US LNG terminal developer Tellurian is exploring the sale of its Haynesville upstream assets as it works on securing financing for the first phase of its Driftwood LNG project worth about $14.5 billion.

The company said in a statement on Tuesday it has asked its financial advisor, Lazard, to explore opportunities for the sale of its upstream business.

Tellurian produced 19.5 billion cubic feet (Bcf) of natural gas for the quarter ended September 30, 2023.

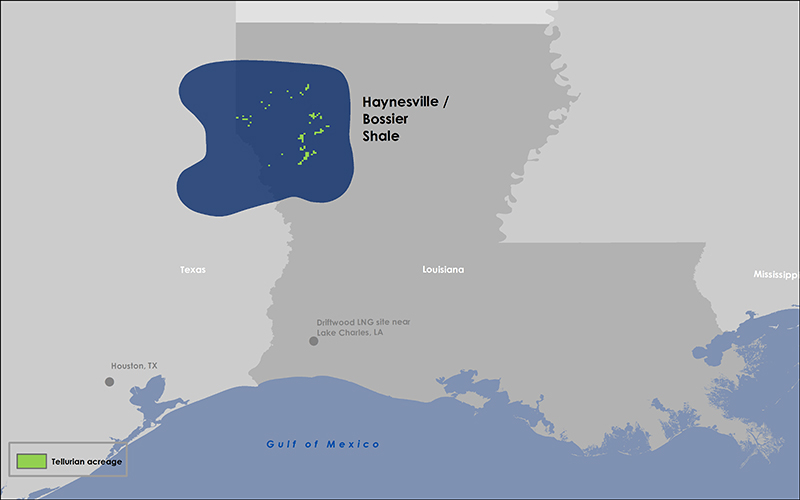

The company’s natural gas assets include 31,149 net acres, interests in 159 producing wells and over 400 drilling locations.

Tellurian recently appointed Lazar as a financial adviser to assist with shaping commercial structures as well as balance sheet management.

Tellurian’s co-founder Martin Houston and new chairman of the board revealed more details on this move in a letter sent to shareholders on January 29.

In December, the company appointed Houston as the chairman replacing Charif Souki, who has left the Driftwood LNG terminal developer.

“As we commercialize Driftwood LNG, Tellurian has been reviewing its strategy, including the dynamics of the US natural gas market in the context of global LNG demand,” CEO Octavio Simoes said.

“We have concluded that there are alternative gas supply strategies available to us from various basins and our ownership of upstream assets is not necessary at this stage of Tellurian’s development. We have a substantial number of drilling locations that we believe will be highly attractive to oil and gas producers that can develop them more quickly than we would,” he said.

“By unlocking the full value of these high-quality assets, we aim to substantially reduce our debt, further reduce our general and administrative expenses, and provide additional cash, enabling us to develop Driftwood LNG. Currently, this approach is more attractive than issuing equity to fund our 2024 development activities and working capital needs,” Simoes added.

Driftwood LNG

As per the Driftwood project, Tellurian issued a limited notice to proceed to compatriot engineering and construction giant Bechtel in March 2022 and it said in August last year that Bechtel completed piling work for the first plant and also concrete pouring for all plant one compressor foundations.

Tellurian also recently released the December construction report.

Under the first phase, Tellurian aims to build two LNG plants near Lake Charles with an export capacity of up to 11 mtpa.

However, the company is still working to secure financing for the project.

Tellurian previously said it expects the first phase to cost about $14.5 billion with about $6 billion equity investment.