Spot charter rates for the global liquefied natural gas (LNG) carrier fleet remained steady this week, while European prices rose compared to the previous week.

Last week, charter rates dropped slightly compared to the week before.

“Freight rates in the Atlantic and Pacific basins stayed steady this week, with the Spark30S Atlantic spot rate decreasing by $750 per day to $42,500 per day, and the Spark25S Pacific rate increasing by $500 per day to $46,250 per day,” Qasim Afghan, Spark’s commercial analyst told LNG Prime on Friday.

“The month-averaged rate for April is the lowest in four years for both the Atlantic and Pacific basins,” he said.

LNG shipping rates remained steady this year despite the ongoing shipping constraints via the Panama and Suez canals.

Platts, a part of S&P Global Commodity Insights, also said in a report last week that the numbers of available vessels did not affect LNG shipping rates this year.

According to the agency, in April, the number of available spot vessels in the Atlantic basin soared to around 13 to 14 vessels, and it the Pacific to around 16 vessels, before falling back in the past week to around 12 to 13 ships.

European prices climb

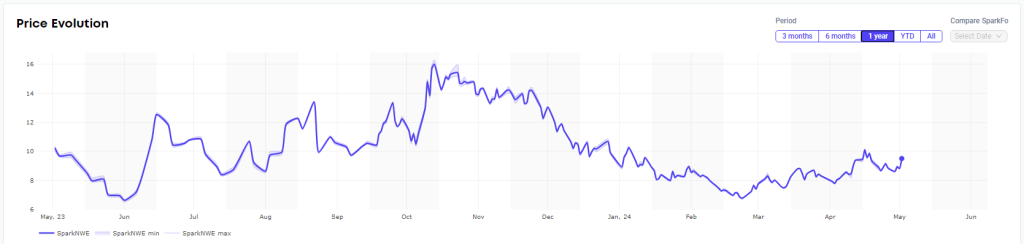

In Europe, the SparkNWE DES LNG front month dropped compared to the last week.

“The SparkNWE DES LNG front month price for June delivery is assessed at $9.508/MMBtu and at a $0.175/MMBtu discount to the TTF,” Afghan said.

He said this is a $0.351/MMBtu increase in DES LNG price, and a $0.015/MMBtu narrowing of the discount to the TTF.

Levels of gas in storages in Europe rose compared to the last week.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU were 62.61 percent full on May 1.

Gas storages were 61.74 percent full on April 24, and 60.22 percent full on May 1 last year.

Freeport LNG, Gorgon LNG

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia, settled at $10.410/MMBtu on Thursday.

Moreover, US LNG exports dropped in the week ending May 1, with the Freeport LNG terminal shipping only one cargo during the period, according to the EIA.

Freeport LNG said in March it will operate with only the third train until “sometime in May” when it expects to bring back online the first and the second train.

According to reports, the third LNG train tripped offline on April 9 and on April 23 as well.

Besides Freeport LNG, Chevron Australia, a unit of US energy giant Chevron, is working to resume full production from its Gorgon LNG terminal in Western Australia following a “mechanical fault” which is affecting one LNG production train.

Chevron expects repair activities to “take a number of weeks”.

In Europe, Norway’s Equinor restarted its 4.3 mtpa Hammerfest LNG export plant on April 27 following a gas leak.