This story requires a subscription

This includes a single user license.

Last week, Atlantic LNG shipping rates rose for the second week in a row.

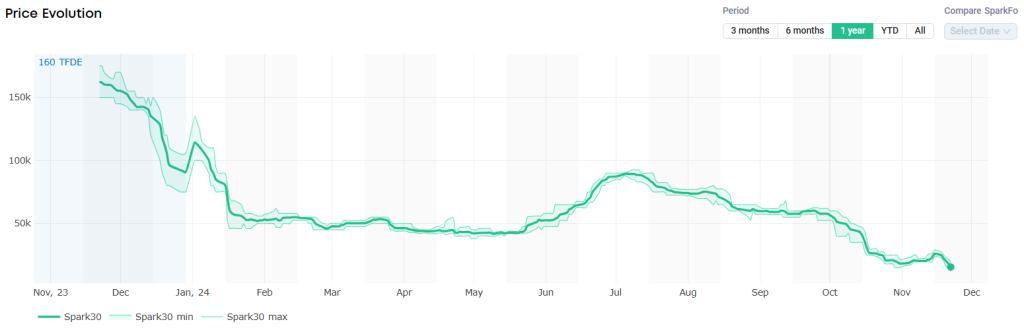

“Spark30S Atlantic rates have fallen $10,500 to $15,500 per day, wiping out recent gains in the last two weeks,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

Afghan said this is the lowest Spark30S-174 assessment on record.

“Spark25S Pacific rates continued to decline for a fifteenth straight week, falling by $3,000 to $23,000 per day,” he said.

LNG shipping firms such as Flex LNG and CoolCo expect spot LNG charter rates to remain weak by the end of this year.

In their recent quarterly reports, Flex LNG and CoolCo cited a large number of newbuilds entering the market as the main reason behind the weak spot market.

European prices jump

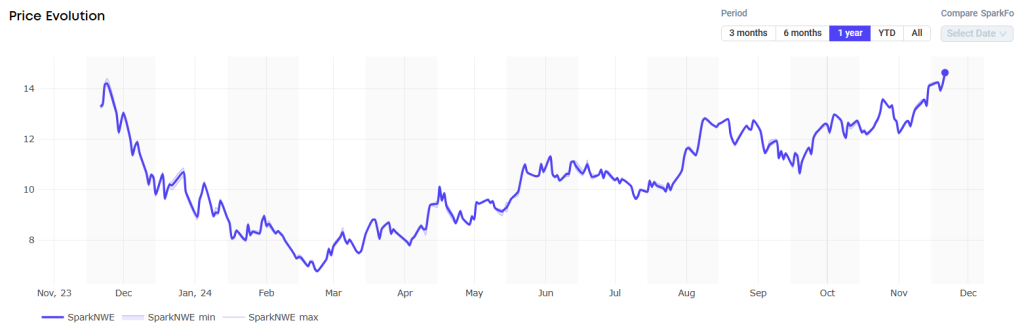

In Europe, the SparkNWE DES LNG increased compared to last week.

“The SparkNWE DES LNG front month price for December delivery rose by $0.528 this week, pricing in at $14.635/MMBtu – this is the highest SparkNWE price since October 2023, as the TTF continues to rally amid continuing arbitrations between OMV and Gazprom,” Afghan said.

He said “the discount to the TTF widened slightly, currently assessed at -$0.245/MMBtu.”

According to Afghan, the US arb to NE-Asia (via the Cape of Good Hope) for December increased by $0.623 and is currently pricing in at -$0.257/MMBtu.

“Whilst the US arb is still signaling prompt month US cargoes are incentivized to voyage to NW-Europe for a ninth straight week, it is much more marginal than last week due to a significant week-on-week increase in the JKM-TTF spread, as well as record low Spark30S freight rates in the Atlantic basin,” he said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to decline and were 89.41 percent full on November 20.

Gas storages were 92.10 percent full on November 13 and 98.75 percent full on November 13, 2023.

Wood Mackenzie said December TTF prices have risen mostly due to Gazprom’s supply halt to Austria’s OMV and anticipated winter heating demand.

With winter having begun and heating demand cutting through European storage, the European balance has tightened its last recorded storage, its said.

Also, Norway’s Sleipner field will undergo maintenance, reducing its capacity by 5.1 million mcmd from December 1 to January 24, with additional cuts across the Norwegian gas system in early December and late January, Wood Mackenzie said.

JKM surges

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in January 2025 settled at $15.075/MMBtu on Thursday.

Last week, JKM for December settled at 13.579/MMBtu on Friday, November 15.

Front-month JKM rose to 14.650/MMBtu on Monday. It dropped to 14.400/MMBtu on Tuesday and rose to 14.660/MMBtu on Wednesday.

Egypt tender delayed

According to Kpler, Egypt’s plans to secure LNG supplies for the first quarter of 2025 have encountered a setback as its tender for approximately 20 cargoes, initially expected in early December, faces delays.

The issue stems from technical challenges affecting the 170,00-cbm Hoegh Galleon FSRU, particularly with its vaporizers.

Kpler said these problems have disrupted the sendout of regasified LNG, limiting storage capacity for incoming cargoes.