Spot charter rates for the global liquefied natural gas (LNG) carrier fleet remained almost flat this week, while European and Asian prices rose compared to the week before.

Last week, charter rates fell for the third consecutive week.

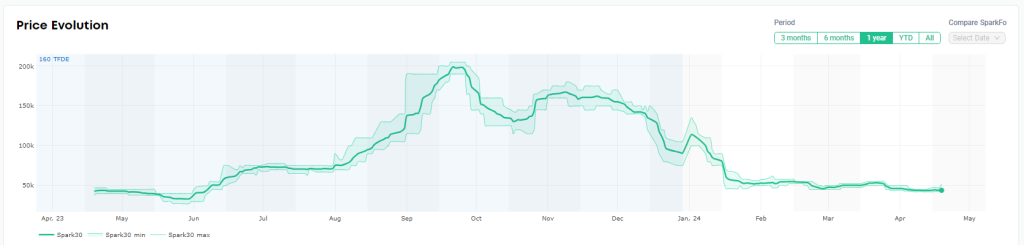

“Freight rates in the Atlantic and Pacific basins stayed steady this week, with the Spark30S Atlantic spot rate increasing by $250 per day to $44,000 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

He said that the Spark25S Pacific rate fell by $500 per day to $46,250 per day.

First LNG tanker in Suez since January

Kpler said in a report that the 174,000-cbm Flex Volunteer recently passed through the Suez Canal on its way to Jordan.

“This is the first LNG tanker to transit Suez in three months after disruptions caused by attacks from Yemen’s Houthi rebel groups on ships in the area pushed shippers to avoid the route,” it said.

Market experts speculate that Flex Volunteer, chartered by Vitol, was likely carrying LNG purchased by Egypt’s state-owned EGAS from Vitol for delivery to Aqaba, it said.

EGAS is utilizing Aqaba as it lacks an FSRU, preventing it from receiving LNG cargoes directly, Kpler said.

The 162,000-cbm, Clean Horizon, was the last ship to transit the Suez Canal before Flex Volunteer on January 16, it said.

This week, the Panama Canal Authority also announced that it will raise the total number of daily transits.

“Scheduled maintenance work at the Gatun Locks, set to take place from May 7 to 15, will necessitate a temporary reduction in daily transits from 20 to 17 at the Panamax locks,” it said.

The canal will implement “significant increases in transit capacity thereafter, raising the total number of daily transits from 24 to 32,” the authority said.

The Cape of Good Hope route’s popularity for US LNG exporters looking to reach Asia has increased sharply in 2024, with the number of cargoes making the voyage reaching a record in March at 27, according to S&P Global Commodity Insights data.

Moreover, the cape continues to see higher than normal activity by US LNG exporters, with 18 cargoes transiting through the passage thus far in April, compared with just three for the whole month in 2023, the data shows.

US LNG exporters have turned to this route, which is the longest option to reach Asia, following a historic drought in Panama and attacks on ships in the Bab al-Mandab Strait by Houthi rebels in Yemen since October, it said.

European, Asian prices up

This week, one of the main topics was the Iran-Israel conflict and its implications on the oil and gas market.

Japanese utilities have “strong concerns” over escalating tensions in the Middle East as any supply disruption in the region would have a big impact on fuel supply and prices, Reuters said in a report on Friday.

In spot market moves, Papua New Guinea’s national oil and gas company Kumul Petroleum sold its first spot cargo produced at the PNG LNG project to PetroChina International, while power producer First Gen awarded a contract to a unit of China’s state-owned energy giant CNOOC to supply one spot cargo to its FSRU-based terminal in Batangas, Philippines.

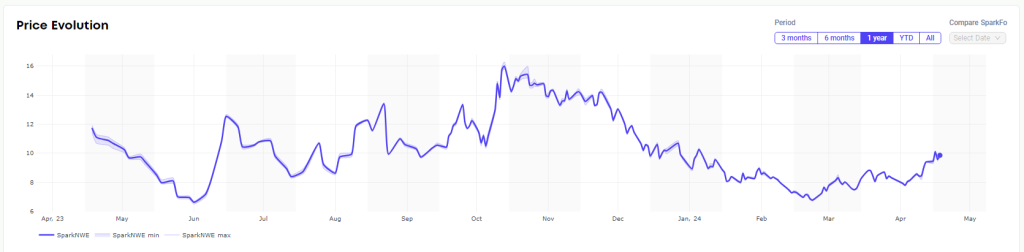

In Europe, the SparkNWE DES LNG front month jumped compared to the last week.

“The SparkNWE DES LNG front month price for May delivery is assessed at $9.860/MMBtu and at a $0.230/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.868/MMBtu increase in DES LNG price, the second largest weekly increase in SparkNWE DES LNG price in six months (Oct 2023) and seconded only by last weeks week-on-week increase.

“This marks a 46 percent rally since the YTD lows seen in February,” Afghan said.

Levels of gas in storages in Europe are very high following a mild winter and the EU-27 ended the winter with record-high stocks in gas storages.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU rose and they were 62.06 percent full on April 17.

Gas storages were 61 percent full on April 10, and 56.71 percent full on April 17 last year.

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, jumped when compared to the last week, according to Platts data.

JKM for June settled at $10.880/MMBtu on Thursday.

The data shows that JKM reached the highest levels in 2024 during this week and it settled at 11.260/MMBtu on Tuesday.

Freeport LNG

US LNG exports decreased in the week ending April 17 compared to the week before, with the Freeport LNG terminal shipping only one cargo during the period, according to the EIA.

The agency said that scheduled volumes of natural gas at the Stratton Ridge delivery location for Freeport LNG on the Gulf South pipeline have been close to 0 Bcf/d from April 12 to April 17.

Freeport LNG said last month it will operate with only the third train until “sometime in May” when it expects to bring back online the first and the second train.

According to reports, the third LNG train tripped offline due to an issue with a flow meter on April 9 and came back online on April 10.

Freeport LNG declined to comment on the status of the third train.