French energy giant TotalEnergies and its partners have postponed a final investment decision on the planned Papua LNG export project in Papua New Guinea.

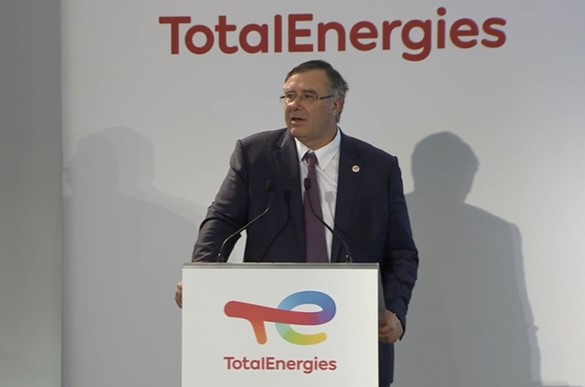

This was revealed during a meeting between Patrick Pouyanne, chairman and CEO of TotalEnergies, and James Marape, the Prime Minister of Papua New Guinea, according to a statement by TotalEnergies.

Pouyanne reaffirmed that TotalEnergies, operator of the project, and its international partners ExxonMobil, Santos, JX Nippon, are “fully committed” to Papua LNG.

“In particular, he shared the high interest of several LNG buyers for off-taking LNG from Papua LNG due to its strategic location close to key Asian markets,” he said.

Pouyanne also said that, after receiving first EPC offers, it appears that the project “will need to keep working with contractors to obtain commercially viable EPC contracts and requires more work to reach FID.”

“In that view, the project will review the structure of some packages and open the competition to an enlarged panel of Asian contractors. As a consequence, FID of Papua LNG project is now expected in 2025,” the statement said.

Pouyanne and Marape “agreed that this slight delay will not affect the early works planned in Papua New Guinea in 2024 and that the project will maintain its full support to local population of Gulf Province,” the statement said.

Moreover, Pouyanne announced that TotalEnergies intends to drill the first deepwater exploration well on the PPL 576 license in 2025.

Papua LNG

In March 2023, the Papua LNG partners launched fully-integrated front-end engineering and design (FEED) for the project, while TotalEnergies sold a small stake in the project to Japan’s JX Nippon Oil & Gas Exploration in June.

Pouyanne said in September last year the project partners could take a final investment decision on the project “by the end of this year or beginning of the next year.”

A spokesperson for France’s Credit Agricole recently confirmed to LNG Prime that the group will not finance Papua LNG or Rovuma LNG.

“Credit Agricole does not finance any new fossil fuel extraction projects as disclosed last December during its second climate workshop,” the spokesperson said.

TotalEnergies has a 37.55 percent operating stake in the Papua LNG project, ExxonMobil has 37.04 percent, Santos owns a 22.83 percent interest, and JX Nippon holds 2.58 percent.

The project calls for the design of about 4 million tonnes per year of liquefaction capacity adjacent to the existing PNG LNG processing facilities, operated by ExxonMobil and located 20 kilometers northwest of Port Moresby, Papua New Guinea,

The facility will receives supplies from the Elk-Antelope gas field.

Also, the project includes the use of 2 million tonnes per year of liquefaction capacity in the existing trains of PNG LNG.