This story requires a subscription

This includes a single user license.

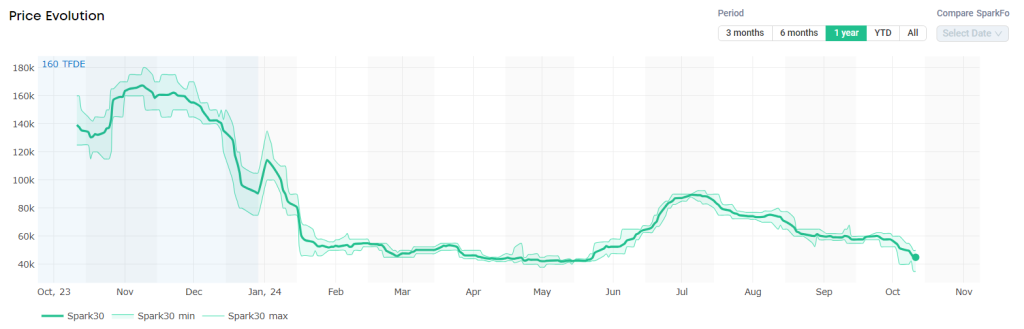

Last week, both Atlantic and Pacific LNG shipping rates declined.

“Spark30S Atlantic rates dropped for a third consecutive week, reducing by $6,500 to $45,000 per day,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

He said this is the first time Spark30S rates have dropped below $50,000 in the fourth quarter in any of the last five years.

In addition, Spark25S Pacific rates continued to decline for an eight week, falling by $7,250 to $52,250 per day.

“Freight rates in both basins continue to be at their lowest levels in five years for this time of year,” Afghan said.

European prices steady

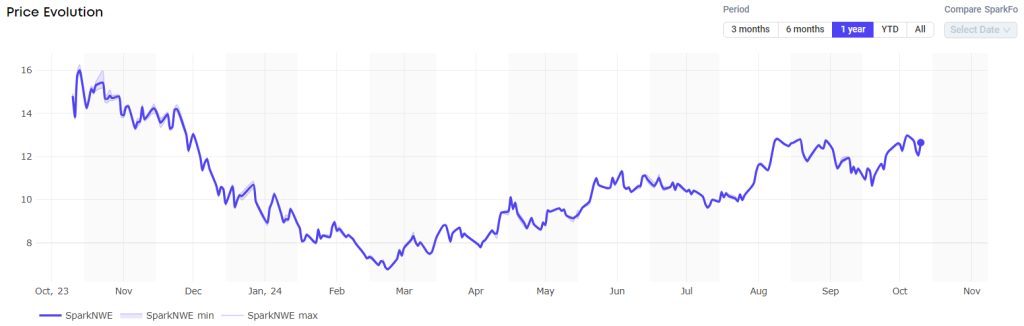

In Europe, the SparkNWE DES LNG was slightly lower compared to $12.683/MMBtu last week.

“The SparkNWE DES LNG front month price for November delivery remained relatively steady this week, pricing in at $12.649/MMBtu,” Afghan said.

“The discount to the TTF is assessed at $0.250/MMBtu, marking the widest discount to the TTF since April,” Afghan said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to rise and were 94.74 percent full on October 9.

Gas storages were 94.33 percent full on October 2 and 97.12 percent full on October 9, 2023.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in November settled at $13.075/MMBtu on Thursday.

Last week, JKM for November settled at 13.090/MMBtu on Friday, October 4.

Front-month JKM then rose to 13.135/MMBtu on Monday. It dropped to 13.095/MMBtu on Tuesday and to 13.070/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that JKM for last week (September 27 – October 4) was almost unchanged at low-$13s on October 4 from low-$13s the previous weekend.

“The previous week, the price fell to high-$12s on Thursday due to weak buying interest in the Asian region as China did not participate in the market due to the National holidays and sufficient supply, but prices rose on October 4 due to concerns that Israel would target Iran’s energy infrastructure in retaliation for Iranian missile attacks,” JOGMEC said.

Northwest European LNG players bidding higher to remain competitive

According to a report by Platts, part of S&P Global Commodity Insights, Northwest European LNG players are bidding higher to remain competitive in the global arena.

Platts assessed the DES Northwest European marker for November at $12.204/MMBtu on October 9, or an 18.5 cents/MMBtu discount versus the Dutch TTF gas hub price.

The NWE-TTF spread was much narrower than the 86.7 cents/MMBtu differential seen this time last year, the report said.

Platts said traders are seeing increasing buyers’ price to attract flows from other competitive demand hubs such as Asia, Egypt, and Brazil.

The strength has helped to increase LNG flows into the continent, the report said.