This story requires a subscription

This includes a single user license.

Woodside announced on July 22 it has entered into a definitive deal to buy Tellurian.

The company said the consideration for the transaction is an all-cash payment of about $900 million, or $1.00 per share of outstanding Tellurian common stock, while the implied enterprise value is about $1.2 billion.

The transaction is expected to close in the fourth quarter of 2024.

Tellurian issued a limited notice to proceed (LNTP) to compatriot engineering and construction giant Bechtel for the Driftwood project in March 2022.

Under the first phase, Tellurian plans to build two LNG plants near Lake Charles with an export capacity of up to 11 mtpa.

The full project would include five plants with a total capacity of about 27.6 mtpa.

Returns

O’Neill said during Woodside’s H1 earnings call on Tuesday that the proposed acquisition of Tellurian and its Driftwood LNG development positions Woodside as a “leading independent LNG player” with exposure to both the Pacific and Atlantic Basin.

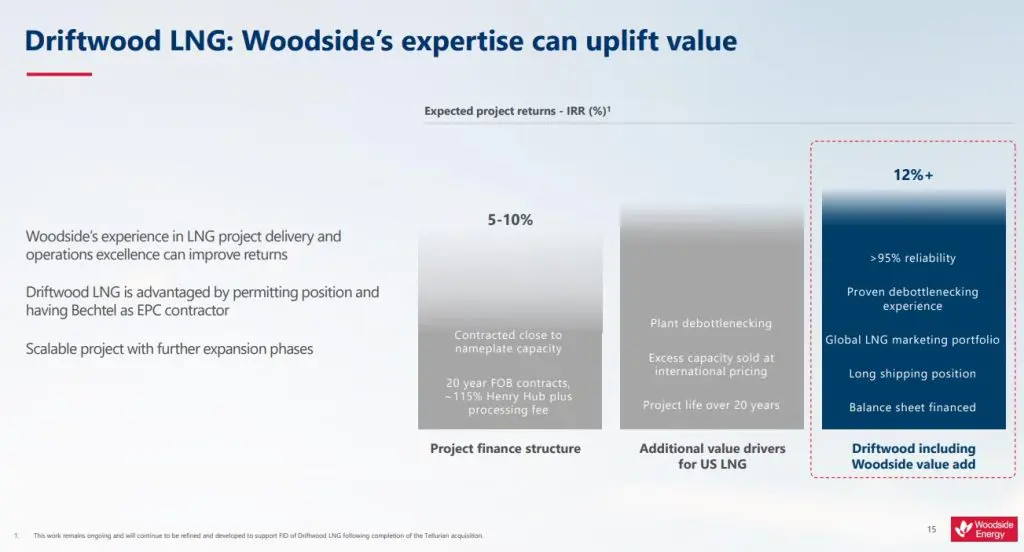

“As we engage with investors following the announcement, there was a desire for more clarity on Woodside’s value drivers and expected returns from the Driftwood LNG opportunity. Driftwood is a pre-FID project, and we are confident it can achieve the returns of our capital allocation framework,” she said.

“Looking at the chart on the slide, the first two gray bars compare the return profile of a typical project finance development with the returns already achieved by some US LNG players,” O’Neill said.

O’Neill said “some are improving returns by increasing plant capacity, selling some volumes at international pricing, and extending the life of the project.”

“We see even more potential for Woodside. Driftwood plays to our established strengths in project execution, operations, and marketing,” she said.

O’Neill said Woodside’s track record on reliability and train debottlenecking gives the company the credentials to extract more value from assets, compared to other players.

“Another competitive advantage of Woodside is our global LNG marketing portfolio. This provides us with flexibility to serve our customers and enables global price indexation. Our long shipping position is another strength we bring to the opportunity,” she said.

“We’ve seen traditional US LNG players building out shipping fleets.. This is, of course, strength of Woodside today,” she said.

Sell-downs

O’Neill said Driftwood is “truly advantaged.” It is the only fully permitted pre-FID opportunity in US LNG and has Bechtel as the EPC contractor, she noted.

“We have a very compelling opportunity for sell-downs,” O’Neill said.

“Multiple inbounds have been received, and we are in conversations with interested parties,” she said.

“Importantly, however, we will be focused to find the right strategic partners for this opportunity as we did for Scarborough,” she said.

O’Neill said during the call that Woodisde is working to put together the “dream team” for Driftwood, as well as deciding “how much equity in the plant we want to maintain and how much equity LNG we want to maintain.”

Woodside may sell up to 50 percent stake in the Driftwood LNG project.

O’Neill also answered a question whether the company would still be comfortable to maintain a modeled 80 percent payout policy within the various scenarios in the absence of a Driftwood sell-down.

“We’ve had more inbounds than we can shake a stick at. So we’ve got the luxury of being able to really pick the partners we want to work with,” she said.

“And our intention, as we progress towards an investment decision there is we want to have line of sight to the partnership that we want,” O’Neill said.

“We may not have everything signed, sealed, and delivered, but we do want to have line of sight to the partnership. If we didn’t have anybody interested,.. it would not be our intention to go forward at 100 percent with nobody queued up,” she said.