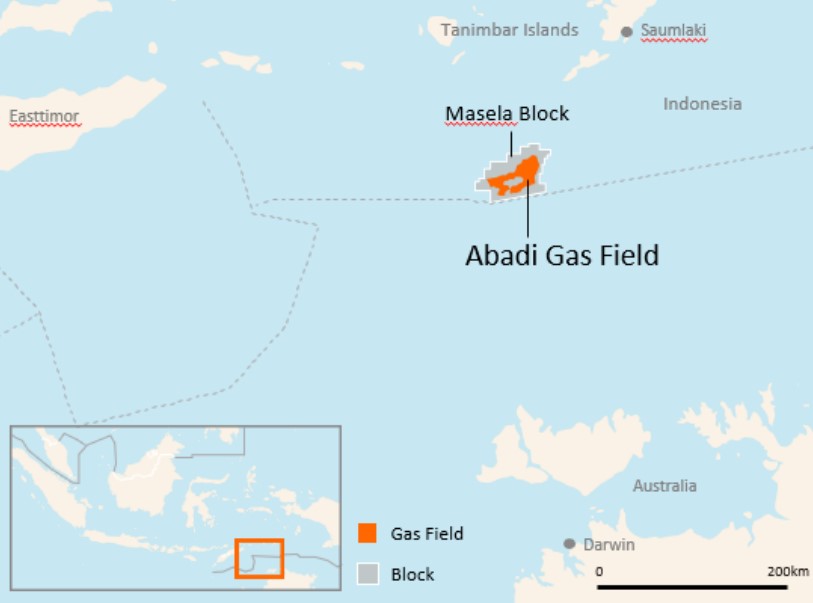

Japan’s Inpex said it had submitted a revised plan of development to the Indonesian government for the planned Abadi LNG project.

The plan submitted by Inpex Masela on behalf of the joint venture with LNG giant Shell incorporates a carbon capture and storage (CCS) component, Inpex said in a statement on Tuesday.

Inpex has a 65 percent stake in the project and Shell holds the rest.

The Inpex-operated project has seen many changes over the years and initially, the development of the Masela offshore block involved a floating LNG plant, while it now includes a 9.5 mtpa onshore LNG plant with an estimated cost of about $20 billion.

In February 2022, Inpex announced its long-term strategy towards a net zero carbon society by 2050.

As part of this initiative, the company has been in dialogue with the authorities to “ensure the project’s competitiveness and sustainability from a long-term perspective for the duration of the energy transition, and to render the project clean and capable of responding to changes in the external environment,” it said.

As a result, Inpex amended the revised POD to include plans to neutralize all carbon dioxide (CO2) emitted from natural gas production at the Abadi gas field through the introduction of CCS.

In addition, the JV has restored other circumstances facilitating the project’s implementation, enabling the submission of the revised POD at this time, Inpex said.

In March 2023, Indonesia enacted a ministerial regulation of energy and mineral resources on carbon capture, utilization and storage (CCS/CCUS) in the oil and gas business.

Accordingly, Inpex expects the project to become the first CCS project to be carried out as a cost recovery business based on the production sharing contract framework governing upstream oil and gas projects in Indonesia.

Inpex to sequentially resume activities

Going forward, Inpex expects to sequentially resume activities associated with the project, including various on-site activities, and prepare to begin FEED work subject to the authorities’ approval of the revised POD and taking into account other circumstances concerning the project’s development status, it said.

Thereafter, Inpex expects to complete the necessary preparations including marketing and financing activities and proceed with the project aiming to reach a final investment decision (FID) in the latter half of the 2020s and commence production in the early 2030s, the firm said.

The project would become Inpex’s second self-operated, large-scale natural gas development project following the Ichthys LNG project in Australia.

Also, Inpex expects the project’s annual LNG production volume to reach 9.5 million tons, equivalent to more than 10 percent of Japan’s annual LNG imports.

Inpex added that it expects the Abadi gas field to contribute to “improving energy security in Indonesia, Japan, and other Asian countries, based on its world-leading gas field properties and plentiful reserves enabling efficient development and its CCS component allowing the stable supply of clean energy over the long term.”