This story requires a subscription

This includes a single user license.

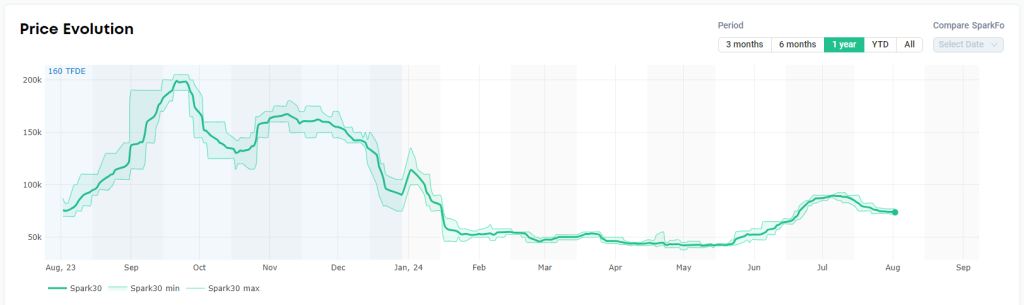

Last week, Pacific rates experienced a $5,500 increase and Atlantic rates decreased.

“Spark30s Atlantic rates continued to decrease for the fourth consecutive week, falling by $1,250 to $73,750 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

On the other hand, Spark25S Pacific rates continued its rally for a sixth consecutive week, rising by $2,500 to $75,250 per day.

“This marks the first time in almost 3 months that Spark25S Pacific rates have surpassed Spark30S Atlantic rates, as Spark25S Pacific rates continue to experience an expected seasonal rally whilst Spark30S Atlantic rates stall,” Afghan said.

European prices surge

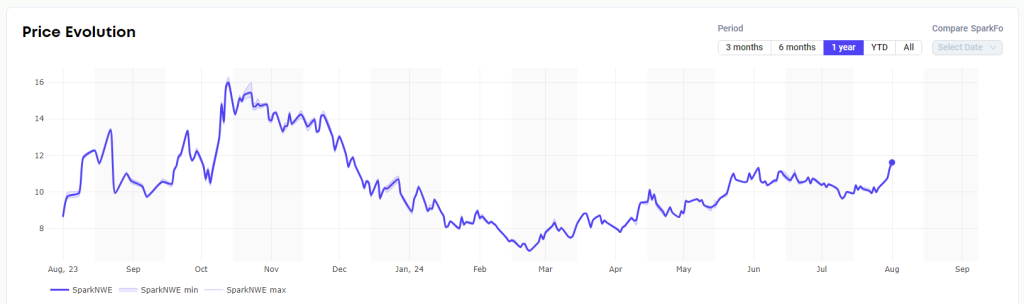

In Europe, the SparkNWE DES LNG front month jumped compared to $9.980/MMBtu in the prior week.

“The SparkNWE DES LNG front month price for September delivery is assessed at $11.613/MMBtu and at a $0.08/MMBtu discount to the TTF,” Afghan said.

This is the highest DES LNG price since early December 2023, and the narrowest discount to the TTF since August 2023, he said.

“The narrow differential is driven by the open arb to send US cargos to Asia, limiting the demand for European regasification capacity which drives this spread,” he said.

European prices rose this week due to geopolitical risks in the Middle East and fears of supply disruptions.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to rise and were 85.12 percent full on July 31.

Gas storages were 83.52 percent full on July 24, and 86 percent full on July 31 last year.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, for September settled at $12.490/MMBtu on Thursday.

Last week, JKM for September settled at 12.205/MMBtu on July 25.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in report earlier this week that buying interest in the Asian region remained subdued last week due to “sufficient inventory levels, resulting in modest overall movement, although there was some information on increased demand in the Indian market on Friday.”

According to S&P Global Commodity Insights data, Asian LNG spot prices in July hovered in the low $12/MMBtu level amid ample cargoes in the spot market and “relatively thin demand”.

The Platts JKM, the benchmark price reflecting LNG delivered to Northeast Asia, fell on the month, with the average JKM price in July at $12.158/MMBtu compared with $12.578/MMBtu in June.

Freeport LNG restart

US LNG exports reached 24 shipments in the week ending July 23, and pipeline deliveries to US terminals increased compared to the week before, according to the Energy Information Administration.

Freeport LNG shipped four LNG cargoes during the week.

The operator of the 15 mtpa liquefaction plant in Texas, told LNG Prime on July 29 it has resumed operations at all of its three liquefaction trains after Hurricane Beryl.

Freeport LNG ramped down production at its liquefaction end export facility on Sunday, July 7, ahead of Hurricane Beryl making landfall.