New Fortress Energy stock rose on Tuesday after the US LNG player announced a dividend boost.

The shares of the Nasdaq-listed firm a hit a high of $50.85 on Tuesday after the announcement while they closed at $48.29, compared to $45.20 in the day before.

NFE said late on Monday that its board of directors had approved an update to the company’s dividend policy.

According to NFE, this update is part of its plan to return significant capital to its shareholders while continuing to fund substantial growth.

Effective immediately, NFE is targeting an annual cash dividend equal to about 40 percent of its annual adjusted Ebitda.

In connection with adopting this dividend policy, NFE declared a dividend of $3.00 per share, with a record date of January 4, 2023, and a payment date of January 13, 2023.

The dividend declared on Monday, on an annualized basis, equates to about 40 percent of NFE’s illustrative adjusted Ebitda goal of $2.5+ billion for fiscal 2023, NFE said.

The firm said that its board would evaluate whether to declare a dividend every six months.

NFE expects to generate more than $11 billion of additional liquidity

NFE expects to generate more than $11 billion of additional liquidity over the next three years.

The LNG firm said it plans to use this primarily to “facilitate accretive investments, including investments in floating LNG facilities and downstream capital expenditures, and to pay significant dividends to shareholders.”

In addition to these priorities, other objectives of the new dividend policy include maintaining a strong and durable balance sheet, reducing the company’s leverage ratio to below 1.0x by year-end 2025, allowing the company to initiate a share buyback program, and achieving and maintaining an investment grade rating, it said.

“Our business is now generating significant, stable, and growing cash, which we believe affords us the ability to both retain capital necessary to grow and return excess capital to shareholders in the form of meaningful dividends,” Wes Edens, chairman and CEO of NFE, said in the statement.

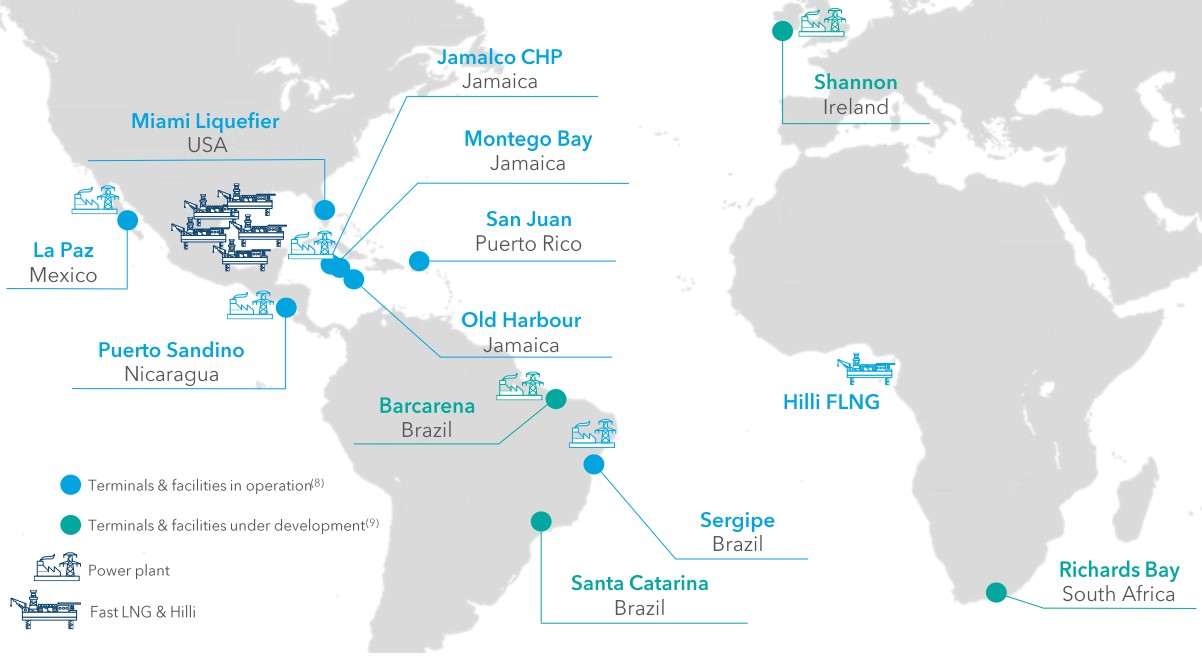

“We are fortunate to have a strong balance sheet and the liquidity we believe is necessary to execute our strategy and achieve our goals, matching long-term LNG supply with long-term power demand around the world,” he said.

NFE currently plans to install five floating LNG producers in the Gulf of Mexico, including off Louisiana, Altamira, and Lakach.

The firm will use its “Fast LNG” liquefaction design that incorporates modular, midsize liquefaction technology with jack up rigs or similar offshore infrastructure.

NFE recently finalized FLNG deals with Mexico’s CFE and Pemex.