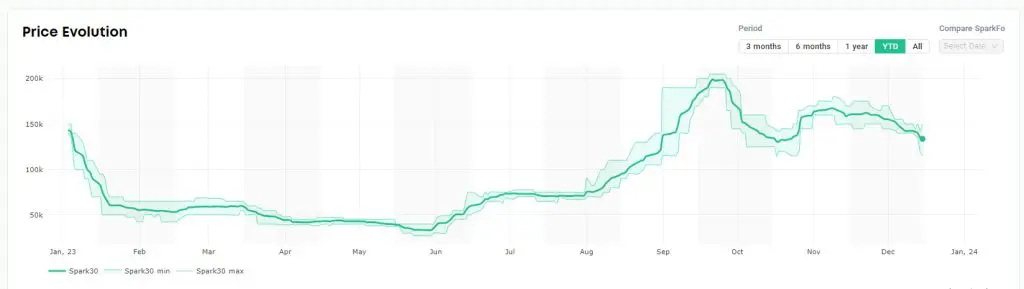

Spot charter rates for the global liquefied natural gas (LNG) carrier fleet continued to decline this week, while European and Asian prices dropped as well.

Last week, the Spark30S Atlantic decreased to $142,500 per day, while the Spark25S Pacific decreased to $117,000 per day.

“LNG freight rates fell once again week, with a 6 percent week-on-week decrease for Atlantic rates and a 12 percent week-on-week decrease for Pacific rates,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

Afghan said that the Atlantic rate decreased by $8,750 to $133,750 per day, whilst the Pacific rate decreased by $13,500 to $103,500 per day.

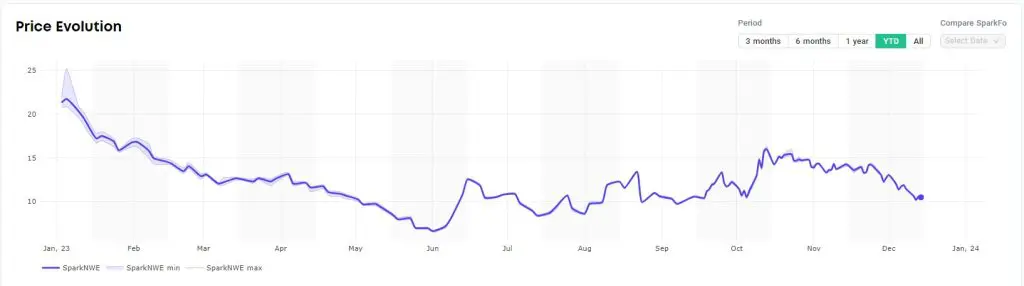

European, Asian LNG prices

As per European LNG pricing, the SparkNWE DES LNG front month also declined from the last week.

The NWE DES LNG for January delivery was assessed last week at $11.887/MMBtu and at a $0.745/MMBtu discount to the TTF.

“The SparkNWE DES LNG price for January delivery is assessed at $10.489/MMBtu and at a $0.740/MMBtu discount to the TTF,” Afghan said on Friday.

He said this is a $1.398/MMBtu decrease in DES LNG price, and the discount to the TTF narrowed by $0.005/MMBtu, when compared to last week’s January prices.

“This is the 3rd consecutive week-on-week decrease in SparkNWE DES LNG prices,” Afghan said.

According to Platts data, JKM, the price for LNG cargoes delivered to Northeast Asia, dropped from the last week.

JKM for January settled at $15.325/MMBtu on Thursday.

Platts recently said the Panama Canal delays have helped to keep Asian LNG prices at a premium to those seen in Europe as shippers seek alternative routes for US LNG shipments, while high inventories and mild temperature forecasts have kept gas demand subdued in Europe.

US liquefaction plants shipped 28 LNG cargoes in the week ending December 13, one cargo less than in the prior week, the US EIA said in its weekly report.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that JKM continues to decline due to weak demand, ample supply, and high inventory levels.