Japan’s Inpex said it has received written approval for the revised plan of development for the Abadi LNG project in Indonesia.

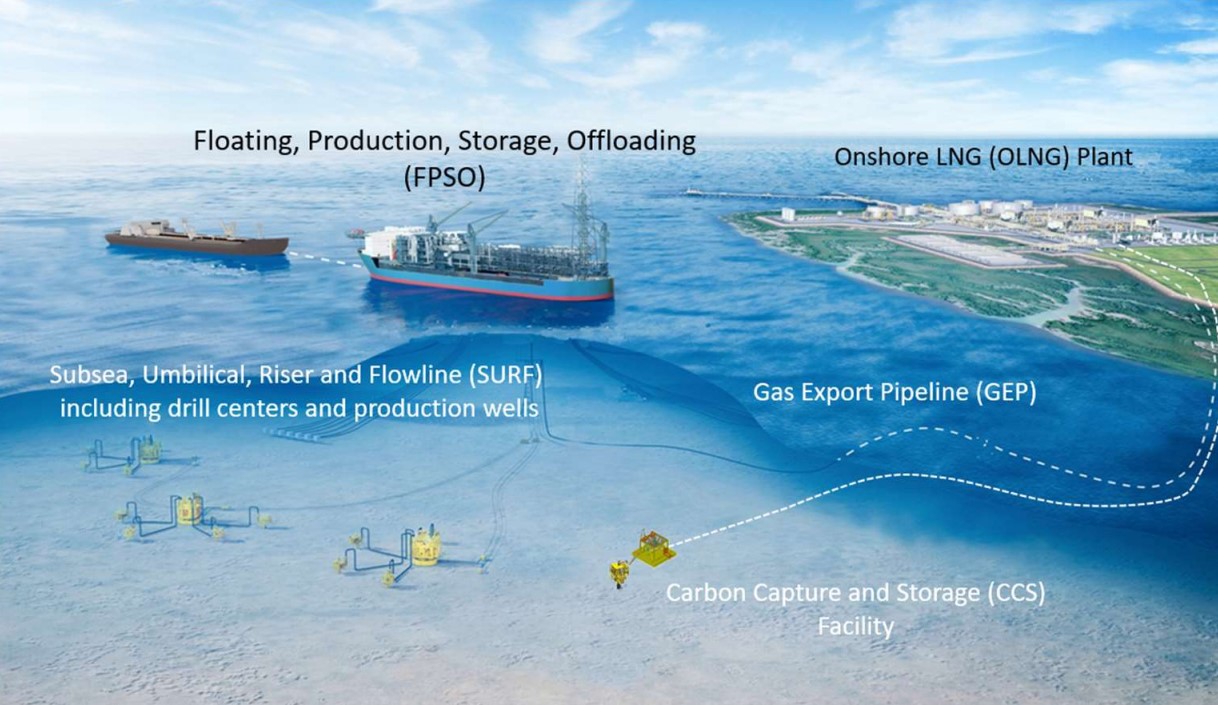

Earlier this year, Inpex Masela on behalf of the joint venture with LNG giant Shell submitted the revised plan to the Indonesian government, adding a carbon capture and storage (CCS) component.

“This marks the official approval of the authorities for the revised POD,” Inpex said in a statement.

In October, Shell completed the sale of its 35 percent stake in Indonesia’s Masela PSC, which includes the planned Abadi LNG project, to Pertamina Hulu Energi and Petronas Masela.

Indonesia’s Pertamina now owns a 20 percent stake and Malaysia’s Petronas has a 15 percent stake in the PSC.

Inpex holds 65 percent operating interest in Masela PSC and is the operator of the Abadi LNG project.

The Japanese company said in the statement that the project is the first in which CCS-related costs are eligible for recovery based on the PSC scheme that governs crude oil and natural gas upstream operations in Indonesia.

Inpex said the approval of the revised POD paves the way for the firm and its partners to “fully mobilize the project as a clean project in support of the energy transition.”

Resuming activities

The Inpex-operated project has seen many changes over the years and initially, the development of the Masela offshore block involved a floating LNG plant, while it now includes a 9.5 mtpa onshore LNG plant with an estimated cost of about $20 billion.

Going forward, Inpex and its partners will pursue the revision of the PSC to incorporate CCS into the contractual scope of work and resume project operations including on-site activities and prepare for FEED work, the firm said.

“Thereafter, the JV will implement the project with the aim of reaching a final investment decision (FID) and production startup at an early stage after completing the necessary preparations including marketing and financing activities,” Inpex said.

Inpex previously said it aims to reach FID in the “latter half of the 2020s and commence production in the early 2030s.”

The project would become Inpex’s second self-operated, large-scale natural gas development project following the Ichthys LNG project in Australia.