The US Maritime Administration (MARAD) said that Delfin LNG needs to file an amended application for its floating LNG export project in the Gulf of Mexico to reflect the changes to the project made since 2017.

Delfin LNG, a unit of Delfin Midstream, requests from MARAD to issue a license to own, construct, and operate a deepwater port off the coast of Louisiana under the record of decision (ROD) issued March 13, 2017.

“MARAD will not issue a license at this time as the ROD no longer supports the issuance of a license,” the agency said in a filling dated April 17.

In the seven years since the ROD was issued, “widespread” changes were made to the project, including to the project ownership, design, financing, and operations, according to MARAD.

“These changes resulted in a revised proposal that is not the same as that approved under the ROD, and as noted below, will require a thorough, statutorily required, interagency, and public review,” MARAD said.

To facilitate this review, Delfin will need to update the application to reflect the changes and submit an amended version for review, it said.

Ownership and financing

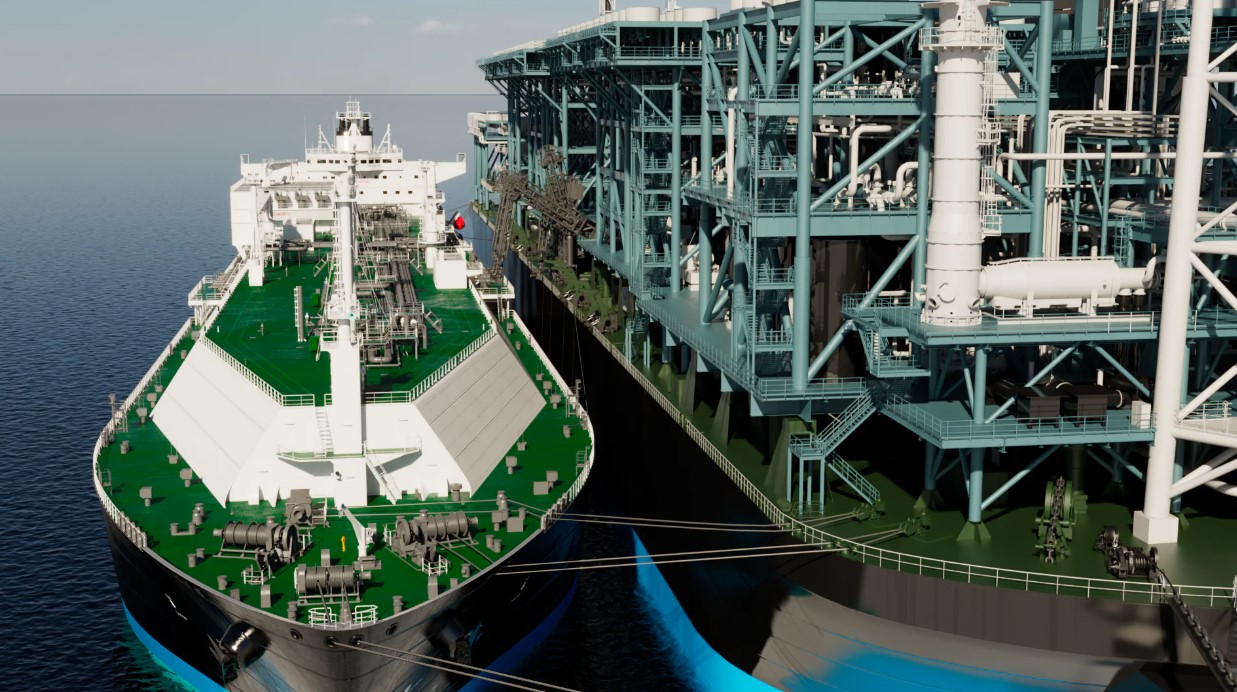

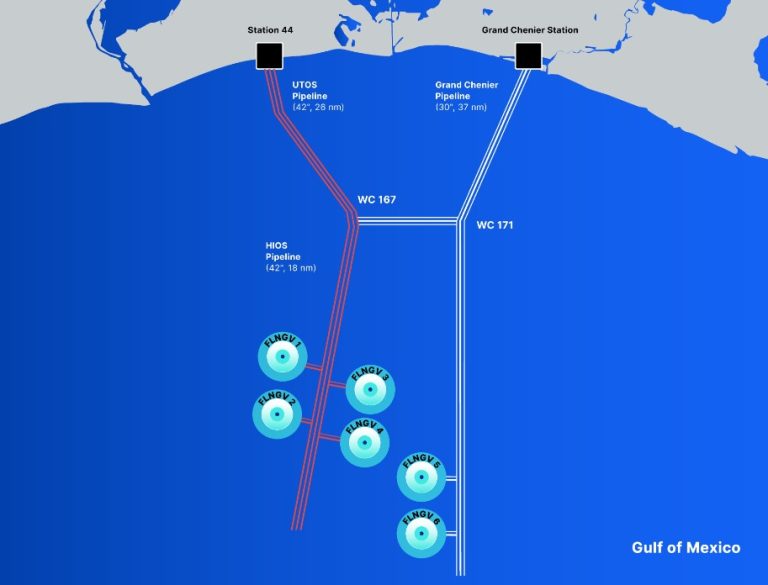

Delfin LNG plans to install up to four self-propelled floating liquefied natural gas vessels (FLNGVs) vessels that could produce up to 13.3 mtpa of LNG or 1.7 billion cubic feet per day of natural gas.

In accordance with its original application, Delfin was to own and operate the FLNGVs under the license.

“Based on correspondence received from Delfin dated July 19 and September 6, 2023, and as discussed in several meetings with the Delfin project team, Delfin now proposes to have the FLNGVs, which are critical to port operations, potentially owned, financed, and operated by third parties other than Delfin,” MARAD said.

This is a “significant departure” from what was contemplated in, and approved under, the ROD, and will require additional evaluation and consideration, it said.

“The project’s proposed financing is also different than what was proposed by Delfin and reflected in the 2017 ROD,” MARAD said.

An equity portion of the project costs was to be provided by Enbridge Holdings LNG, along with participation by suitable and creditworthy Delfin affiliates such as Enbridge Inc, it said.

Also, debt financing was from established sources including the Korea Development Bank, which had made a commitment of $1.5 billion.

Enbridge was also to serve as guarantor of Delfin’s decommissioning obligations and was committed to guarantee the project’s full decommissioning costs, MARAD said.

“Delfin’s proposed equity and debt financing that was approved in the ROD (to support project construction, operations, and decommissioning) has changed significantly,” MARAD said.

Specifically, Enbridge Holdings LNG, and other then-identified Delfin affiliates, no longer appear to be actively involved with the equity financing of the project, MARAD said.

In addition, the Korea Development Bank no longer appears to be involved in providing debt financing, it said.

Design changes

In addition to financing and ownership changes to the project, Delfin’s project update proposed design changes to the mooring system, power generation systems, and cooling systems, MARAD said.

“These proposed design changes were not included in the final environmental impact statement and therefore require an updated environmental review, public engagement, and evaluation,” it said.

“In light of the foregoing, Delfin must update the application to reflect the changes and submit an amended application for interagency review,” the agency said.

“The amended application should include redlines indicating changes to the original application and provide clear and comprehensive documentation regarding the current project ownership, design, financing, and proposed operations, including detailed information regarding all parties involved in the design, construction, financing, and operation of the port,” MARAD said.

If MARAD and the USCG, in coordination with other Federal agencies, determine that the amended application is complete, a notice of amended application will be published in the federal register, and this will be followed by a public comment period.

“MARAD will issue a new record of decision within 90 days after the final public hearing,” it said.

LNG Prime invited Delfin LNG to comment on the MARAD announcement.

DOE approval

Delfin Midstream said in a filling last month it is seeking a five-year extension for its LNG export authorizations from the US Department of Energy.

Delfin said that it is “uniquely situated” as the only FLNG project that has received non-FTA export authorization from DOE and the only LNG export project with conditional approval and a favorable record of decision from MARAD.

The firm submitted the request 90 days prior to the existing commencement deadline in its

non-FTA order, which is June 1, 2024.

Delfin said in the filling it has negotiated and agreed upon major terms of a “near-ready-for-execution” EPCI deal with South Korea’s Samsung Heavy Industries, supported by Black & Veatch of Kansas for the topside liquefaction technology, for a newbuild FLNG.

The firm also said it is negotiating a slot reservation agreement with SHI in order to ensure that construction activities on the first FLNG can start “soon”, and which will give Delfin an exclusive right to the shipyard slot needed for the construction and delivery of the vessel in 2028.

In the coming months, Delfin said it expects to execute the slot reservation agreement, and to issue a limited notice to proceed to SHI to begin work on the FLNGV, and then to execute the EPCI agreement.

Two steps

Before Delfin may absolutely commit to unconditional construction under the EPCI agreement, finalize its financing arrangements, and reach FID on its first FLNGV, however, it needs to solidify the status of its long-standing regulatory approvals, it said.

Delfin has acquired and maintained the regulatory authorizations needed for its project, but two key final steps remain.

First, Delfin needs MARAD to issue its final license under the DWPA.

Delfin said in the filling it has been working with MARAD to that end for over two years and expected to receive the license in 2023.

The firm said in the filling it still expects to receive the final DWPA license “soon”.

Second, Delfin needs DOE/FECM to grant the conditional extension of time for the start of LNG exports.

To ensure the consistency of its requested extension of time with the commencement extension policy, Delfin proposes that DOE/FECM grant only a conditional extension, it said.

The conditional approval will require Delfin to certify by no later than nine months after DOE/FECM’s order that it has obtained the final DWPA license, secured necessary financing arrangements to construct its first FLNG, made its positive FID decision with respect to first FLNG, and issued an unconditional, full NTP for first FLNG to the EPCI contractor.

“While Delfin is confident in its ability to satisfy those conditions within the requested time period, should it fail to do so then the export authorizations would expire at the end of that period,” it said in the filling.