US LNG player New Fortress Energy has finalized its previously announced deals with Mexico’s Pemex to develop and operate an integrated upstream and natural gas liquefaction project off the coast of Veracruz.

NFE revealed in July this year two separate deals with Pemex and CFE aimed at installing floating LNG production units off Mexico.

The Wes Edens-led firm already finalized the deal with CFE and now it completed the agreements with Pemex as well.

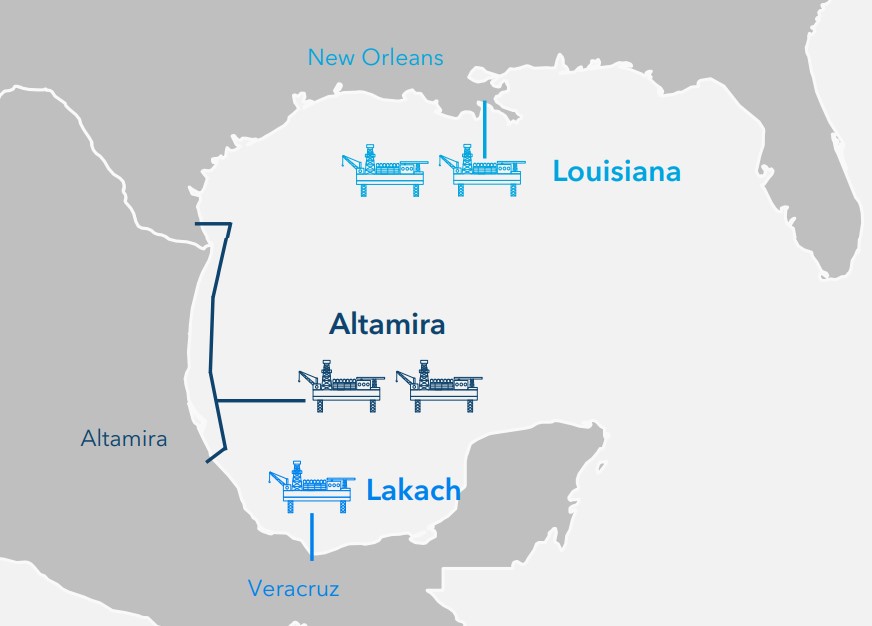

The deals with Pemex comprise a long-term strategic partnership to complete the development of the Lakach deepwater natural gas field, one of the largest non-associated gas fields in the Gulf of Mexico.

NFE said in a statement on Tuesday it would invest in the continued development of the Lakach field over a two-year period by completing seven offshore wells.

In addition, NFE would deploy to the Lakach field its 1.4 MTPA Sevan Driller FLNG unit to liquefy the majority of the produced natural gas.

Singapore’s Sembcorp Marine is currently converting this unit into a floating LNG producer.

Ten years of production

Pursuant to the deals, NFE will provide upstream services to Pemex whereby NFE produces natural gas and condensate in exchange for a fee for every unit of production delivered to Pemex.

The fee is based on a contractual formula that resembles industry-standard gross profit-sharing agreements between the upstream service provider and the owner of the hydrocarbons, NFE said.

NFE would produce natural gas in the Lakach field and would have the right to purchase, at a contracted rate, sufficient volumes for its FLNG unit, while Pemex would sell the remaining natural gas volumes and all of the produced condensate to its customers onshore.

The partners believe the Lakach field would yield about ten years of production, with the possibility of “significantly extending the reserve life” if the nearby Kunah and Piklis fields are developed.

Coupled with these nearby fields, the area around Lakach has a total resource potential of 3.3 trillion cubic feet (Tcf) and comprises one of the most significant undeveloped offshore natural gas resources in the Western hemisphere, the statement said.

“This arrangement represents the first of what we consider to be an ideal formula for the deployment of NFE’s FLNG units to stranded gas plays around the world – one that combines gas for domestic use with low-cost supply for LNG export into global markets,” Edens said in the statement.

The Lakach FLNG unit is one of five FLNG units NFE plans to deploy in the next two years, adding approximately 7 MTPA of incremental liquefaction capacity to the global market.

This is more than half of the world’s total expected capacity additions during the 2023-2024 period, NFE said.