Italy’s Eni has shown interest in buying a stake in Qatar Petroleum’s giant expansion project as the firm also looks to expand its LNG business, according to the company’s chief executive.

Qatar Petroleum recently took a final investment decision on the North Field East project which includes building four “mega trains” with a capacity of 8 million tonnes per year in the Ras Laffan complex.

This phase will increase Qatar’s LNG production capacity from 77 to 110 mtpa but QP has plans for the second phase as well as additional expansions.

QP said the costs of this expansion project would reach $28.75 billion.

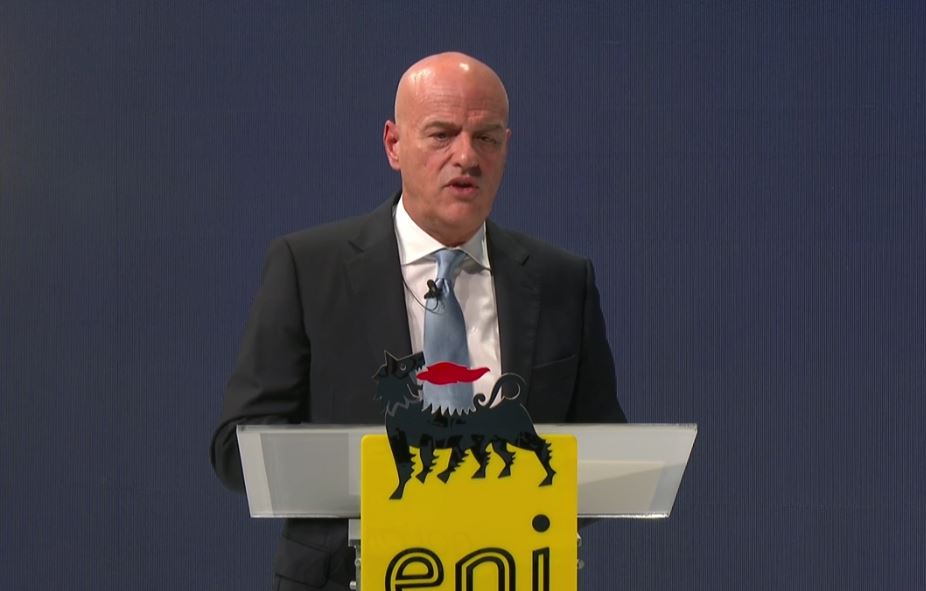

Eni’s CEO Claudio Descalzi told analysts during the firm’s fourth-quarter conference call on Friday that the firm held talks with QP regarding the expansion for at least “three, four years.”

“So, we’re clearly interested. We think that is a good project,” he said.

Moreover, Descalzi said the investment is “much less” than forecasted at the very beginning.

“So, they’ve been able to finalize a very good contract,” he said.

In the meantime, Saipem, in which Eni owns a 30.5 percent stake, has won a $1.7 billion offshore contract for the expansion.

Descalzi said Eni’s investment would depend on several conditions saying he could not tell the exact percentage because it doesn’t just depend on Eni, but also on QP.

“We showed interest and we’ll see in the future what is going to happen,” he said.

Eni targets LNG growth

Besides the Qatari investment, Eni is also looking to boost its LNG volumes.

The Italian firm expects its contractual LNG volumes to exceed 14 million tonnes per year by 2024, a 45 percent growth compared to 2020 levels.

Descalzi said Eni’s new projects in Indonesia, Nigeria, Angola, Mozambique, and Egypt, where it restarted the Damietta plant, would drive this growth.

To remind, Eni and its partners on Monday shipped the first cargo from the Damietta plant in Egypt since 2012.

The facility stopped operations in 2012 due to declining domestic production, but new gas finds allowed the partners to restart the plant.