This story requires a subscription

This includes a single user license.

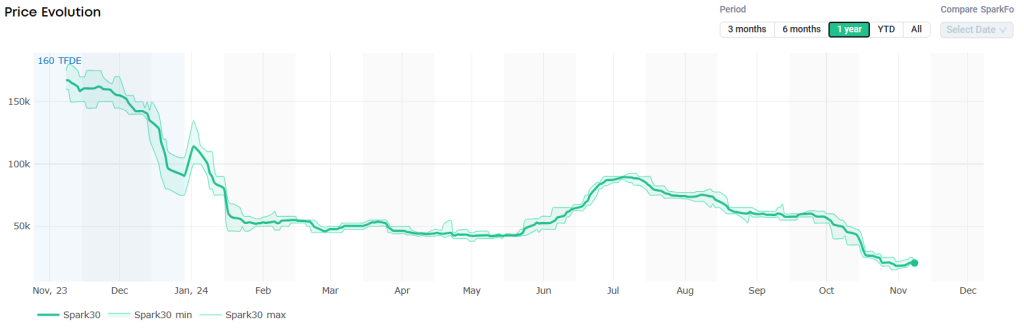

Last week, LNG shipping rates continued to slide in both basins.

“Spark30S Atlantic rates have experienced a week-on-week increase for the first time in seven weeks, rising by $2,250 to $20,500 per day,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

Spark25S Pacific rates continued to decline for a thirteenth straight week, falling by $2,250 to $38,250 per day.

“Winter freight rates in both basins are currently at record lows, and this is set to continue as Spark’s FFA Cal 2025 assessment is currently pricing in at $31,800 for the Atlantic, and $44,600 in the Pacific – the lowest Cal rates on record for a 174 2 stroke vessel,” he said.

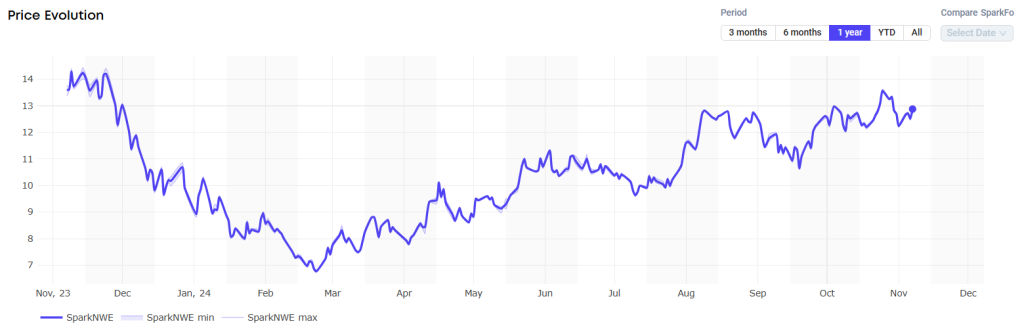

European prices sightly up

In Europe, the SparkNWE DES LNG increased compared to last week.

“The SparkNWE DES LNG front month price for December delivery rose by $0.18 this week, pricing in at $12.879/MMBtu,” Afghan said.

He said the discount to the TTF narrowed slightly, currently assessed at -$0.200/MMBtu.

“The US arb to NE-Asia (via the Cape of Good Hope) for December fell week-on-week by $0.141 and is currently pricing in at $-0.23/MMBtu, signaling prompt month US cargoes are incentivized to voyage to NW-Europe for a seventh straight week,” he said.

“Spark30S Atlantic freight rates would have to drop to a record low of $5,000 per day for this arb to open up,” Afghan said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU declined compared to the previous week and were 94.43 percent full on November 6.

Gas storages were 95.20 percent full on October 30 and 99.50 percent full on November 6, 2023.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in December settled at $13.495/MMBtu on Thursday.

Last week, JKM for December settled at 13.475/MMBtu on Friday, November 1.

Front-month JKM remained flat on Monday. It rose to 13.540/MMBtu on Tuesday and dropped to 13.495/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that JKM for last week (October 28 – November 1) fell to high-$12s on November 1 from low-$14s the previous weekend.

“In the first half of the week, the price moved modestly around $14 amid no significant change in fundamentals, but on November 1 fell by more than one dollar to a three-week low, following a significant fall in European gas prices,” JOGMEC said.

LNG futures traded volumes hit record

Traded volumes and end-month open interest for the JKM LNG futures cleared on the Intercontinental Exchange (ICE) reached new highs in October as the market prepared for the winter season, according to a report by Platts, part of S&P Global Commodity Insights.

The report said LNG futures traded volumes on ICE hit a three-year high of 100,755 lots in October, equivalent to about 19.38 million mt or 305 LNG cargoes.

The volume increased 32.61 percent year over year and 5.36 percent month over month.

Meanwhile, trading activity for the JKM LNG options contract dropped 65 percent, with traded volumes at 800 lots and end-month open interest at 12,100 lots, down 13.39 percent month over month.

Asian physical LNG spot prices in October remained steady, with JKM prices hovering around the mid-$13/MMBtu level.

The Platts JKM rose slightly, averaging $13.384/MMBtu in October compared to $13.219/MMBtu in September.

According to the report, buying activity in the Japan-South Korea-Taiwan-China (JKTC) region remained muted amid the shoulder month, as utilities have procured necessary cargoes for the upcoming winter season.

The report noted that major LNG importer China faces high inventories, prompting some market participants to sell.