Australia’s Santos said Monday it signed a long-term supply deal with a unit of Japan’s Mitsubishi Corporation to supply LNG from the Barossa project.

Santos will supply 1.5 million tonnes per annum of LNG to Diamond Gas International for a period of ten years with extension options.

The price will be based on the Platts Japan Korea Marker (JKM). Santos also has options to pursue further LNG transactions through commercial flexibilities negotiated with Diamond Gas, it said.

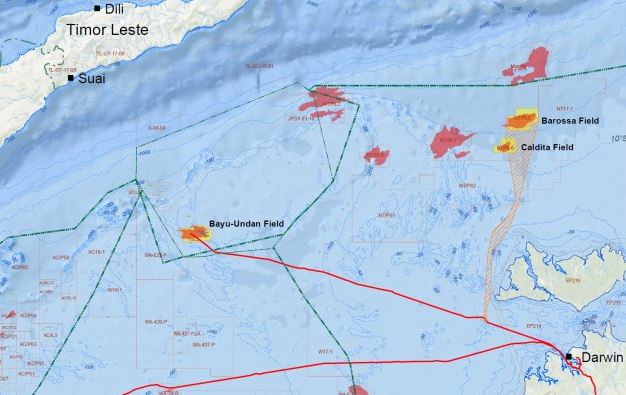

To remind, Santos is developing the Barossa gas field offshore northern Australia to secure feed gas for the Darwin LNG plant.

The Barossa field is located offshore about 300 kilometres north of Darwin.

Santos chief executive Kevin Gallagher said the deal with DGI represents “another significant step” towards a final investment decision on Barossa, which is targeted for the first half of 2021.

“Barossa is a globally-competitive, low-cost brownfield LNG project providing new supply into a tightening LNG market, where JKM-based pricing is an increasingly deep, liquid and flexible marker for both sellers and buyers,” he said.

“The SPA delivers a firm LNG offtake arrangement which represents over 80 percent of Santos’ equity LNG volume from the Barossa project at our expected 50 percent interest level,” Gallagher said.

The deal follows the previously announced sell-down to JERA, while the JKM-indexation provides portfolio balance to Santos existing oil-linked LNG offtake agreements from GLNG and PNG LNG, he said.

Gallagher added that the new contract also represents the first Santos long-term equity LNG sale from one of its major projects.

Carbon-neutral LNG

In addition to the long-term deal, Santos and Mitsubishi Corporation have signed a memorandum of understanding to jointly investigate opportunities for carbon-neutral LNG from Barossa.

These include collaborating on opportunities relating to Santos’ Moomba carbon capture and storage (CCS) project, pursuit of carbon neutral LNG, bilateral agreements for carbon credits and potential future development of zero emissions hydrogen.

Santos’ Moomba CCS project is FID-ready and will have the capacity to permanently store 1.7 million tonnes per annum of CO2 deep underground in depleted natural gas reservoirs.

This is subject to government approval regarding eligibility for Australian Carbon Credit Units.

Santos currently holds a 62.5% operated interest in the Barossa joint venture along with partner SK E&S (37.5%). The firm is also a joint venture partner and operator in Darwin LNG with a 68.4% interest.

Completion of the planned sell-downs to SK E&S and JERA, announced in early 2020, will see Santos’ interests in Darwin LNG and the Barossa project change to 43.4% and 50%, respectively.

Santos added the sell-downs are subject to customary consents, regulatory approvals and FID on Barossa.