This story requires a subscription

This includes a single user license.

Last week, both Atlantic and Pacific rates declined.

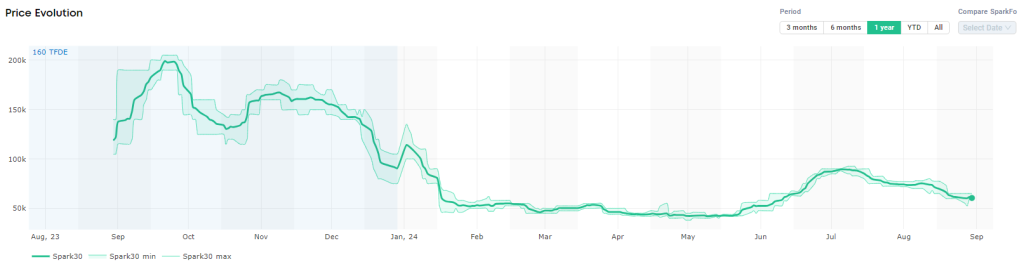

“Spark30s Atlantic rates experienced a third week-on-week decrease, falling by $1,000 to $60,500 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

He said that Spark25S Pacific rates also declined this week, falling by $1,250 to $77,500 per day.

“This marks a $9,250 decline in Pacific rates in the last three weeks,” Afghan said.

European prices climb

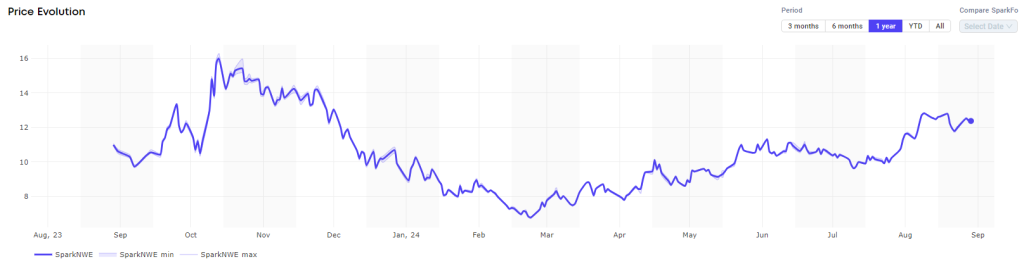

In Europe, the SparkNWE DES LNG front rose this week.

“The SparkNWE DES LNG front month price for September delivery is assessed at $12.379/MMBtu, experiencing a $0.585/MMBtu week-on-week increase,” Afghan said.

“The discount to the TTF widened by $0.02/MMBtu this week to $0.145/MMBtu,” Afghan said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU continued to rise and were 91.98 percent full on August 28.

Gas storages were 90.54 percent full on August 21, and 92.65 percent full on August 28, 2023.

Market preparing for winter

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, for October settled at $14.010/MMBtu on Thursday.

Last week, JKM for October settled at 13.820/MMBtu on August 23.

Front month JKM remained flat on Monday, and rose to 14.055/MMBtu on Tuesday, and 14.065/MMBtu on Wednesday.

S&P Global Commodity Insights said in a report on Friday the global LNG market is bracing for a potentially strong winter this year into early 2025 as bullish signals from the waterborne cargo market and vulnerability to supply side shocks heighten sentiment.

“Prices have cooled since the record highs seen post Russia’s invasion on Ukraine as Europe’s rapid build out in LNG infrastructure and increasing supply in the global LNG arena helped to subdue market volatility,” it said.

NWE prices have cooled since the record high of $74.486/MMBtu on August 26, 2022, while JKM has cooled since the record high of $84.762/MMBtu on March 7, 2022, however, bullish signals are looming in the current market, the report said.

“In my view, the current balance in the market is very fragile and it will continue to be in the winter, Asian buyers didn’t even start to fill up their inventories – temperatures are still high, Egypt took away significant chunk of supply from Europe, South America may take some extra cargos in Q4, Q1 as well,” Alija Bajramovic, senior research analyst for European and Russian LNG, at Commodity Insights said.

“Although things aren’t bad as they used to be – we have full storages, French nuclear is back, demand for gas in power generation is very low – Europe will still be living on the prayer despite that – one serious cold spell can really affect things,” Bajramovic said.