The first phase of BP’s Greater Tortue Ahmeyim FLNG development offshore Mauritania and Senegal will be slightly delayed, according to project partner Kosmos Energy.

Dallas-based Kosmos said on Tuesday the project partners have received a revised forecast from the EPCIC contractor, TechnipFMC. The contractor said that COSCO Shipping’s Qidong yard would likely deliver the FPSO later than planned.

This is due to “labor shortages at the COSCO yard in China following a ramp up in activity at the shipyard as the pandemic recedes,” Kosmos said.

Kosmos said the partners expect this would delay the project for about three months, pushing the timing of first gas to the third quarter of 2023.

BP, as operator of the project, has informed partners that costs would probably increase due to the impacts of Covid-19, including the FPSO delay, cost inflation and scope growth, the firm said.

On the basis of the revised schedule, Kosmos currently expects the gross cost for the project to be about 15% higher, resulting in an estimated increase of Phase 1 costs to first gas net to Kosmos of around $100 million, coming primarily in 2023.

Moreover, Kosmos expects the FPSO sale and lease back transaction to close this quarter upon the finalization of the documentation between the governments and partners.

Following the closing of the transaction, the company will work to complete the refinancing of the National Oil Company loans, Kosmos said.

Second phase FID

In addition, the project partners continue to make progress on the second phase of the LNG project with a final investment decision targeted for late 2022, the firm said.

The Tortue/Ahmeyim gas field, located offshore on the border between Mauritania and Senegal, has about 15 trillion cubic feet of gas, according to BP.

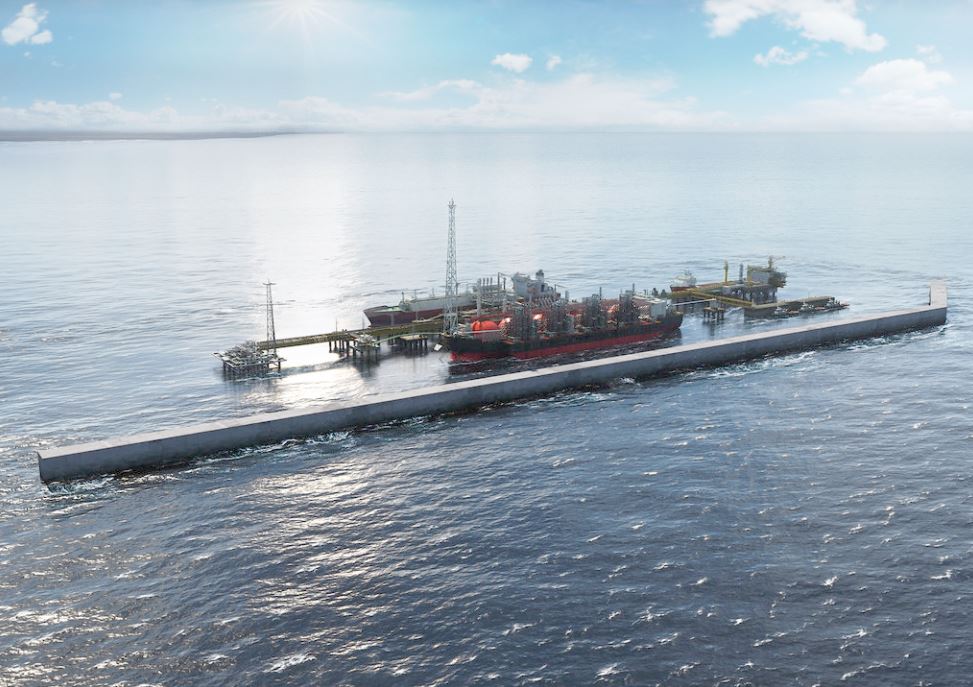

The FPSO will process the gas, removing heavier hydrocarbon components, prior to delivering it to a floating LNG provider which will sit nearshore a hub.

Besides operator BP and Kosmos, the project includes national oil companies Petrosen and SMHPM.

Furthermore, Singapore’s Keppel shipyard is currently converting Golar’s Gimi FLNG for the project. BP and Golar agreed on a one-year delay for the unit last year due to the Covid-19 coronavirus pandemic.

The yard should deliver the FLNG in 2023.

Once deployed offshore Mauritania and Senegal, it would provide about 2.5 million tonnes of LNG per annum on average.