Qatari LNG shipping giant Nakilat said both its net profit and revenue rose last year.

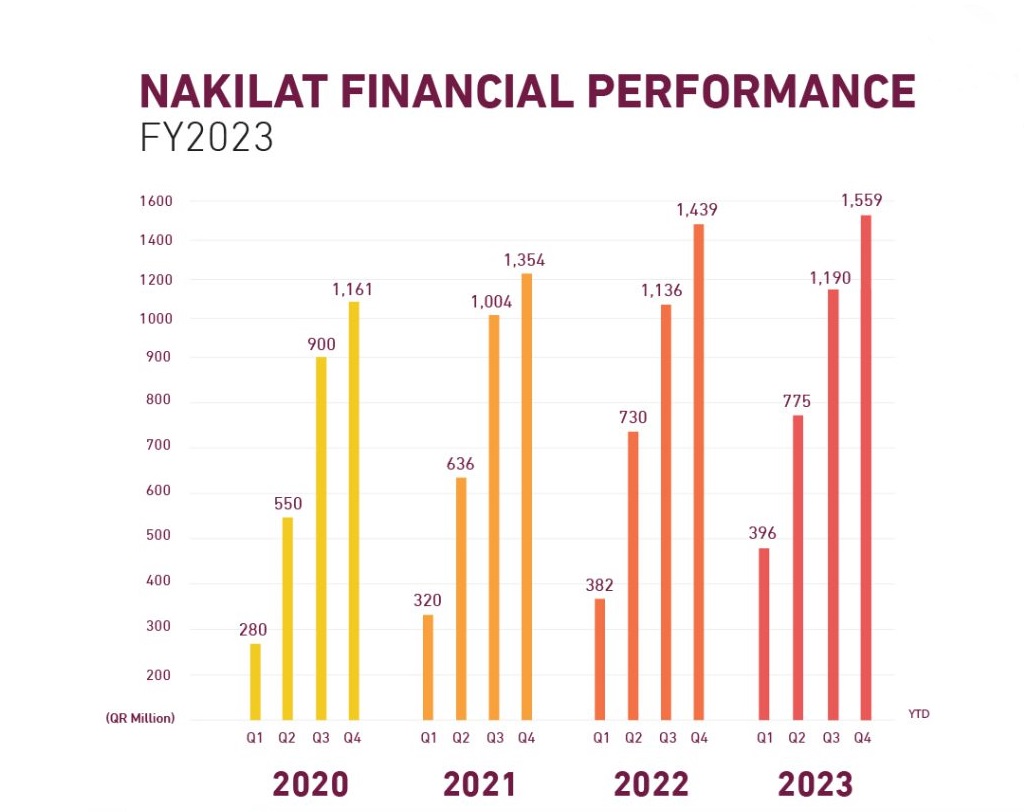

The firm reported a net profit of about 1.56 billion riyals ($428.4 million) for the year ended December 31, 2023, a rise of 8.3 percent compared to record 1.44 billion riyals in 2022.

According to Nakilat, net profit in 2023 was driven by higher revenues offset by higher finance charges.

Total revenue increased by 6.5 percent year-on-year to 4.65 billion riyals ($1.27 billion) mainly due to higher results from joint ventures and higher interest income, it said.

In the third quarter of 2023, Nakilat reported net profit of about 1.19 billion million riyals and total revenue of 3.47 billion riyals.

Nakilat also said that its expenses rose by 4.4 percent to 3.09 billion riyals in 2023 due to higher finance charges.

Citing Clarksons data, Nakilat said spot LNG rates for 160,000-cbm DFDE vessels rose 13.1 percent to $141,000 per day in the fourth when compared to the prior quarter, while the rates averaged $96,000 per day in 2023.

Rates for ME-GI vessels averaged $124,000 per day in 2023.

Nakilat recently placed orders worth about $955 million with South Korea’s Hyundai Samho for the construction of two LNG tankers and four LPG/ammonia carriers.

Upon delivery of the two new LNG carriers, Nakilat’s LNG fleet will expand to 71 vessels, while the LPG fleet will grow to eight vessels.

Nakilat’s fleet currently includes 24 conventional LNG carriers, 31 Q-Flex vessels (210,000-217,000 cbm), 14 Q-Max vessels (263,000-266,000 cbm), and also one FSRU.