Spot charter rates for the global liquefied natural gas (LNG) carrier fleet continued their downward trend this week, while European and Asian prices also decreased compared to the previous week.

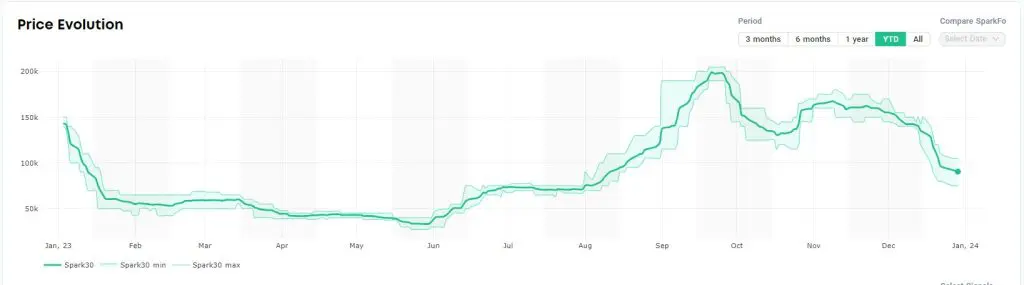

Last week, both the Spark30S Atlantic and the Spark25S Pacific dropped below $100,000 per day.

“LNG freight rates have fallen for the fourth consecutive week, with a 6 percent week-on-week decrease for Atlantic rates and a 5 percent w-o-w decrease for Pacific rates,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

Afghan said that the Atlantic rate decreased by $6,000 to $90,500 per day, whilst the Pacific rate decreased by $4,000 to $72,500 per day.

This is the lowest Spark25S Pacific year-end rate for the last four years, according to Afghan.

Rates continue to decline despite delays at the Panama Canal, and constraints at the Suez Canal due to attacks in the Red Sea.

Kpler said last week that at least eight LNG vessels re-routed away from the Red Sea towards the Cape of Good Hope amid ongoing security risks in the Bab el-Mandeb Strait.

European, Asian LNG prices

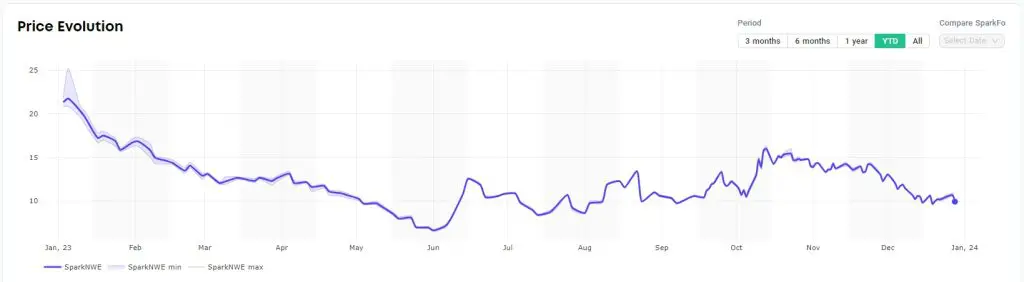

In Europe, the SparkNWE DES LNG front month also declined from the last week.

The NWE DES LNG for January delivery was assessed last week at $10.206/MMBtu and at a $0.810/MMBtu discount to the TTF.

“The SparkNWE DES LNG price for January delivery is assessed at $9.925/MMBtu and at a $0.850/MMBtu discount to the TTF,” Afghan said on Friday.

He said this is a $0.282/MMBtu decrease in DES LNG price, and the discount to the TTF widened by $0.04/MMBtu, when compared to last week’s January prices.

Platts, part of S&P Global Commodity Insights, said in a report this week that Europe’s delivered imports of LNG in December were at 10.36 million mt as of December 27, or around 94 percent of the November level, which was the highest since May.

The US is supplier of 53 percent of the total, with some 13 percent coming from Russia and 8 percent from Algeria. Qatar also contributed around 8 percent of the supply.

Platts said demand remains muted as inventories across Europe remain comfortable.

Data by Gas Infrastructure Europe (GIE) shows that gas storages in the EU were 86.98 percent full on December 28 and 93.94 percent in the UK.

According to Platts data, JKM, the price for LNG cargoes delivered to Northeast Asia, also dropped from the last week.

JKM for February settled at $11.935/MMBtu on Thursday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that Asian spot LNG prices continued to decline due to low demand and ample supply.

This month, JOGMEC did not publish both the contract-based and the arrival-based monthly spot LNG price for November as there were less than two companies that imported spot LNG.