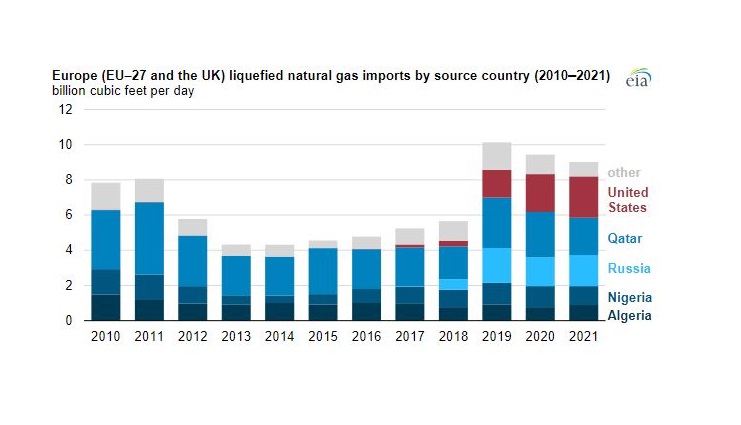

The United States, Qatar, and Russia supplied most of the LNG shipments to Europe in 2021, according to a new report by the US Energy Information Administration.

Combined, these three countries accounted for almost 70 percent of Europe’s total LNG imports, EIA said, citing Cedigaz data.

Europe’s largest source of LNG in 2021 became the US, accounting for 26 percent of all LNG imported by European Union member countries and the UK.

The US was followed by Qatar with 24 percent, and Russia with 20 percent.

Also, the report shows that in January 2022, the US supplied more than half of all LNG imports into Europe for the month.

Exports of LNG from the US to EU-27 and the UK increased from 3.4 billion cubic feet per day (Bcf/d) in November 2021 to 6.5 Bcf/d in January 2022.

It represents the most LNG shipped to Europe from the US on a monthly basis to date, according to the US Department of Energy’s LNG monthly reports and EIA’s estimations, based on LNG shipping data.

Rising US LNG exports are the result of both natural gas supply challenges in Europe and the sizable price differences between natural gas produced in the US and current prices at European trading hubs, EIA said in the report.

Also, natural gas supply constraints in Europe and the low storage inventories of the past year contributed to recent increases in US LNG exports to Europe.

Europe’s natural gas imports increased in recent years due to production decline

Europe’s natural gas production has been in continuous decline because of production limits on the Groningen field in the Netherlands and declines in the mature fields in the North Sea.

To meet demand, Europe’s natural gas imports, particularly from Russia, have increased in recent years.

Pipeline flows of natural gas from Russia decreased during 2021.

Pipeline receipts from Russia at the three main entry points, Kondratki in Poland, Greifswald in Germany, and Velke Kapusany in Slovakia, averaged 10.7 Bcf/d in 2021, compared with 11.8 Bcf/d in 2020 and 14.1 Bcf/d in 2019, according to data by Refinitiv Eikon.

The three entry points combined account for 14.3 Bcf/d of import pipeline capacity from Russia.

More natural gas delivered by pipeline from Norway, which increased from 10.4 Bcf/d in 2019 and in 2020 to 11.1 Bcf/d in 2021, was not enough to offset reduced pipeline receipts from Russia, EIA said in the report.

Rise of regional natural gas prices

Supply challenges in the European market have led to rising regional prices for natural gas.

The natural gas spot price at the Title Transfer Facility (TTF) in the Netherlands, the most liquid virtual natural gas hub in Europe, has been trading at all-time high levels.

TTF price averaged $28.52 per million British thermal units (MMBtu) from September 2021 through the first week of February 2022, the report shows.

It peaked at $60.20/MMBtu on December 21, 2021.

In comparison, prior to this sharp price increase, the TTF price had averaged $9.28/MMBtu from January through August 2021, $3.28/MMBtu during 2020, $4.45/MMBtu during 2019, and $6.45/MMBtu from 2014 through 2018.

EIA said in its report that historically, spot natural gas in Europe had been traded at prices lower than LNG spot prices in Asia.

However, in recent months, natural gas prices in Europe have closely tracked LNG prices in Asia.

EIA added that on some days, the natural gas price in Europe exceeded the LNG price in Asia, attracting a higher volume of flexible LNG supplies to the European market.

Data shows that LNG imports to Europe increased in December 2021 and January 2022, averaging 10.8 Bcf/d and 14.9 Bcf/d, respectively, partly in response to the price at TTF rising above LNG spot prices in Asia.