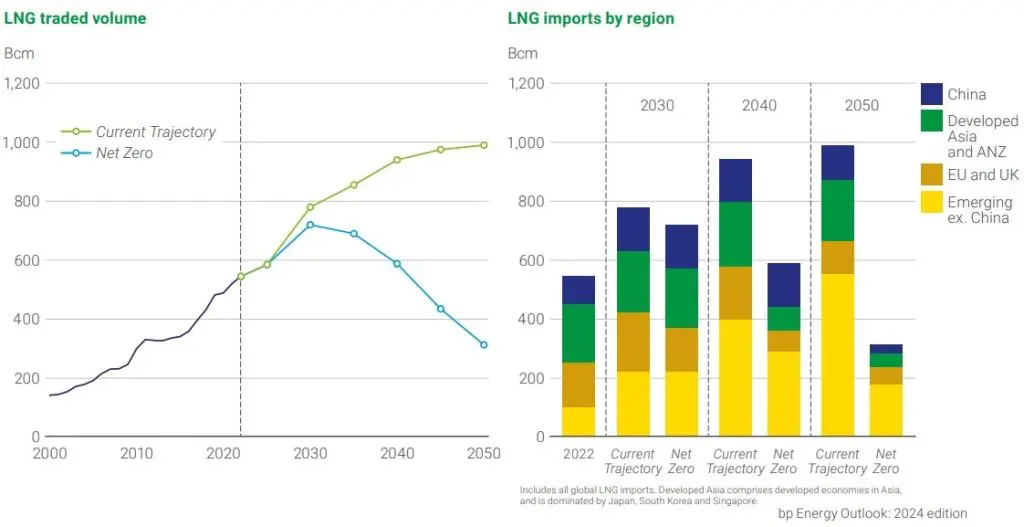

UK-based energy giant BP expects global demand for liquefied natural gas (LNG) to rise up to 40 percent by 2030 compared to 2022 levels.

BP revealed this in its 2024 energy outlook released on Wednesday.

The outlook focuses on two scenarios, current trajectory and net zero.

Current trajectory is designed to capture the broad pathway along which the global energy system is currently travelling, while net zero explores how different elements of the energy system might change in order to achieve a substantial reduction in carbon emissions.

BP expects LNG demand to increase “rapidly” in the near term, but the outlook post-2030 becomes increasingly dependent on the pace of the transition, especially in Europe and Asia, which rely on LNG imports to meet their incremental natural gas demand.

LNG demand grows “robustly” in the first part of the outlook, driven by increasing demand in emerging economies including China, as the increasing use of natural gas in these economies is largely met by imported LNG, BP said.

By 2030, LNG demand is 40 percent and 30 percent above 2022 levels in current trajectory and net zero respectively.

BP said the main difference between the two scenarios out to 2030 reflects contrasting trends in the EU and UK.

In current trajectory, LNG demand in the EU and UK increases out to 2030 as they continue to adjust to the loss of Russian pipeline imports.

In contrast, in net zero a greater shift to alternative energy sources combined with faster gains in energy efficiency means that by 2030, EU and UK LNG demand is below 2022 levels, although still above levels in 2021 prior to the war in Ukraine, BP said.

LNG demand after 2030

BP said the range of outcomes for LNG trade widens post-2030.

In current trajectory, LNG demand increases by more than 25 percent over the subsequent 20 years.

This demand growth requires 300 Bcma of additional liquefaction capacity to come online post2030, according to BP.

In contrast, the gains in LNG demand out to 2030 in net zero are reversed over the following decade, and by 2050 global trade in LNG is around 40 percent below its 2022 level, implying that no additional liquefaction capacity beyond that already under construction is required, it said.

BP said this widening range of outcomes adds to the uncertainty associated with investments in LNG facilities, which typically have an economic life of 15-20 years.

The growth of LNG demand after 2030 in current trajectory is driven entirely by continuing strong growth in emerging economies (excluding China), with India accounting for a third of this increase.

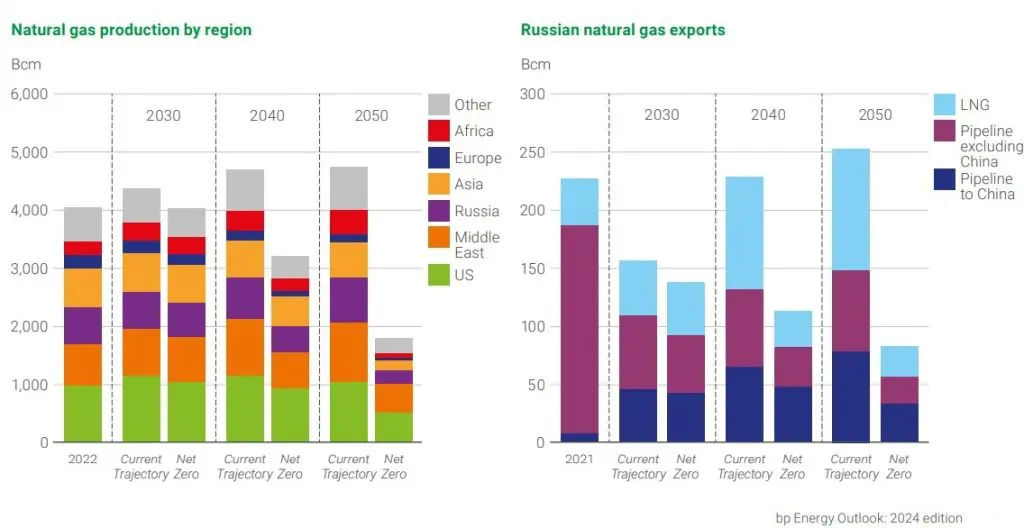

BP said the overall growth in global LNG trade is tempered by falling demand in Europe as the region transitions away from natural gas, and in China where growth in pipeline supplies from Russia reduces the need for LNG imports.

LNG demand in emerging economies in net zero also continues to grow during the 2030s before peaking towards the end of the decade, but this growth is more than offset by sharp falls across the main demand centers in Europe and developed Asian economies, as the use of gas in these economies is crowded out by increasing electrification and a shift towards lower carbon energy sources, BP said.