This story requires a subscription

This includes a single user license.

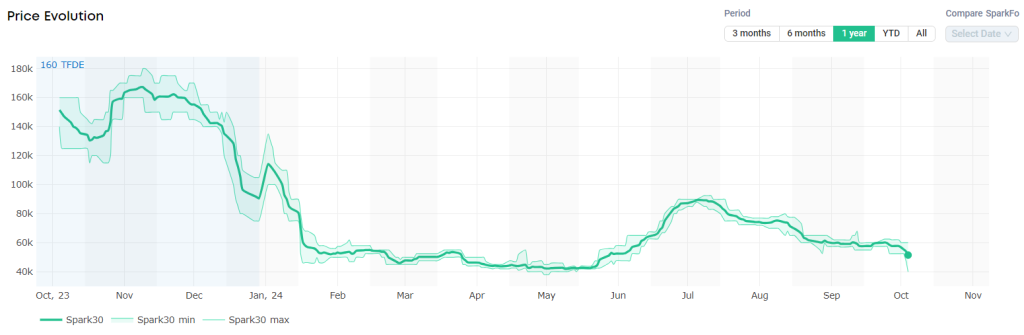

Last week, LNG shipping rates also declined.

“Spark30S Atlantic rates dropped for a second consecutive week, reducing by $6,250 to $51,500 per day,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

He said Spark25S Pacific rates continued to decline for an eight week, falling by $4,500 to $59,500 per day.

“Freight rates in both basins are currently at their lowest levels in five years for this time of year,” Afghan said.

European prices up

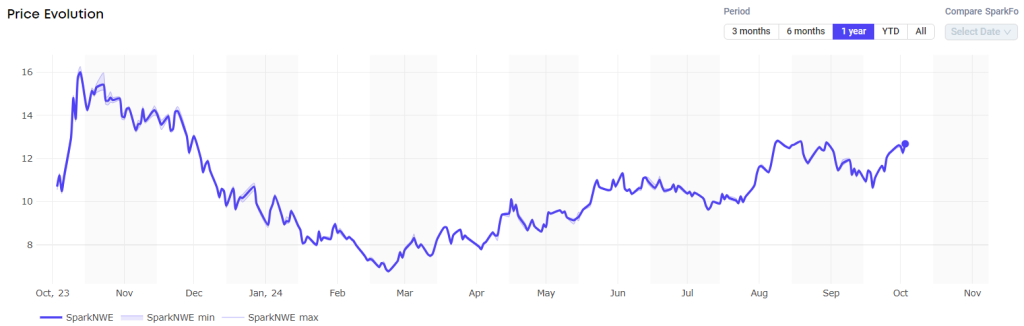

In Europe, the SparkNWE DES LNG front month rose this week compared to $12.225/MMBtu last week.

“The SparkNWE DES LNG front month price for November delivery is pricing in at $12.683/MMBtu, and the discount to the TTF assessed at $0.205/MMBtu,” Afghan said.

“At current DES LNG and freight prices, delivery to NW-Europe for US cargoes is approximately $0.60/MMBtu more profitable than delivering to NE-Asia via COGH, with this premium almost doubling this week due to a large reduction in the JKM-TTF spread,” Afghan said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to rise and were 94.33 percent full on October 2.

Gas storages were 93.98 percent full on September 25 and 96.17 percent full on October 2, 2023.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in November settled at $13.095/MMBtu on Thursday.

Last week, JKM for November settled at 13.205/MMBtu on Friday, September 27.

Front-month JKM then dropped to 13.125/MMBtu on Monday. It rose to 13.175/MMBtu on Tuesday and dropped again to 13.090/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that JKM for last week (September 23 – 27) rose to low-$13s on September 27 from high $12s the previous weekend.

“Supply was steady throughout the week, but the price went upward trend mid-to-late in the week due to rise of European gas price and procurement activities for the winter months,” JOGMEC said.

JKM-NWE spread reaches 1-year low

According to a report by S&P Global Commodity Insights on Wendesday, the JKM-NWE spread fell to 16.3 cents/MMBtu on October 1, the lowest level since October 12, 2023, amid weak Asian LNG demand and worries over potential tight constraints in Europe during winter.

“While the narrowed JKM-NWE spread was partly due to European LNG prices strengthening during London hours October 1, driven by escalating Middle East tensions, a negative East-West arbitrage window highlighted thin appetite for LNG volumes in Asia,” the report said.

The Platts-assessed East-West arbitrage (via the Cape of Good Hope) dipped 3.4 cents/MMBtu on the week to minus 67 cents/MMBtu on October 1, S&P Global Commodity Insights data showed, indicating limited opportunities for traders to shift Atlantic supply to the East.

LNG demand from major importer China remains thin because the flat price is still above $13/MMBtu, the report said citing sources, adding that bidding prices are at $12-$12.50/MMBtu.

Similarly, Indian demand is not expected to increase significantly as offers remain above $12.5/MMBtu on a flat price basis, the report said.

The report said that European gas prices remained resilient due to supply-related risks stemming from the Middle East conflict and the early stoppage of gas flows from Russia via Ukraine, sources said.

“The region is also experiencing heavy maintenance at the Norwegian Continental Shelf, which, although planned, was adding to bullish sentiment due to the potential for unplanned extensions,” the report said.

The report said temperatures have also dropped, especially in Northwest Europe, supporting LNG demand in recent weeks.