US shale gas producer Chesapeake Energy has entered into an offtake deal with Delfin Midstream, the US developer of a floating LNG export project in the Gulf of Mexico, to supply LNG to Geneva-based trader Gunvor.

Chesapeake said in a statement on Tuesday that the LNG export deal includes executed sales and purchase agreements for long-term liquefaction offtake.

Under the SPA, Chesapeake will buy about 0.5 million tonnes per annum (mtpa) of LNG from Delfin at a Henry Hub price with a targeted start date in 2028.

The firm will then deliver LNG to Gunvor on an free on board (FOB) basis with the sales price linked to the Japan Korea Marker (JKM) for a period of 20 years, it said.

These volumes will represent 0.5 mtpa of the previously announced up to 2 mtpa heads of agreement with Gunvor, Delfin said.

Also, these volumes will add to the SPA Gunvor signed with Delfin in November last year for up to 1 mtpa.

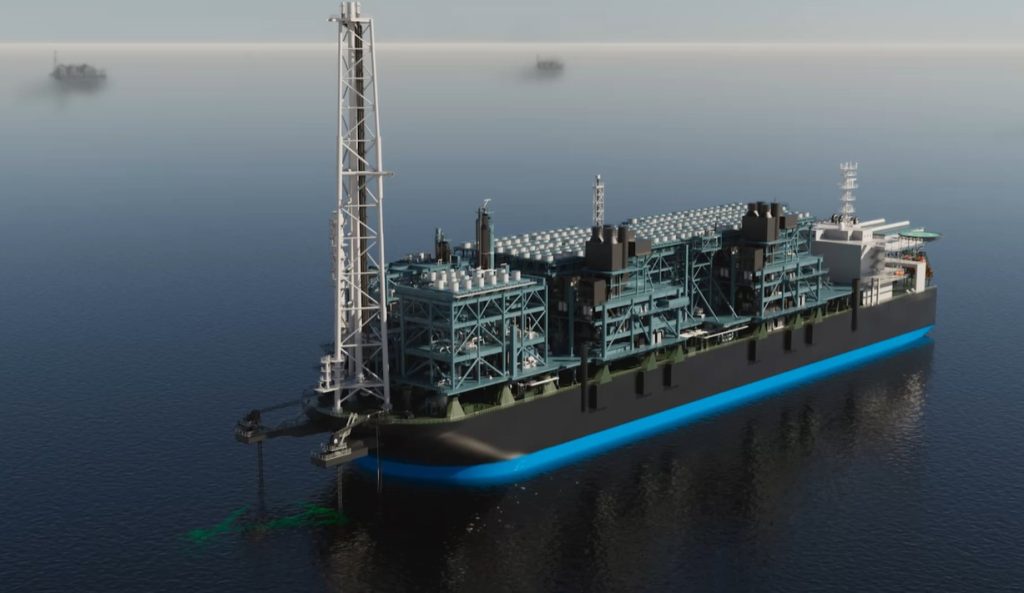

Delfin plans to install up to four self-propelled FLNG vessels that could produce up to 13.3 mtpa of LNG or 1.7 billion cubic feet per day of natural gas as part of its Delfin LNG project.

The firm also aims to install two FLNG units under the Avocet LNG project.

Delfin said in November it had secured commercial agreements for LNG sales and liquefaction services and the firm was “in the final phase towards FID on its first three FLNG vessels”.

Kalpesh Patel, co-head of LNG trading and a member of Gunvor’s executive committee, said the new deal “represents an important step in finalizing the 0.5 mtpa out of our total of 2 mtpa arrangement with Chesapeake, while expanding our existing cooperation with Delfin.”

“We continue to provide reliable and competitive logistics services to our partners by utilizing our fleet consisting of vessels procured via term charters and equity ownership,” he said.

He added that Gunvor “looks forward to establishing additional agreements with the companies in the near future.”

Nick Dell’Osso, Chesapeake president and CEO, said this deal “cements an important step on our path to ‘Be LNG Ready’ and is further recognition of the depth of our portfolio and strength of our financial position.”