Spot charter rates for the global liquefied natural gas (LNG) carrier fleet remained almost flat this week, while European prices increased for the third week in a row.

Last week, Atlantic freight rates slightly increased after falling to their lowest levels reported since June 2023 in the prior week.

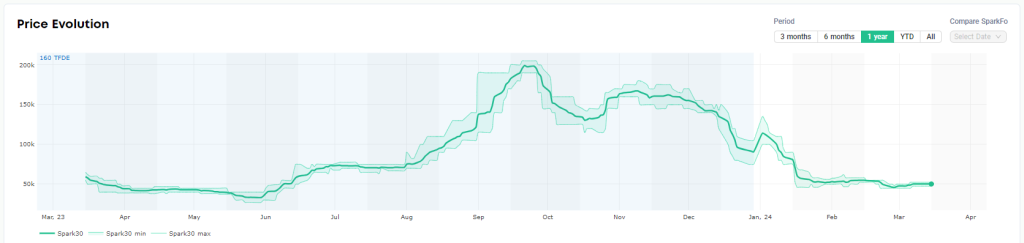

“Freight rates remain steady, with the Spark30S Atlantic spot rate remaining at $50,250 per day, and the Spark25S Pacific rate falling by $750 to $50,750 per day,” Qasim Afghan, Spark’s commercial analyst, told LNG Prime on Friday.

“This is the second time in a month that Atlantic rates have remained flat week-on-week,” he said.

US LNG exports round Cape of Good Hope

LNG freight rates have not been impacted despite the fact that LNG carriers are still avoiding the Suez Canal due to the situation in the Red Sea.

In addition, due to a drought situation impacting the Panama Canal, LNG transits through the waterway remain low and vessels are choosing other routes to deliver their cargoes.

“Although drought-related restrictions have improved slightly at the Panama Canal since the start of the year, the proportion of US LNG exports being sent round the Cape of Good Hope remains elevated in March as attacks on commercial shipping in the Red Sea force shippers to take the longer route to Asia,” Platts said in a report on Thursday.

Of the total US exports of 3.33 million mt delivered in March thus far, around 710,000 mt were delivered into Asia, with all volumes transiting through the Cape of Good Hope to reach their destination, according to data from S&P Global Commodity Insights.

“No US volumes have been delivered to Asia via the Suez or Panama canals so far in March, with the last US cargo delivered via the Suez Canal arriving in Japan on January 27 after being exported from the Cove Point LNG export terminal in Maryland on December 16, 2023,” it said.

European and Asian prices rise

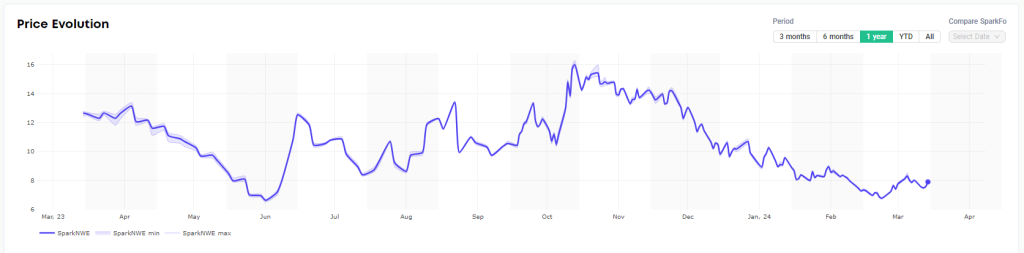

In Europe, the SparkNWE DES LNG front month rose compared to the last week.

The NWE DES LNG for March delivery was assessed last week at $7.861/MMBtu.

“The SparkNWE DES LNG price is reported at $7.902/MMBtu, corresponding to a $0.041/MMBtu week-on-week increase,” Afghan said.

“This marks the third consecutive weekly increase in SparkNWE DES LNG price, and a $1.129/MMBtu increase since the year-low from three weeks ago,” he said.

Levels of gas in storages in Europe remain high due to a mild winter.

Data by Gas Infrastructure Europe (GIE) shows that gas storages in the EU were 59.88 percent full on March 13. Gas storages were 61.30 percent full on March 7, and 56.40 percent full on March 13 last year.

This week, JKM, the price for LNG cargoes delivered to Northeast Asia, rose slightly when compared to the last week, according to Platts data.

JKM for April settled at $8.490/MMBtu on Thursday.

State-run Japan Organization for Metals and Energy Security (JOGMEC) said in a report earlier this week that the JKM rose due to increased buying interest to meet short-term demand.

METI said that Japan’s LNG inventories for power generation as of March 10 stood at 1.83 million tonnes, down from 1.95 million tonnes in the previous week.