Spark Commodities reported a rise in its liquefied natural gas (LNG) freight spot rates in both basins this week.

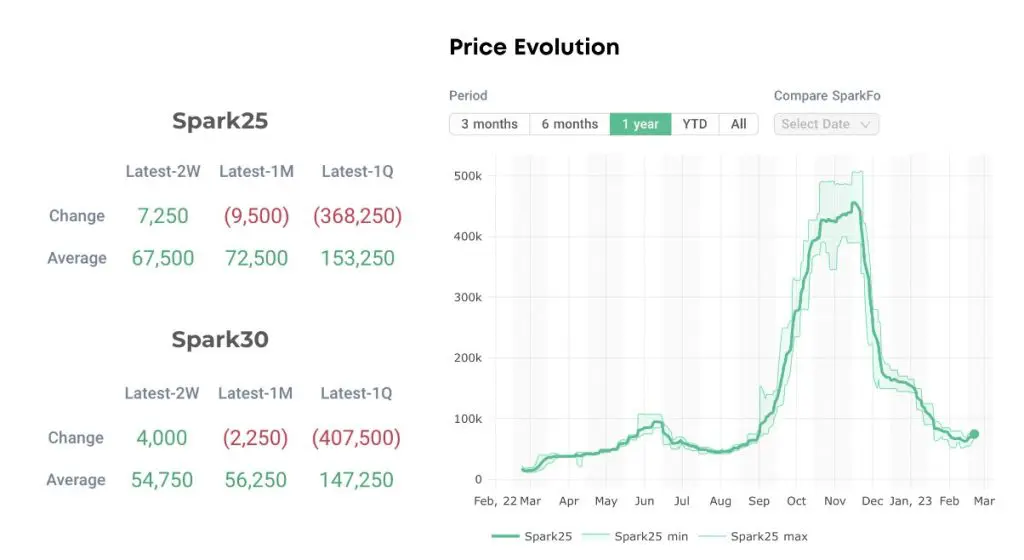

Both the Atlantic and Pacific rates for 160,000-cbm TFDE carriers fell below $100,000 per day in January, continuing their drop since posting record highs in October and November last year.

The downward trend continued in the beginning of February, but the rates are slowly picking up in the last two weeks.

“Spot LNG freight rates continue to tick higher this week with the Far East leading the way, with Spark25 Pacific rates $11,750/day higher w-o-w at $74,750/day and Spark30 Atlantic rates up $5,250/day w-o-w to reach $58,500/day,” Spark said.

Spark previously said that the ongoing delays with the restart of the Freeport LNG facility was one of the main reasons behind the drop in Atlantic LNG rates.

Also, mild winter weather in Europe and full storages pushed down gas prices in Europe.

Freeport LNG announced on Tuesday it secured regulatory approval to launch commercial operations of two trains at its 15 mtpa liquefaction plant in Texas as part of the restart process.

Earlier this month, the LNG terminal operator shipped the first cargo from its LNG export plant in Texas since the shutdown in June last year onboard the 2008-built 155,000-cbm LNG carrier, Kmarin Diamond.

One of the initial three Freeport LNG cargoes already landed in Europe.

The 180,000-cbm LNG Schneeweisschen, owned by MOL and chartered by Uniper, delivered a Freeport LNG cargo to Germany’s first FSRU-based import facility in Wilhelmshaven last week, according to its AIS data provided by VesselsValue.

Prior to the shutdown on June 8 last year, most of the cargoes produced at the Freeport LNG plant in 2022 landed in Europe. This is the case with other US LNG terminals as well.

Shell recently said that Europe increased its LNG imports by 60 percent to 121 million tonnes in 2022.

However, Europe’s increased need for LNG looks set to intensify competition with Asia for limited new supply available over the next two years and may dominate LNG trade over the longer term, according to Shell.

As per prices in Europe and Asia, the TTF price for March settled at $15.229/MMBtu, while the JKM spot LNG price for April settled at $14.300/MMBtu on Tuesday.