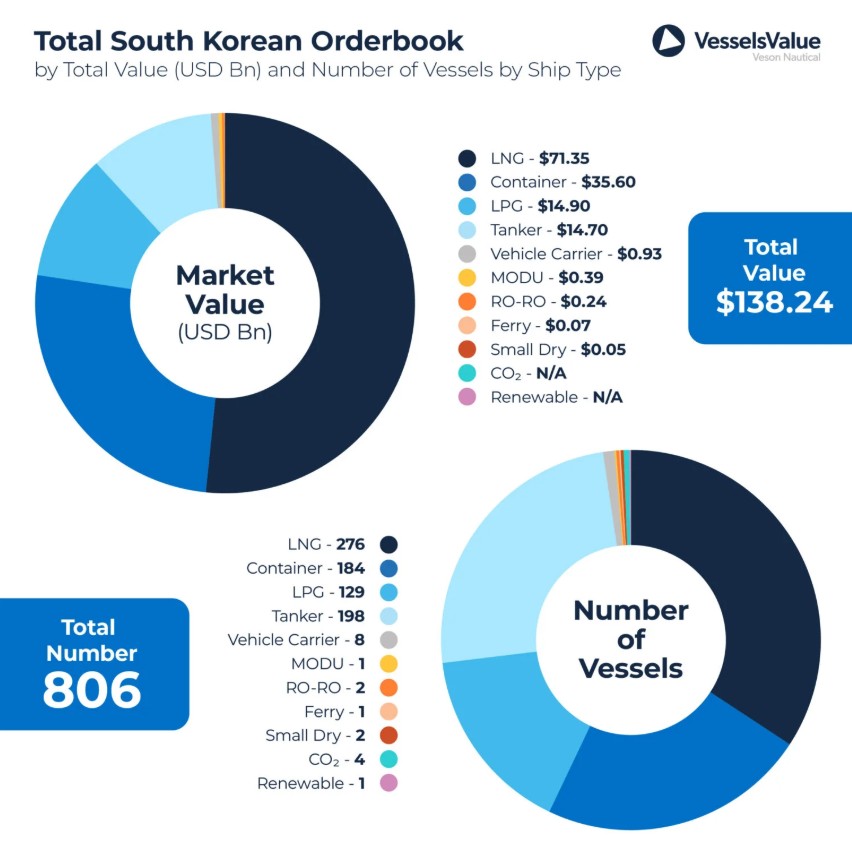

South Korean yards have 276 LNG carriers worth $71.3 billion on order, according to the newest data by Veson Nautical’s VesselsValue.

Within the South Korean orderbook, the LNG sector is the most valuable, accounting for around 52 percent of the total South Korean orderbook value, and this sector also has the highest volume of orders, VesselsValue said.

LNG carrier shipbuilders are Hanwha Ocean, HD Hyundai yards, and Samsung Heavy.

In total, the South Korean orderbook includes 806 vessels worth $138.24 billion, the report shows.

Container vessels rank second with a market value of $35.6 billion—equating to a share of c.26 percent and 184 vessels on order.

Moreover, the LPG sector ranks third with a value of $14.9 billion and 129 vessels on order, closely followed by the tanker orderbook which is valued at $14.7 billion.

Tankers surpass both LPG and container vessels in volume with 185 vessels scheduled to be built, while car carriers rank fifth with a value of $929 million and a total of eight vessels on order.

Owners

VesselValue said France’s CMA CGM is in first place with a total of $8.09 billion on order, and they have the highest volume of orders consisting exclusively of 38 container vessels.

In second place, Japan’s NYK has a total of $7.21 billion on order, which includes 26 174,000-cbm LNG vessels and three VLACs of 88,000 CBM.

In addition to these vessels on order in South Korea, NYK has a further 56 vessels on order in Chinese, Japanese, and German yards, including additional orders for LNG, LPG orders, bulkers, and tankers, VesselsValue said.

Qatar Gas Transport, or Nakilat, ranks third in value with an orderbook worth $6.9 billion, consisting of 29 vessels, primarily LNG carriers.

Moreover, VesselsValue said QatarEnergy is ranked fourth with an orderbook value of $6.52 billion, consisting of 25 large LNG vessels.

With a total orderbook value of $6.38 billion, Taiwan’s Evergreen Marine ranks fifth. The 28 vessels on order are all containers of 15,372 – 15,500 TEU or ULCVs of 24,000 TEU.

They are followed by Japan’s MOL with an orderbook value of $5.62 Bn and a total of 26 vessels on order, VesselsValue said.

Dual fuel

Of the vessels on order in South Korea, approximately 37 percent are being fitted with dual-fuel capabilities, with a market value of $71.4 billion, the report said.

With the exception of LNG carriers, which will always be dual fuel, this includes all vehicle carriers and Ro-Ro’s, VesselValue said.

Also, the second highest percentage is the container sector, where 148 dual-fuel vessels have been contracted, equating to c.80 percent of the orderbook.

Approximately 50 percent of the LPG orderbook, or 64 vessels, will be built as dual fuel, with a market value of $7.5 billion, the report said.