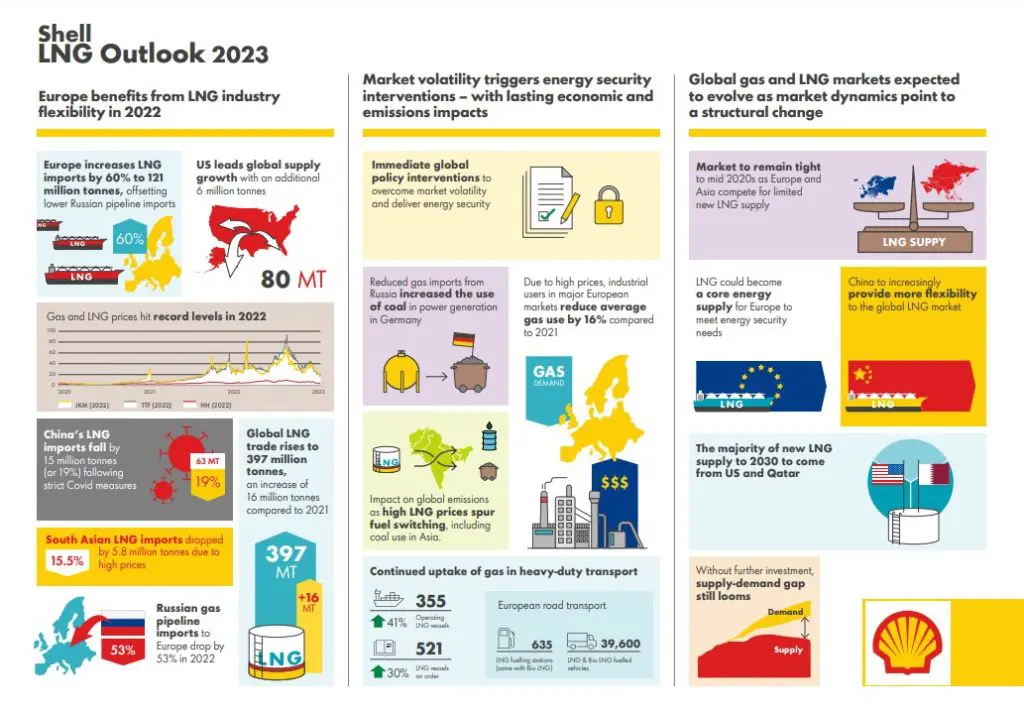

The global LNG trade increased by 16 million tonnes to 397 million tonnes in 2022 when compared to the year before, while Europe increased its LNG imports by 60 percent to 121 million tonnes, Shell said in its latest annual LNG Outlook.

Shell’s 2021 report issued last year revealed that the global LNG trade increased 6 percent to some 380 million tonnes in 2021.

Europe’s increased need for LNG looks set to intensify competition with Asia for limited new supply available over the next two years and may dominate LNG trade over the longer term, according to Shell’s LNG Outlook 2023.

European countries, including the UK, imported 121 million tonnes of LNG in 2022, an increase of 60 percent compared to 2021, which enabled them to withstand a slump in Russian pipeline gas imports following its invasion of Ukraine, the report said.

Moreover, a 15 million tonne fall in Chinese imports combined with reduced imports by South Asian buyers helped European countries to secure enough gas and avoid shortages, it said.

Europe’s rapidly rising appetite for LNG pushed prices to record highs and generated volatility in energy markets around the world, Shell said.

European energy security

With reduced Russian pipeline gas, LNG is becoming an increasingly important pillar of European energy security, supported by the rapid development of new regasification terminals in north-west Europe, the report said.

In contrast, China is evolving from being a rapidly growing import market to playing a more flexible role with an increased ability to balance the global LNG market.

“The war in Ukraine has had far-reaching impacts on energy security around the world and caused structural shifts in the market that are likely to impact the global LNG industry over the long term,” Steve Hill, Shell’s executive VP for energy marketing, said.

“It has also underscored the need for a more strategic approach – through longer-term contracts – to secure reliable supply to avoid exposure to price spikes,” he said.

The drop in Russian pipeline gas flows prompted unprecedented policy and regulatory intervention as governments in Europe sought to bolster energy security and shield their economies from high costs, including prioritizing LNG imports and quickly developing new import terminals, the report said.

In 2022, Europe’s LNG demand forced other buyers to reduce their imports and switch to other fuels, generating more emissions, according to Shell.

High global LNG prices led to a drop in LNG imports in South Asia, with Pakistan and Bangladesh importing more fuel oil to minimize power supply shortages and India using more coal, it said.

LNG demand to reach 650 to over 700 million tonnes a year by 2040

Total global trade in LNG reached 397 million tonnes in 2022. Industry forecasts expect LNG demand to reach 650 to over 700 million tonnes a year by 2040, according to Shell.

More investment in liquefaction projects is required to avoid a supply-demand gap that is expected to emerge by the late 2020s, the firm said.

Also, diverse new technologies to reduce emissions from gas and LNG supply chains will help to consolidate its role in the energy transition, it said.

And there is growing industry focus on the development and deployment of decarbonized gases – including renewable natural gas, synthetic natural gas, hydrogen and ammonia – to deliver more sustainable energy security in the future, Shell said.