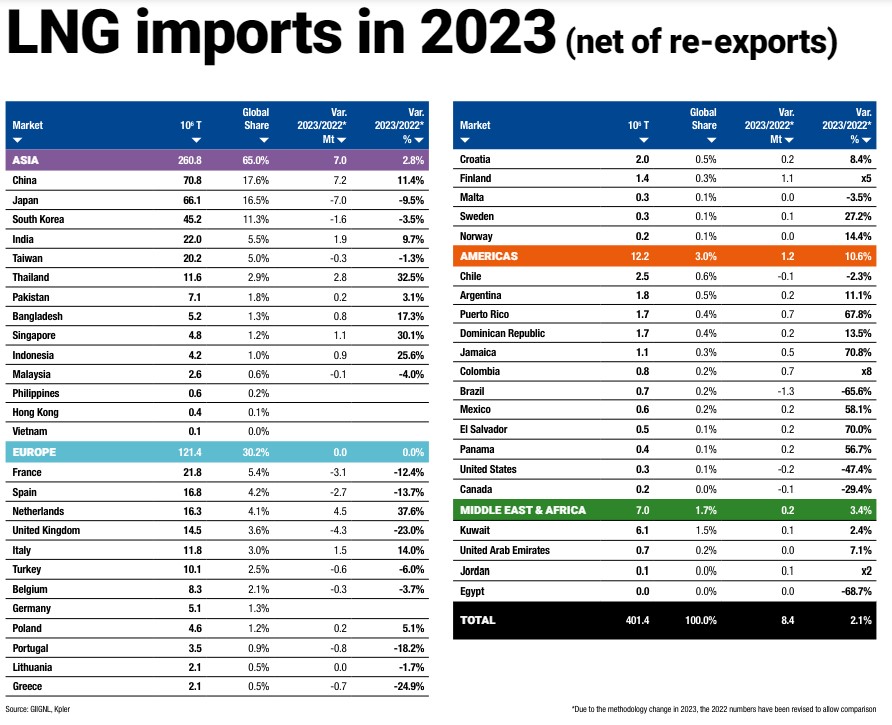

Global LNG imports reached 401 million tons in 2023, increasing by 2.1 percent compared with the previous year, according to the newest annual report by the international group of LNG importers, GIIGNL.

GIIGNL’s previous report showed that global LNG imports rose 4.5 percent in 2022 to 389.2 million tons.

However, the Paris-based group said in the 2024 report that LNG imports rose 5.6 percent in 2022 to 393 million tons, resulting of methodological adjustment in its data treatment.

According to the group, the global LNG market in 2023 marked a “pivotal phase characterized by modest growth and dynamic shifts due to geopolitical and economic changes.”

The number of importing countries rose to 48, while the number of exporting countries remained steady at 20.

GIIGNL said the market saw a modest growth of 2.1 percent a slowdown from the 5.6 percent growth in 2022.

This growth was driven by Asia (+7 MT) and the Americas (+1.2 MT) whereas Europe’s demand remained stable at 121 MT.

GIIGNL said that spot LNG trades totaled 141 MT, representing 35 percent of LNG imports.

Chinese LNG imports jumped

In Asia, trends varied significantly: Japan’s LNG imports decreased notably (-7 MT), whereas China’s imports surged (+7.2 MT), GIIGNL said.

China overtook Japan as the world’s largest LNG importer.

Price-sensitive importers like India saw a rise in imports due to lower market prices, while South Korea’s imports dropped to 45.2 MT due to decreased gas consumption in power generation.

Taiwan’s imports remained stable at 20.2 MT, and Thailand’s imports rose to 11.6 MT due to increased electricity sector demand.

Europe’s LNG imports stabilized

Europe’s LNG imports stabilized with notable trends such as Germany and the Netherlands enhancing their regasification capacities, leading to significant import increases, GIIGNL said.

However, other European nations that had increased imports in 2022 due to the drop in Russian pipeline gas saw a decline in 2023.

The Netherlands imported 16.3 MT, mainly from the US.

Moreover, Italy increased imports to 11.8 MT with new FSRU-based terminals, while Finland’s imports rose due to its first large-scale FSRU terminal.

Türkiye’s imports slightly declined due to falling residential gas consumption and economic impacts from an earthquake, the group said.

The Americas saw an 11 percent growth in imports, driven by Colombia, which increased imports to 0.8 MT due to hydropower shortfalls.

Brazil’s imports declined due to increased renewable energy generation.

Chile and Argentina remained the largest regional importers, with stable imports at 2.5 MT and 1.8 MT, respectively.

Global regasification capacity reached 1,143 MTPA

Global regasification capacity reached 1,143 MTPA, with 17 new terminals adding 68 MTPA of capacity, GIIGNL said.

Asia led the capacity growth with new terminals in China and India.

Europe enhanced capacity with new FSRU-based terminals in Germany, France, Finland, Italy, and Türkiye.

In the Americas, new facilities in Brazil highlighted the responsive expansion strategy, the group said.

US top LNG exporter

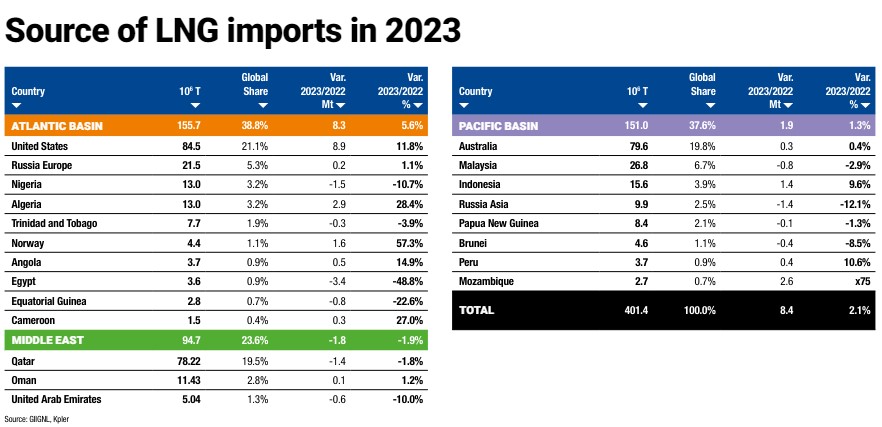

The US emerged as the top LNG exporter, contributing 84.5 million tons, with significant volumes delivered to Asia and Europe, GIIGNL said.

The US significantly ramped up production with facilities like Calcasieu Pass and Freeport LNG adding 8.9 MT to the market.

Compared to 2022, Algeria added nearly 3 MT to the supply, benefiting mainly Spain, Italy, and Türkiye.

Also, Mozambique’s Coral South FLNG added 2.6 MT, with Thailand, China, and South Korea as primary destinations.

Norway added 1.6 MT through Hammerfest LNG, while Russia’s Portovaya LNG operated at full capacity, adding 1.2 MT to global supply.

In the Pacific, Indonesian supply increased by 1.6 MT primarily from the Tangguh project, while Australia added 0.6 MT despite Darwin LNG’s shutdown.

Oman’s debottlenecking program increased capacity by 0.2 MT, GIIGNL said.

Significant declines in supply were observed in Egypt (-3.2 MT), Russia (-1 MT), and Nigeria (-1.5 MT) due to various operational and geopolitical issues, it said.

Global liquefaction capacity reached 481 MTPA

Global liquefaction capacity reached 481 MTPA in 2023, including 12 MTPA of floating liquefaction units (FLNG), GIIGNL said.

One new liquefaction train, the 3.8 MTPA Tangguh T3 in Indonesia, started operations in 2023.

The Republic of the Congo and Mexico joined the ranks of LNG exporters in 2024 with start-up of a 0.7 MTPA FLNG project in Congo, which uses the Tango FLNG barge, and of the 1.4 MTPA Altamira Fast LNG facility in Mexico, the group said.

FIDs were taken on four liquefaction projects in 2023, with a total capacity of around 38 MTPA.

772 vessels

GIIGNL said the total LNG tanker fleet consisted of 772 vessels at the end of 2023.

It included 51 FSRUs and 79 vessels (53 LNGBVs + 26 small-scale LNG carriers) of equal or less than 30,000 cubic meters.

Total cargo capacity at the end of 2023 stood at 114 million cubic meters, while total operational capacity (vessels known to be in service) amounted to 113 million cubic meters.

In 2023, the average spot charter rate for a 160,000 cubic meters TFDE LNG carrier stood at around $97,100/day, compared to an average of around $131,500/day in 2022.

A total of 41 vessels were delivered in 2023, compared to 35 vessels in 2022.

The number of new orders reached a total of 66 units, compared to 178 new orders in 2022.

At the end of 2023, the orderbook consisted of 341 units (58 million cubic meters) including 3 FSRUs and 9 LNGBVs.

The orderbook represented 51percent of existing fleet capacity.

The group said 89 units on order were scheduled for delivery in 2024. It included 2 FSRUs and 6 LNGBVs.