Norway’s Crown LNG and Catcha Investment signed a definitive agreement for a business combination that would result in Crown becoming a US publicly listed company.

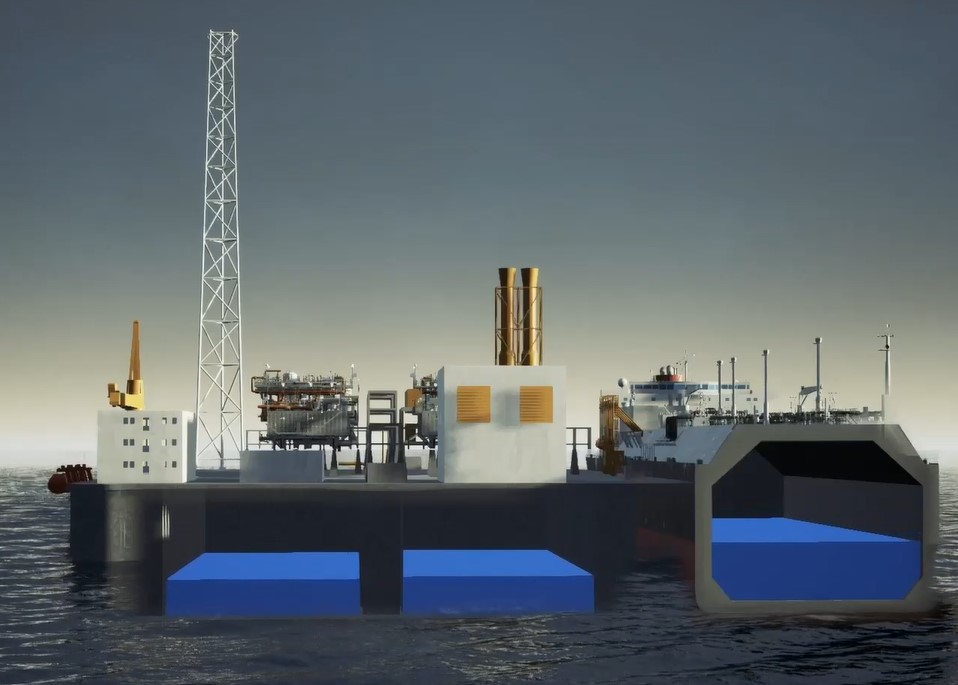

Crown LNG develops offshore liquefaction and LNG regasification terminal infrastructure solutions for harsh weather locations and is working on projects in India and Scotland.

On the other hand, Catcha Investment is a special purpose acquisition company (SPAC) backed by the investment firm of Patrick Grove and Luke Elliott.

According to a joint statement, the combined company, named Crown LNG Holdings Limited, intends to apply to list its shares on the New York Stock Exchange under the new ticker symbol “CGBS”.

Catcha has agreed to combine with Crown through Crown LNG Holdings Limited based on a pre-money valuation of Crown at about $600 million.

The transaction will provide $50 million of capital, with net proceeds going to fund both the Kakinada and Grangemouth projects to final investment decision (FID), the statement said.

The partners expects the implied pro forma enterprise valuation of the public company to be about $685 million.

Also, completion of the proposed transaction remains subject to customary closing conditions, and the partners expect this to occur in the fourth quarter of 2023.

“Transformative step”

Swapan Kataria, CEO of Crown, said in the statement that this business combination with Catcha is a “transformative step” for accelerating Crown’s growth, with the aim to provide its investors with a stable, long-term return on their investment.

“Our targeted blue-chip potential customer base will reflect the strong and growing global demand for harsh weather LNG infrastructure allowing for year-round operation to enable the global energy transition and ensure energy security by facilitating access to reliable natural gas supplies, as well as hydrogen, ammonia and power,” Kataria said.

He added that the capital raised in this transaction will further strengthen the company’s ability to execute on its diversified project pipeline in India, the UK, Vietnam, Canada, and other global markets.

Catcha’s Patrick Grove said that the LNG market is being driven by “strong market tailwinds, including rising energy security concerns and the increasing use of natural gas as a transition fuel with a tenth of the emissions of coal fired plants.”

He said that Crown will help to enable LNG access for under-served markets and at the same time “benefit everyone in the ecosystem customers, governments, producers, and investors.”

FIDs in 2024 and 2025

Currently, Crown is advancing development of two projects toward FID – Kakinada, on the east coast of India, and Grangemouth, in Scotland.

The Grangemouth FSRU project will have a capacity of 5 mpta and will cost about $533 million.

It will supply a natural gas-fired power plant.

The Grangemouth facility has secured support from the Department for Energy Security and Net Zero, as well as access to existing gas and power infrastructure in partnership with GBTron, Kataria said during an investor conference call on Thursday.

“We expect FID in Q3 of 2024 and have invested approximately $4.6 million in the project already,” he said.

As per the Kakinada project in India, this terminal will utilize GBS facilities and will have a capacity of 7.2 mtpa.

This project will cost about $1 billion.

Moreover, the Kakinada project’s GBS terminal has already received a license to operate for 365 days given its more robust characteristics and foul weather capabilities, Kataria said.

“Crown LNG expects FID on the Kakinada project in Q3 of 2025, with invested capital of over $45 million to date in the project,” he said.