent by the end of September and remain full until the end of October, with an additional 4 mtpa of floating storage also accumulated, according to a new report by Wood Mackenzie.

The report states that low European demand for gas has kept storage levels at record highs this year.

This is despite Europe importing 11 mtpa less LNG through May, compared to the same period in 2023, Wood Mackenzie said.

Wood Mackenzie said lower European demand has pushed LNG into Asia with imports to China alone up 22 percent.

Looking ahead, high prices are likely to provide some headwinds to near-term Asian demand growth, it said.

JKM above $12/MMBtu

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, for July settled at $12.095/MMBtu on Thursday.

Last week, JKM for July settled at 11.970/MMBtu on Friday.

It rose to 12/MMBtu on Tuesday an remained above 12/MMBtu on Wednesday and Thursday.

Wheatstone LNG offline

Chevron’s unit in Australia said on Thursday it expects to complete repair activities on the Wheatstone offshore platform, which provides gas to the onshore LNG plant, in the coming weeks.

Chevron Australia suspended operations on the offshore platform on June 10 to repair the platform’s fuel gas system.

The company has advised the WA domestic gas market (AEMO’s Gas Bulletin Board) that supply is currently scheduled to return by June 27, 2024.

This means that the company could restart the plant in about two weeks from now, but this date may change in the meantime depending on the repair activities.

LNG terminal operator Brunei LNG confirmed to LNG Prime that normal operations have resumed on May 28 following an outage on May 20.

This week, power producer First Gen awarded a contract to a unit of Japan’s Tokyo Gas to supply one LNG cargo in July to its FSRU-based terminal in Batangas, while PetroVietnam Gas received a cargo from PetroChina International at its Thi Vai LNG import terminal.

The shipment, provided by PetroChina International (Singapore), will be used to fuel power plants during heatwaves in the country.

US LNG exports reached 25 shipments in the week ending June 12, down by one shipment compared the week before, and pipeline deliveries to US terminals decreased 0.3 Bcf/d from last week to 12.9 Bcf/d, according to the US EIA.

Hoegh LNG’s FSRU arrives in Egypt

Egypt is reportedly seeking cargoes to meet electricity needs during the summer months.

Norwegian FSRU player Hoegh LNG recently confirmed it has signed a deal with Australian Industrial Energy (AIE) and Egypt’s EGAS to deploy the 2019-built FSRU Hoegh Galleon to Egypt.

The agreement with EGAS is for an interim period of June 2024 to February 2026.

Hoegh Galleon arrived from the Sagunto LNG import terminal in Spain to Ain Sohna on Friday, its AIS data shows.