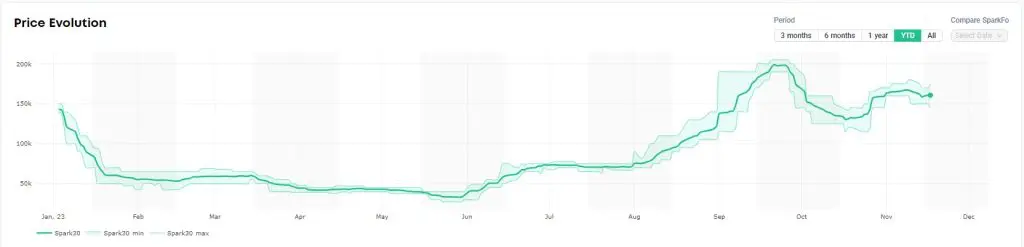

Spot liquefied natural gas (LNG) freight rates fell this week for the first time in four weeks, according to Spark Commodities.

Last week, LNG shipping rates increased but the rate of increase slowed compared to the previous weeks.

The Spark30S Atlantic increased by $750 to $165,750 per day, while the Spark25S Pacific increased by $2,250 to $152,500 per day.

“LNG freight rates fell this week for the first time in four weeks, with a 3 percent week-on-week decrease in the Atlantic,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

Afghan said that the Spark30S Atlantic decreased by $5,000 to $160,750 per day, while the Spark25S Pacific decreased by $750 to $151,750 per day.

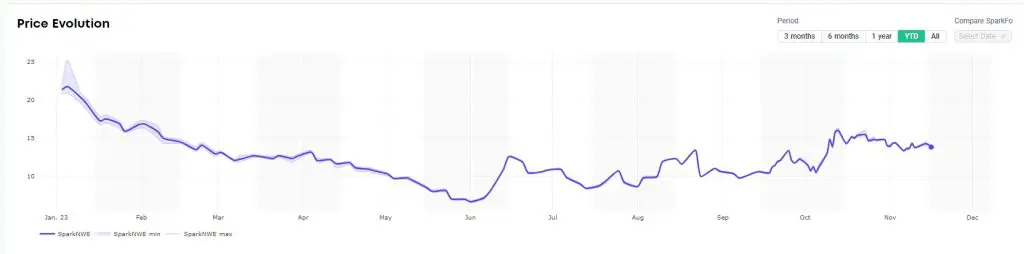

European and Asian LNG prices

As per European LNG pricing, the SparkNWE DES LNG front month also declined from the last week.

The NWE DES LNG for December was assessed last Friday at $14.289/MMBtu and at a $0.825/MMBtu discount to the TTF.

“The SparkNWE DES LNG price for December delivery is assessed at $13.801/MMBtu and at a $0.815/MMBtu discount to the TTF,” Afghan said.

“This is a $0.488/MMBtu reduction in DES LNG price, with the discount to the TTF remaining almost unchanged, when compared to last week’s December prices,” he said.

According to Platts data, JKM, the price for LNG cargoes delivered to Northeast Asia, dropped from the last week.

JKM for January settled at $17.100/MMBtu on Thursday.

Platts also reported that anticipated inability for LNG carriers to reserve slots for transiting the Panama canal starting in December would likely lead to spot cargoes bound for Asia to seek alternatives routes.

The Canal has experienced its most severe drought in years, leading the authority to implement restrictive water-saving measures over the past few months.

Platts said South Korean buyers of US LNG have already started bypassing the Panama Canal, while Japanese lifters of US LNG are also considering alternative options for shipping their winter cargoes.