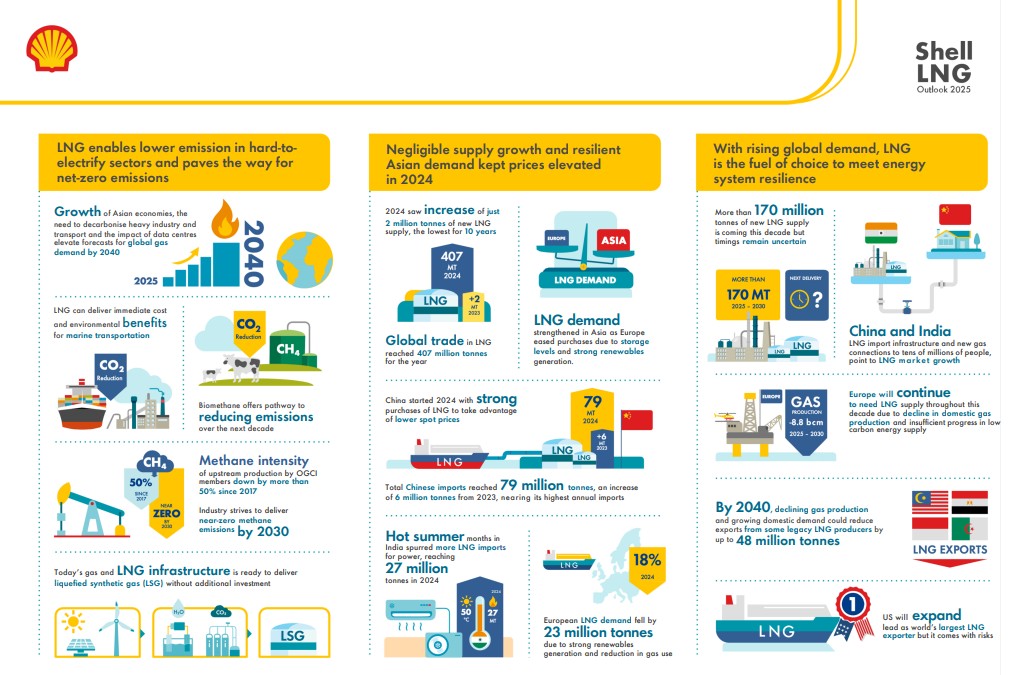

Global demand for liquefied natural gas (LNG) is forecast to rise by around 60 percent by 2040, largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence, according to Shell’s LNG Outlook 2025.

Industry forecasts now expect LNG demand to reach 630-718 million tonnes a year by 2040, a higher forecast than last year.

UK-based LNG giant Shell said global LNG trade grew by only 2 million tonnes in 2024, the lowest annual increase in 10 years, to reach 407 million tonnes due to constrained new supply development.

“More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain,” Shell said.

Shell said China is significantly increasing its LNG import capacity and aims to add piped gas connections for 150 million people by 2030 to meet increasing demand.

India is also moving ahead with building natural gas infrastructure and adding gas connections to 30 million people over the next five years, it said.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonization goals,” Tom Summers, senior VP for Shell LNG marketing and trading, said.

“LNG will continue to be a fuel of choice because it’s a reliable, flexible, and adaptable way to meet growing global energy demand,” Summers said.

LNG as fuel on the rise

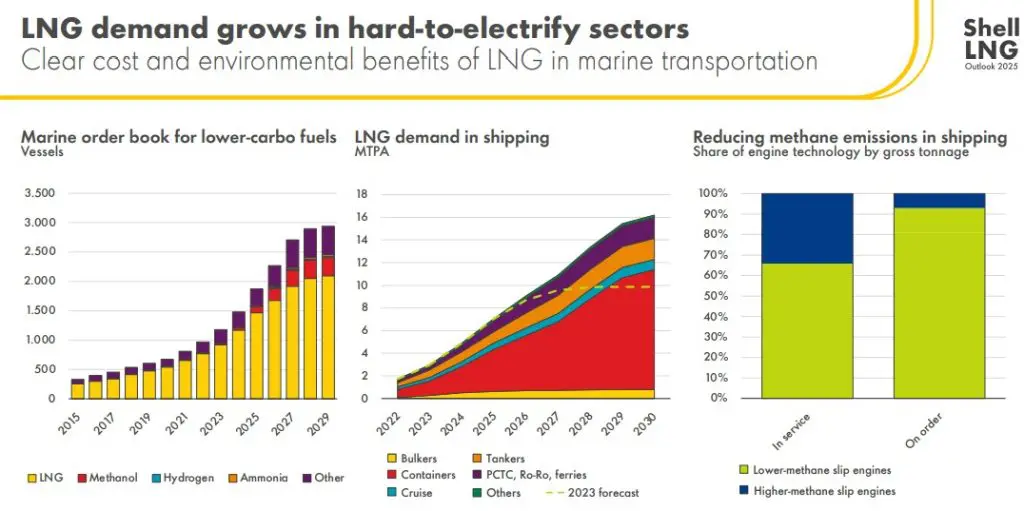

In the marine sector, a growing order book of LNG-powered vessels will see demand from this market rise to more than 16 million tonnes a year by 2030, up 60 percent from the previous forecast, Shell said.

“LNG is becoming a cost-effective fuel for shipping and road transport, bringing down emissions today and offering pathways to incorporate lower-carbon sources such as bio-LNG or synthetic LNG,” Shell said.

Europe will continue to need LNG into the 2030s to balance the growing share of intermittent renewables in its power sector and to ensure energy security.

In the longer term, existing natural gas infrastructure could be used to import bio-LNG or synthetic LNG and be repurposed for the import of green hydrogen, Shell said.

“Significant growth in LNG supply will come from Qatar and the USA. The USA is set to extend its lead as the world’s largest LNG exporter, potentially reaching 180 million tonnes a year by 2030 and accounting for a third of global supply,” Shell said.

Europe to boost LNG imports

The early part of 2024 saw spot LNG prices fall to their lowest level since early 2022, but prices recovered by mid-year due to delays in the development of new supply capacity, Shell said.

“Demand for LNG strengthened in Asia during the first half of 2024 as China took advantage of lower prices, importing 79 million tonnes during the year. India bought record volumes to help meet stronger power demand due to hotter weather in early summer. Its imports rose to 27 million tonnes, a 20 percent increase from 2023,” it said.

While LNG continued to play a vital role in European energy security in 2024, imports fell by 23 million tonnes, or 19 percent, due to strong renewable energy generation and a limited recovery in industrial gas demand, according to Shell.

However, cold winter temperatures and spells of low wind power generation towards the end of the year drove strong gas storage withdrawals which, combined with the expiry of Russian pipeline gas flows to Europe through Ukraine on December 31, 2024, drove up prices.

Shell said Europe is expected to increase imports of LNG in 2025 to refill its gas storage.